What Does Banco Desio’s Lower Net Income Mean for Its Long-Term Strategy? (BIT:BDB)

Reviewed by Sasha Jovanovic

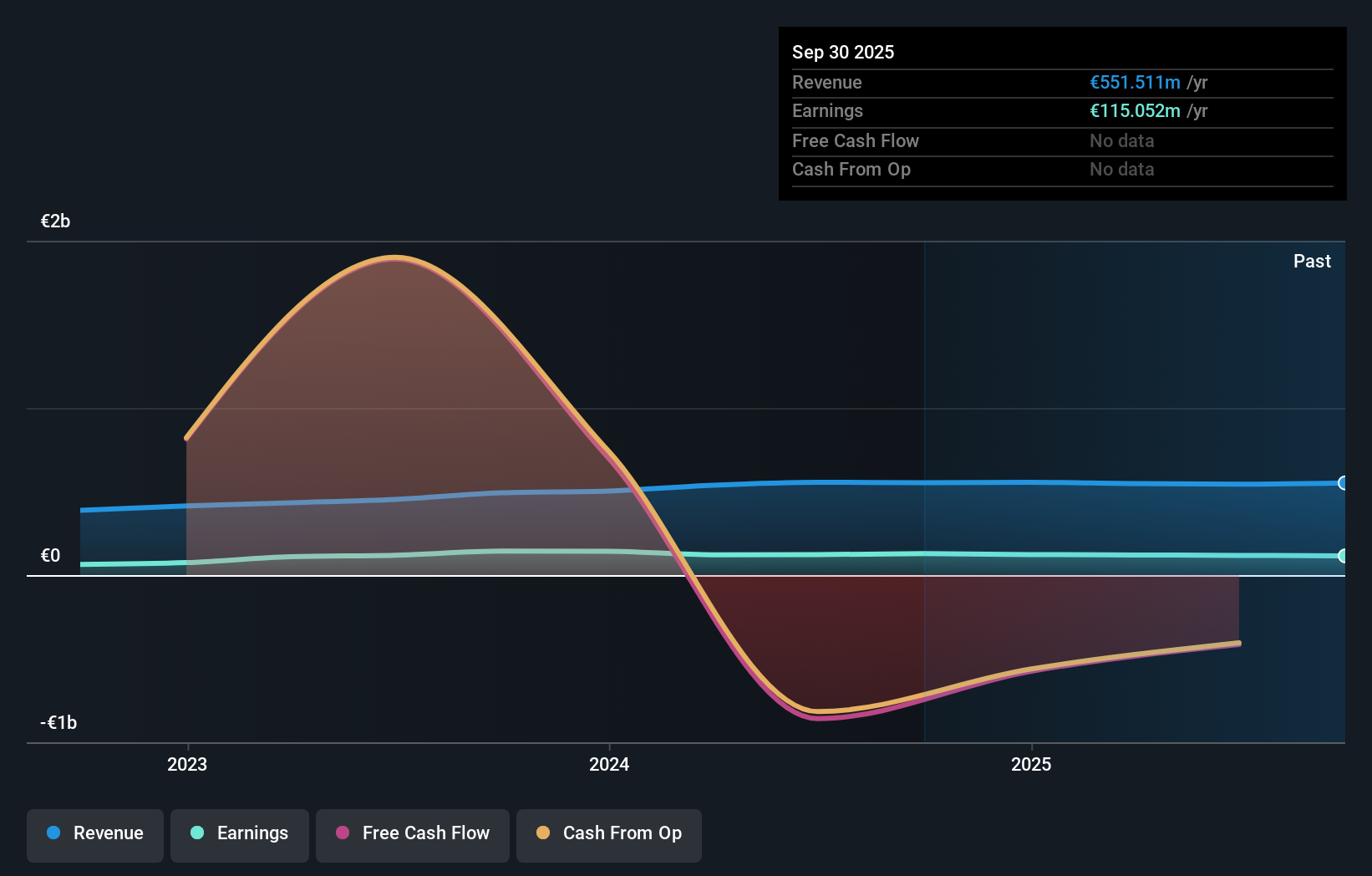

- Banco di Desio e della Brianza S.p.A. recently announced its earnings results for the nine months ended September 30, 2025, reporting net income of €105.9 million compared to €116.4 million for the same period last year.

- The decrease in net income provides insight into the company's financial performance and can influence how investors view its long-term prospects.

- We'll explore how the decline in net income for the first nine months of 2025 shapes Banco di Desio e della Brianza's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Banco di Desio e della Brianza's Investment Narrative?

For anyone interested in Banco di Desio e della Brianza, the investment story hinges on believing in the resilience of the Italian banking sector and BDB’s ability to manage profitability in a shifting market. The latest earnings release, revealing a year-to-date net income of €105.9 million compared to €116.4 million last year, extends the trend of declining profits seen over several quarters. This drop, while not alarming in the context of previous modest earnings contractions, could weigh on some of the key short-term catalysts, such as investor optimism about consistent dividend payments and questions around bad loan management. The risk profile remains prominent, with a relatively low allowance for bad loans and an unstable dividend history meaning the recent results reinforce, rather than reset, these concerns. Overall, while the share price has remained fairly resilient, the earnings decline keeps the focus squarely on loan quality and future profitability.

On the other side, persistent concerns about bad loans and dividend reliability may still shape sentiment. Banco di Desio e della Brianza's share price has been on the slide but might be up to 10% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore another fair value estimate on Banco di Desio e della Brianza - why the stock might be worth as much as €7.40!

Build Your Own Banco di Desio e della Brianza Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco di Desio e della Brianza research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Banco di Desio e della Brianza research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco di Desio e della Brianza's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco di Desio e della Brianza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BDB

Banco di Desio e della Brianza

Provides banking products and services to individuals and enterprises in Italy.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives