- Italy

- /

- Auto Components

- /

- BIT:CIR

If You Had Bought CIR. - Compagnie Industriali Riunite (BIT:CIR) Stock Five Years Ago, You Could Pocket A 31% Gain Today

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the CIR S.p.A. - Compagnie Industriali Riunite (BIT:CIR) share price is up 31% in the last 5 years, clearly besting the market decline of around 7.4% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 22%.

View our latest analysis for CIR. - Compagnie Industriali Riunite

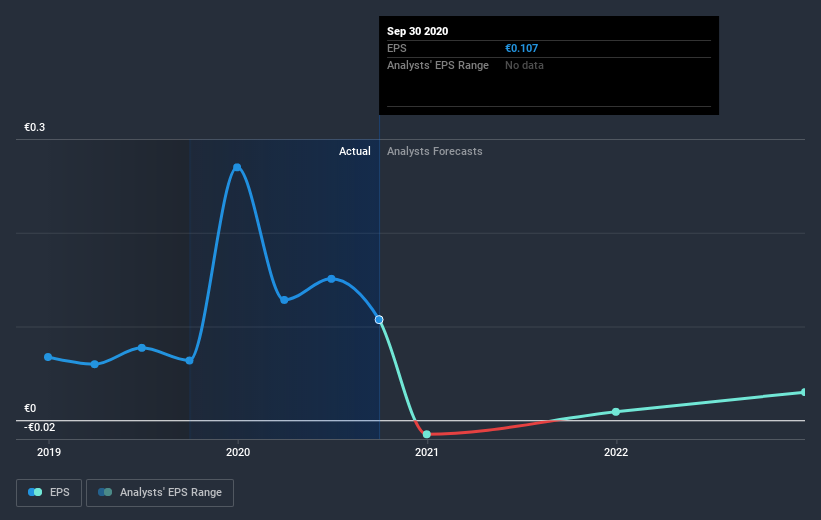

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, CIR. - Compagnie Industriali Riunite moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that CIR. - Compagnie Industriali Riunite has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between CIR. - Compagnie Industriali Riunite's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for CIR. - Compagnie Industriali Riunite shareholders, and that cash payout contributed to why its TSR of 47%, over the last 5 years, is better than the share price return.

A Different Perspective

CIR. - Compagnie Industriali Riunite shareholders gained a total return of 22% during the year. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 8% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with CIR. - Compagnie Industriali Riunite (including 2 which make us uncomfortable) .

Of course CIR. - Compagnie Industriali Riunite may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you decide to trade CIR. - Compagnie Industriali Riunite, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:CIR

CIR. - Compagnie Industriali Riunite

Through its subsidiaries, primarily operates in the automotive components and healthcare sectors in Italy, the rest of European countries, North America, South America, Asia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives