FinecoBank (BIT:FBK) Trades Above Fair Value Despite Forecasted Slower Profit Growth vs Market

Reviewed by Simply Wall St

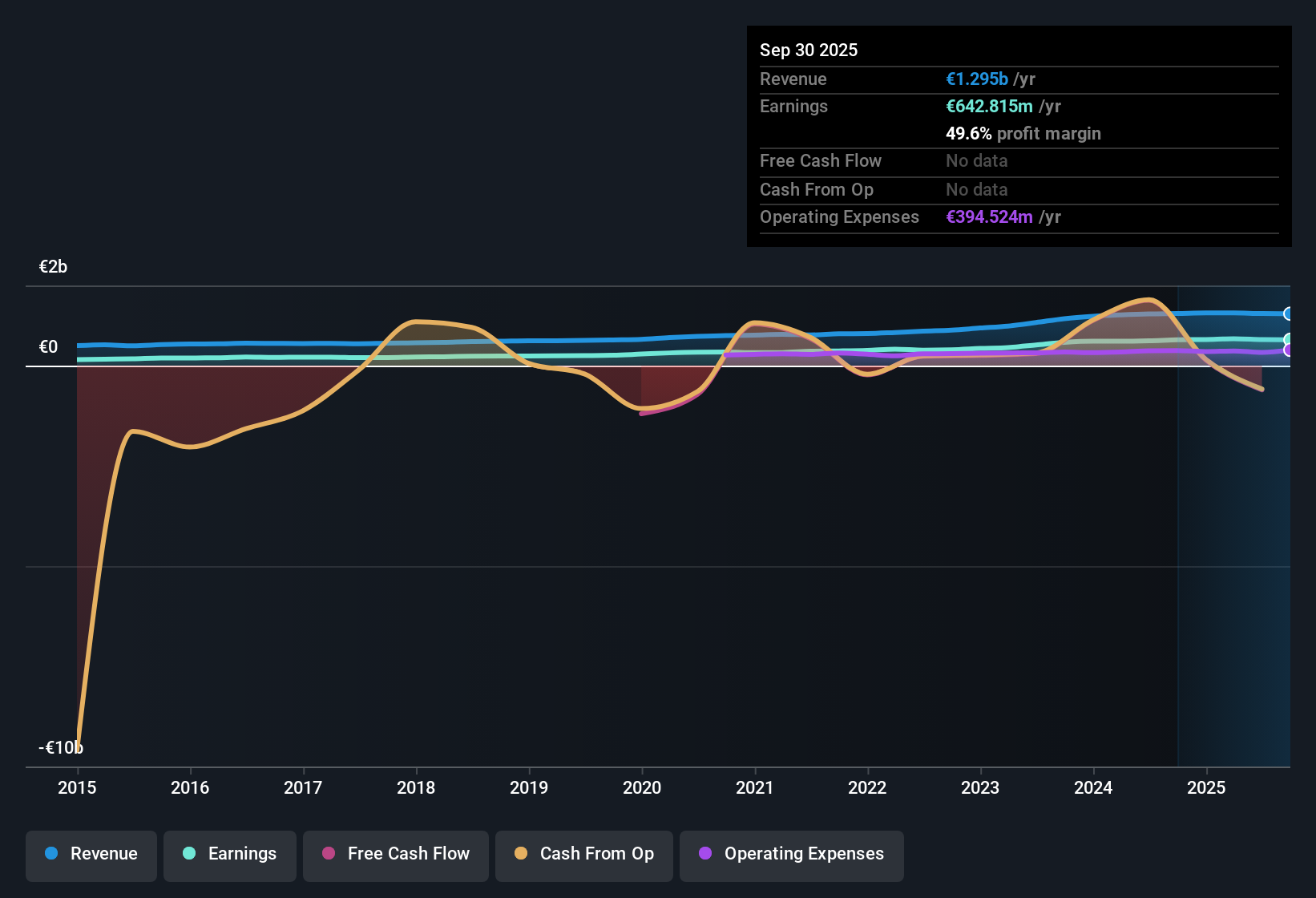

FinecoBank Banca Fineco (BIT:FBK) reported forecasted earnings growth of 4.47% per year and revenue growth of 5.8% per year. The latter is expected to outpace the broader Italian market’s rate of 5.2%. Over the past five years, earnings grew at an annualized rate of 16.4%. The current net profit margin remains steady at 49.6%, unchanged from last year. Investors will note that despite high earnings quality, profit growth is expected to lag the broader market in the coming years, and the company recently posted negative earnings growth.

See our full analysis for FinecoBank Banca Fineco.The next step is to see how these results stack up against the dominant narratives investors follow. Some numbers back up the current story, while others might challenge it.

See what the community is saying about FinecoBank Banca Fineco

Margins Expected to Ease Despite Strong Fee Growth

- Analysts project FinecoBank’s net profit margin will decline from 50.1% now to 47.8% within three years, even as expanding client numbers and higher transaction volumes are expected to boost fee income.

- The analysts' consensus view highlights the bank’s push into advisory and higher-margin services, which could support profitability,

- but at the same time, new regulations on instant payments may squeeze banking fees and pressure margins further.

- Aggressive marketing and innovation aim to attract younger and high-net-worth clients. However, cost growth and market competition remain obstacles to maintaining margin strength.

- Analysts suggest Fineco’s ability to balance service innovation with cost control will be critical for sustaining profitability as the landscape shifts. 📊 Read the full FinecoBank Banca Fineco Consensus Narrative.

Valuation Premiums Defy Slower Profit Growth

- FinecoBank’s current share price of €21.18 trades not only above its DCF fair value of €12.57, but also at a notable premium to industry average P/E ratios. This raises questions about upside at this level.

- According to the analysts' consensus narrative, future growth expectations underpin the elevated valuation,

- but to justify today’s price, investors would need to expect FinecoBank to achieve €1.5 billion in revenue and earnings of €724.2 million by 2028, along with a jump in the P/E ratio from 17.3x to 23.6x.

- Despite these ambitious assumptions, a modest 9.8% gap remains between the current share price and the analyst price target of €21.11. This signals limited near-term upside unless forecasts are beaten.

Dividend Sustainability Faces Cost and Payout Pressures

- The bank’s capital-light model and robust capital ratios could support a payout ratio increase to 70 to 80%, but analysts caution that rising costs, expected to climb 6% in 2025, pose risks to dividend sustainability.

- The consensus narrative notes that while growing fee income and asset management revenues offer room for higher returns to shareholders,

- persistently strong operating leverage will be required to offset higher costs and new regulatory burdens.

- If revenue growth fails to keep pace with expenses, FinecoBank may need to moderate its payout ambitions to protect balance sheet strength.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for FinecoBank Banca Fineco on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want a fresh angle on these figures? Take just a few minutes to shape your insights and share your own take. Do it your way

A great starting point for your FinecoBank Banca Fineco research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

FinecoBank’s premium valuation, modest profit growth outlook, and margin pressures suggest investors may face limited upside and elevated risk at current prices.

If you’d rather hunt for overlooked value, start with these 836 undervalued stocks based on cash flows to discover stocks trading below their fair value with potential for greater returns and less downside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:FBK

FinecoBank Banca Fineco

Provides banking, credit, trading and investment services in Italy.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives