What To Know Before Buying Banco di Desio e della Brianza S.p.A. (BIT:BDB) For Its Dividend

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Could Banco di Desio e della Brianza S.p.A. (BIT:BDB) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

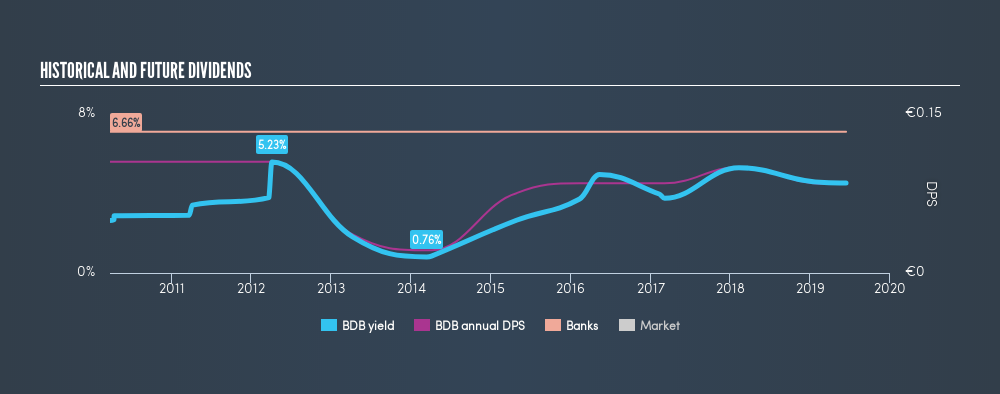

With a nine-year payment history and a 4.2% yield, many investors probably find Banco di Desio e della Brianza intriguing. It sure looks interesting on these metrics - but there's always more to the story . There are a few simple ways to reduce the risks of buying Banco di Desio e della Brianza for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Banco di Desio e della Brianza paid out 29% of its profit as dividends, over the trailing twelve month period. This is a middling range that strikes a nice balance between paying dividends to shareholders, and retaining enough earnings to invest in future growth. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

We update our data on Banco di Desio e della Brianza every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the last decade of data, we can see that Banco di Desio e della Brianza paid its first dividend at least nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once by more than 20%, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was €0.10 in 2010, compared to €0.084 last year. This works out to be a decline of approximately 2.5% per year over that time. Banco di Desio e della Brianza's dividend hasn't shrunk linearly at 2.5% per annum, but the CAGR is a useful estimate of the historical rate of change.

A shrinking dividend over a nine-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings have grown at around 4.1% a year for the past five years, which is better than seeing them shrink! Banco di Desio e della Brianza is paying out less than half of its earnings, which we like. Earnings per share growth have grown slowly, which is not great, but if the retained earnings can be reinvested effectively, future growth may be stronger.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, we like that Banco di Desio e della Brianza has a low and conservative payout ratio. Second, earnings growth has been ordinary, and its history of dividend payments is chequered - having cut its dividend at least once in the past. In summary, we're unenthused by Banco di Desio e della Brianza as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Banco di Desio e della Brianza stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BIT:BDB

Banco di Desio e della Brianza

Provides banking products and services to individuals and enterprises in Italy.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives