The European market has recently experienced a mix of optimism and caution, with the pan-European STOXX Europe 600 Index edging higher amid hopes for new trade deals, only to see gains curbed by tariff concerns. In this dynamic environment, identifying promising small-cap stocks can be crucial for investors looking to enhance their portfolios. A good stock in such conditions often demonstrates resilience against economic fluctuations and possesses strong fundamentals that promise potential growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Cembre (BIT:CMB)

Simply Wall St Value Rating: ★★★★★★

Overview: Cembre S.p.A. is involved in the production and distribution of electrical connectors, cable accessories, and tools across Italy, Europe, and international markets with a market capitalization of €1 billion.

Operations: Cembre generates revenue primarily from the sale of electric connectors and related tools, totaling €231.29 million.

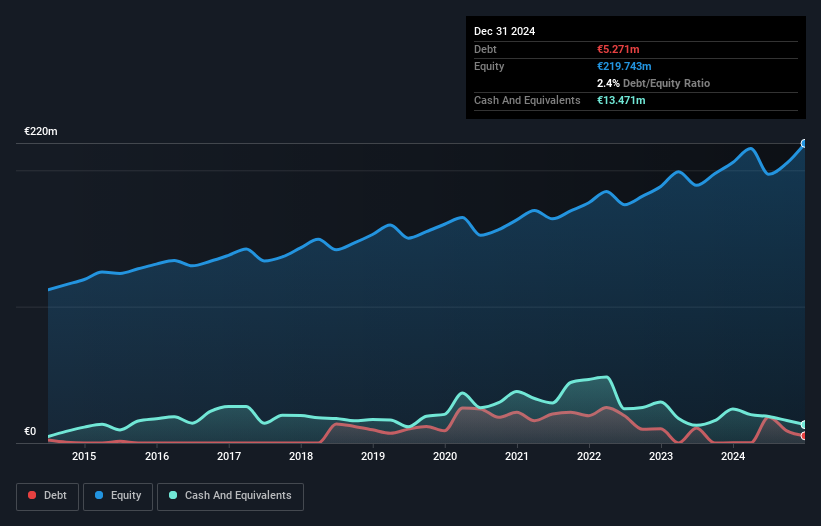

Cembre, a nimble player in the European market, showcases robust financial health with its interest payments well covered by EBIT at 186 times. Over the past year, earnings have surged by 12.8%, outpacing the electrical industry's -1.8%. The company's debt-to-equity ratio has impressively shrunk from 15.6% to just 0.04% over five years, highlighting prudent financial management. Recent earnings announcements reveal a net income of €11.9 million for Q1 2025, up from €9.72 million the previous year, indicating strong operational performance and potential for continued growth in revenue and profitability moving forward.

- Delve into the full analysis health report here for a deeper understanding of Cembre.

Evaluate Cembre's historical performance by accessing our past performance report.

cBrain (CPSE:CBRAIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: cBrain A/S is a software company that offers solutions for government, private, education, and non-profit sectors across Denmark, the European Union, and internationally with a market cap of DKK4.38 billion.

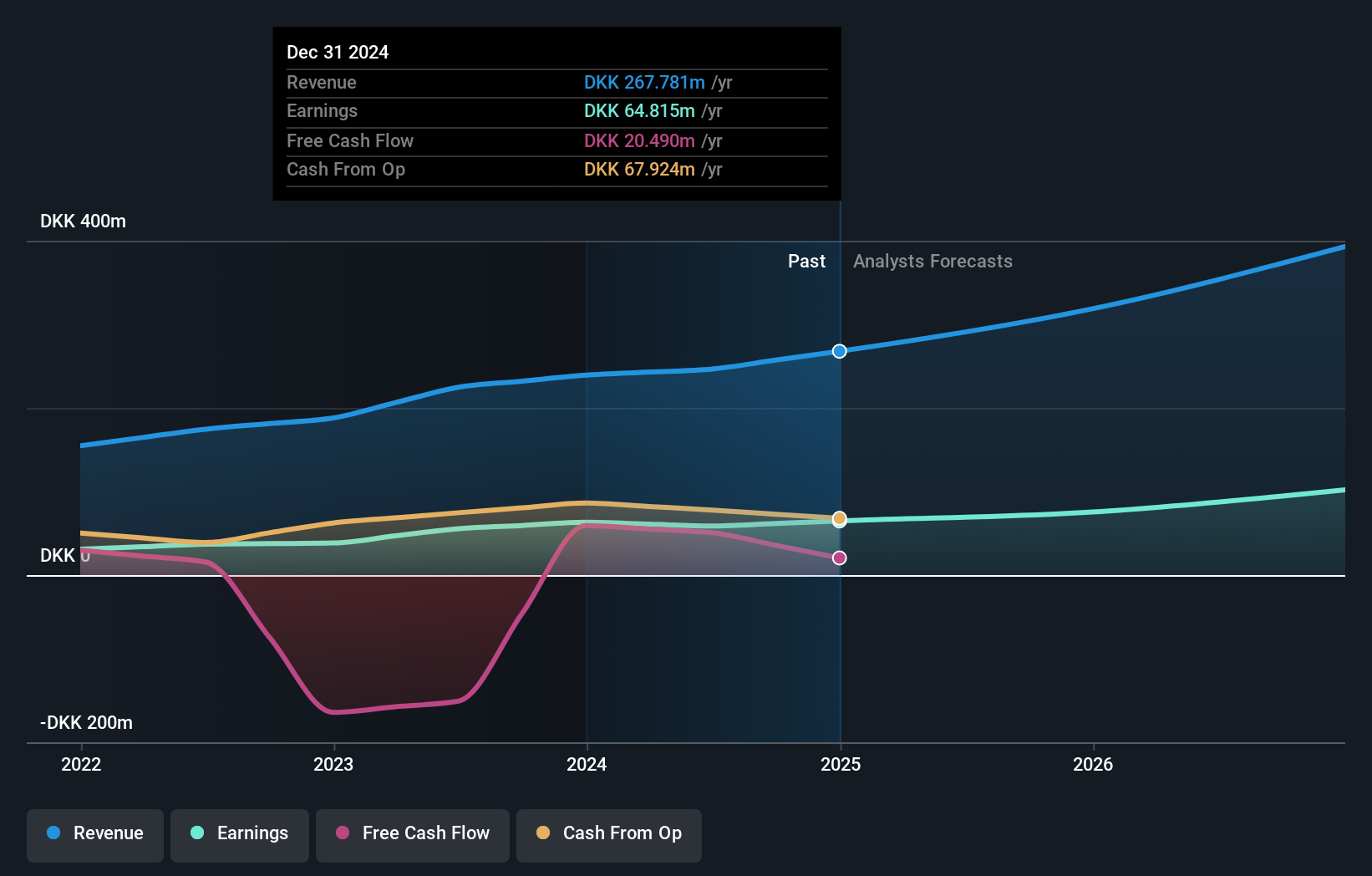

Operations: The company's primary revenue stream is from its Software & Programming segment, generating DKK267.78 million. With a market cap of DKK4.38 billion, the company focuses on providing software solutions across various sectors internationally.

cBrain, a dynamic player in the European market, has demonstrated robust earnings growth of 34.4% annually over the past five years. Despite recent volatility in its share price, the company remains financially sound with a satisfactory net debt to equity ratio of 9.2%. Its interest payments are well covered by EBIT at 37.5 times coverage, indicating strong financial health. While its earnings growth last year was only 2.6%, lagging behind the industry average of 16.1%, cBrain's profitability and high-quality past earnings provide confidence for future prospects as it continues to expand internationally under new CFO Lars Møller Christiansen's leadership.

- Dive into the specifics of cBrain here with our thorough health report.

Explore historical data to track cBrain's performance over time in our Past section.

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG, along with its subsidiaries, is engaged in the mining, production, and sale of salt across Germany, the European Union, and internationally; it has a market capitalization of approximately €619.94 million.

Operations: The company's primary revenue stream is from salt sales, generating €273.17 million, complemented by waste management services contributing €63.75 million. The net profit margin trend is noteworthy for its variability in recent periods.

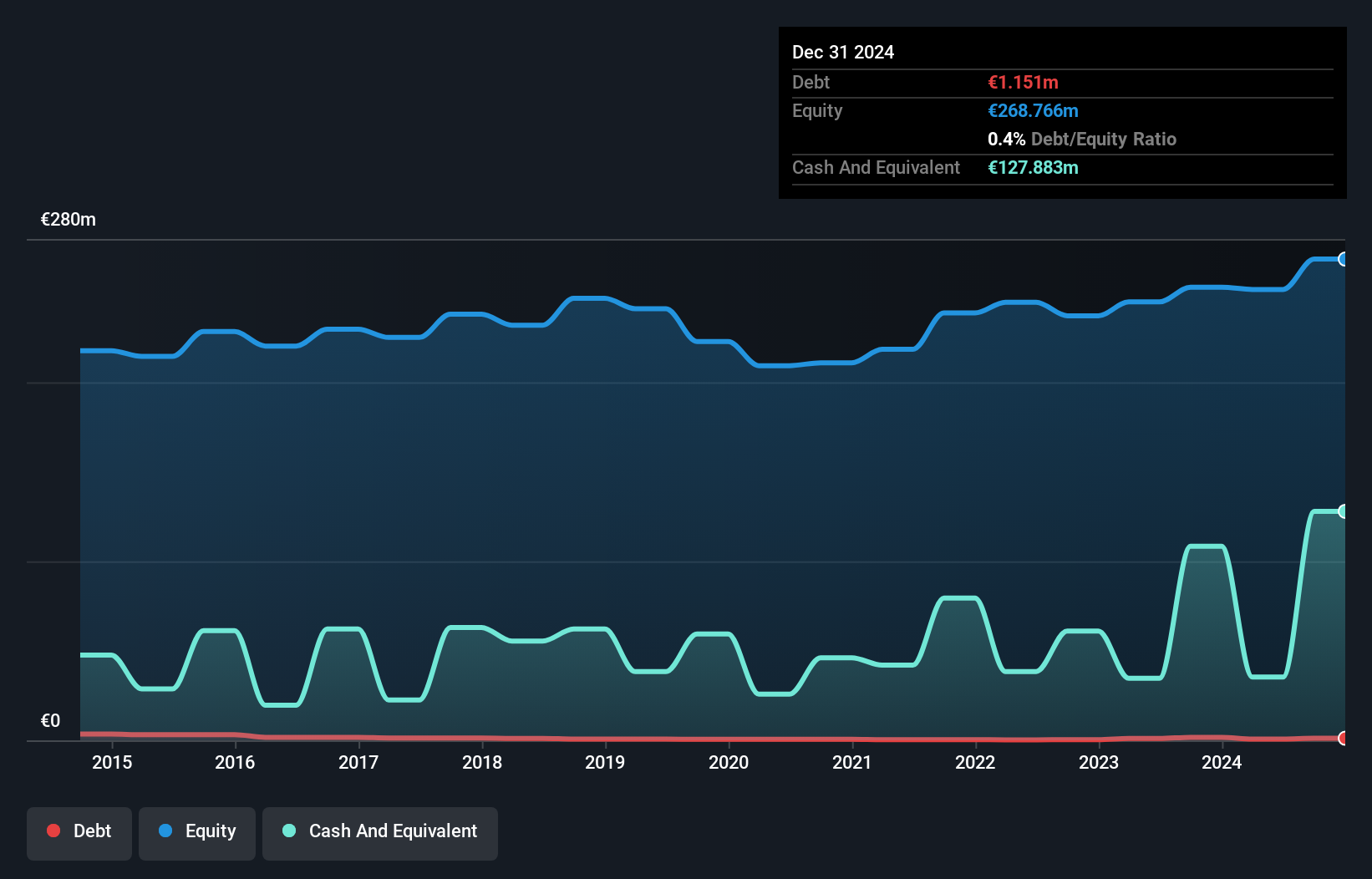

Südwestdeutsche Salzwerke, a small player in the European market, showcases promising financial stability despite some challenges. Over the past year, earnings rose by 0.3%, outpacing the broader Food industry which saw a -7.6% change. The company has high-quality earnings and its interest payments are well covered with an EBIT coverage of 8.7 times, indicating solid operational efficiency. With more cash than total debt on hand and positive free cash flow reported at US$70.67 million as of June 2024, SSH seems well-positioned financially even though its debt to equity ratio increased from 0.2% to 0.4% over five years.

Seize The Opportunity

- Access the full spectrum of 315 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if cBrain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:CBRAIN

cBrain

A software company, provides software solutions for government, private, education, and non-profit sectors in Denmark, rest of the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives