Is Stellantis a Value Opportunity After a 25% Slide in 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether Stellantis is a value opportunity or a value trap at today’s price, you are not alone. That is exactly what we are going to unpack here.

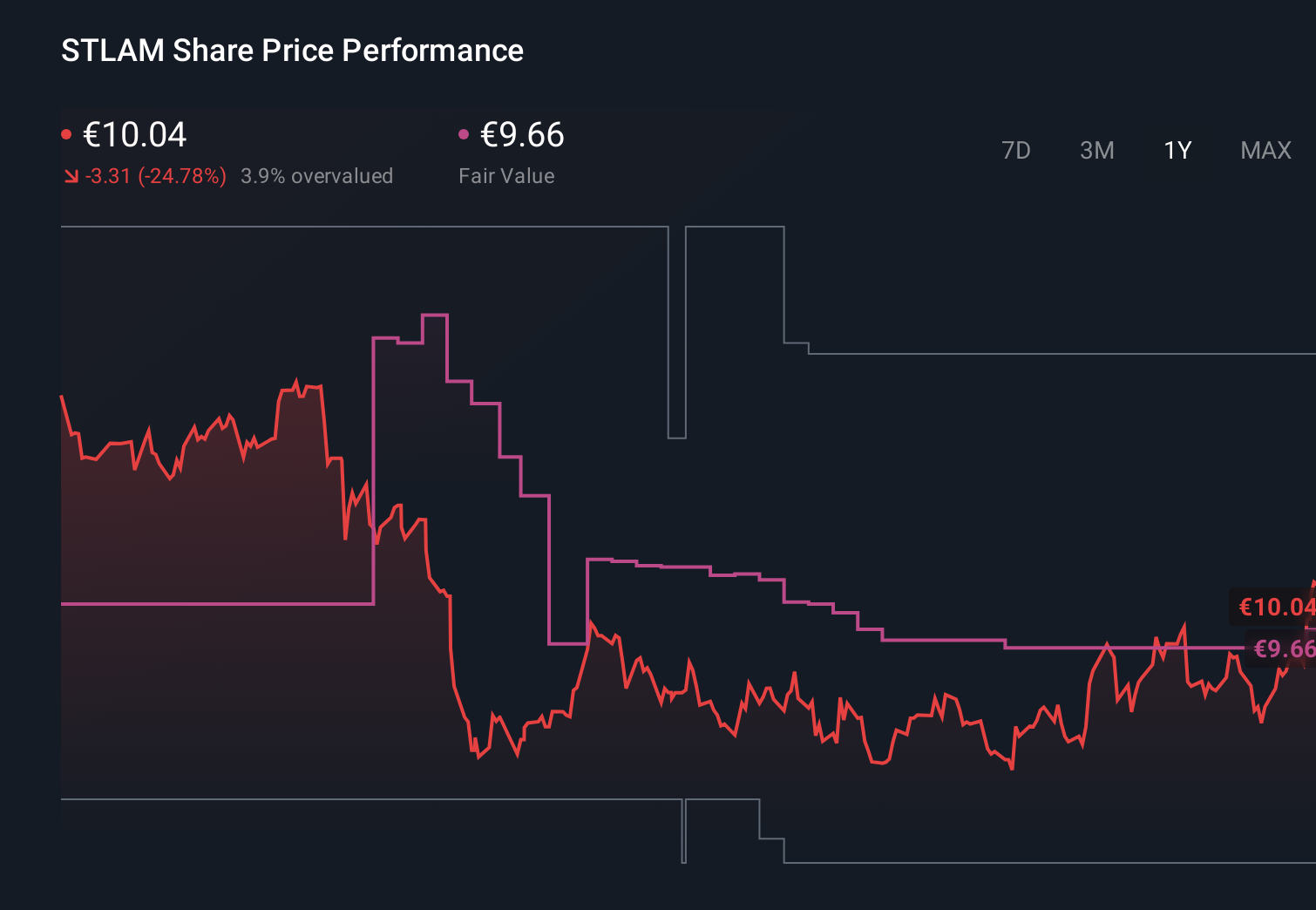

- The stock has been choppy recently, sliding about 6.6% over the last week after a roughly 11.7% jump over the past month. It remains down around 25.2% year to date and 16.6% over the last year.

- Those swings have come as investors weigh Stellantis’ strategic push into electrification and software-defined vehicles alongside shifting sentiment on global auto demand. Longer-term debates about how legacy automakers will navigate the EV transition and capital allocation are still very much driving the conversation around the shares.

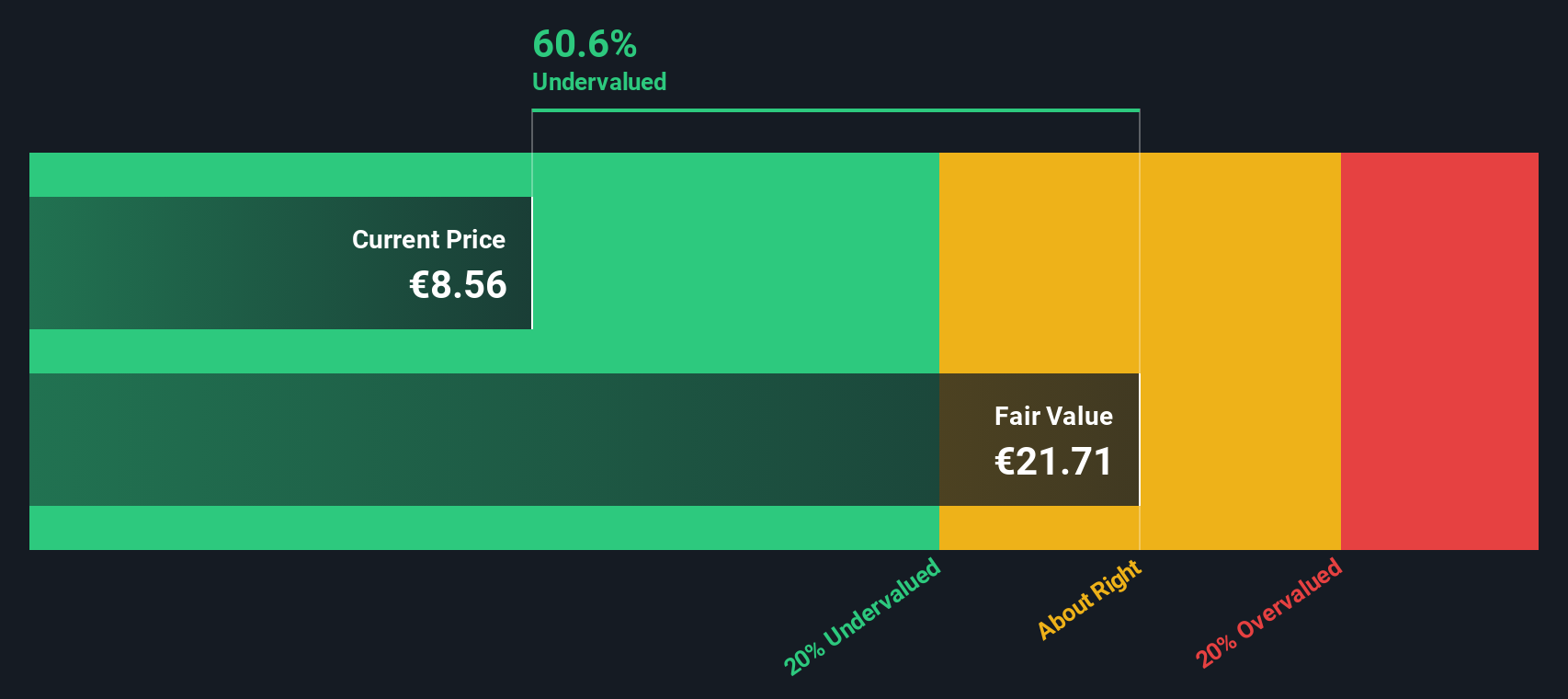

- Despite the volatility, Stellantis currently scores a solid 5 out of 6 on our undervaluation checks. This suggests the market may be underpricing parts of the story. Next we will walk through the main valuation approaches investors are using today, and by the end of this article we will also hint at an even more insightful way to think about fair value.

Find out why Stellantis's -16.6% return over the last year is lagging behind its peers.

Approach 1: Stellantis Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by forecasting the cash it can generate in the future and discounting those cash flows back to today in € terms.

For Stellantis, the latest twelve months free cash flow is roughly €11.9 billion outflow, reflecting heavy investment in its transition and current industry cyclicality. Analysts and extrapolations then project a recovery to positive free cash flow of about €5.8 billion by 2029, with a gradual climb continuing over the following years as shown by Simply Wall St’s 2 Stage Free Cash Flow to Equity model.

By summing and discounting these cash flows, the DCF model arrives at an intrinsic value of €23.17 per share. Compared with today’s market price, this implies the shares trade at roughly a 59.2% discount to estimated fair value, which suggests investors may be overly cautious about Stellantis’ long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Stellantis is undervalued by 59.2%. Track this in your watchlist or portfolio, or discover 898 more undervalued stocks based on cash flows.

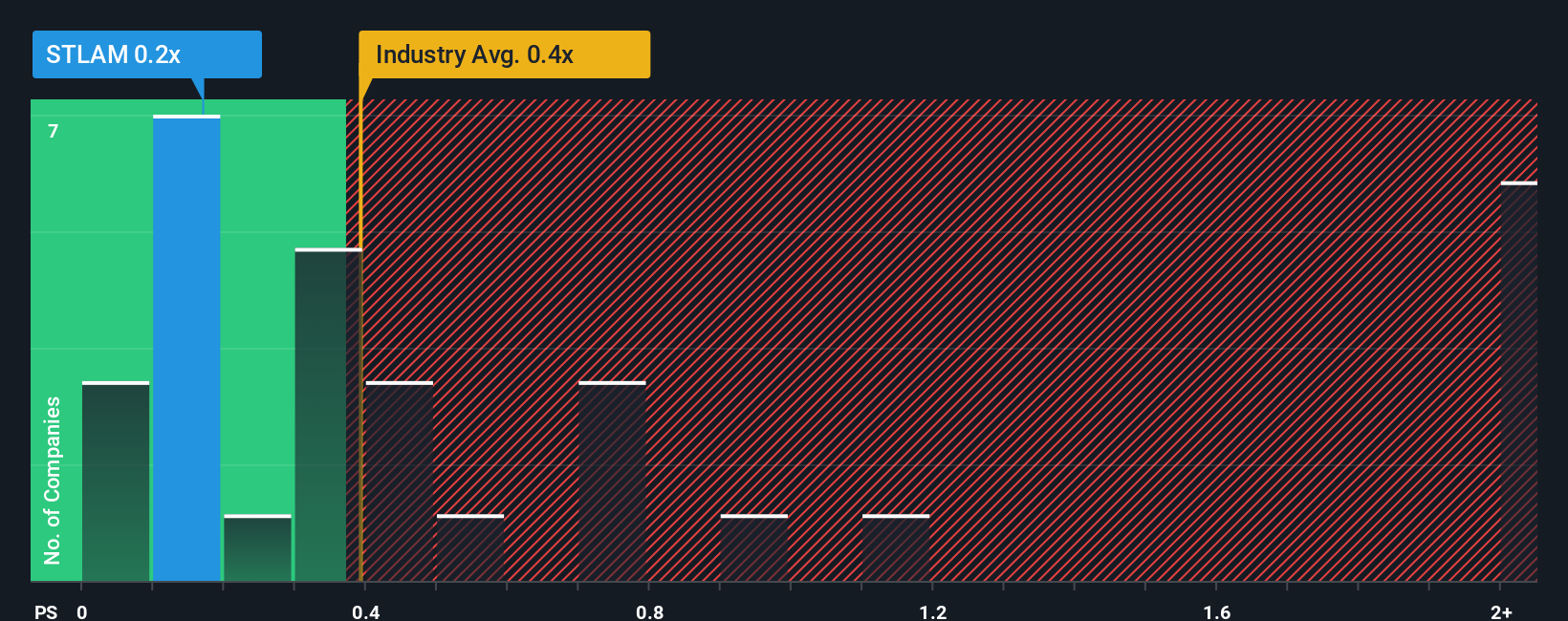

Approach 2: Stellantis Price vs Sales

For established, revenue generating automakers, the price to sales multiple is a useful way to judge valuation because it looks at what investors are paying for each euro of current sales, which tends to be more stable than near term earnings for cyclical businesses.

In general, companies with stronger growth prospects and lower perceived risk can justify a higher price to sales ratio, while slower growth or higher uncertainty usually warrant a lower multiple. Stellantis currently trades on a price to sales ratio of about 0.19x, which is well below the Auto industry average of roughly 0.80x and also far under the broader peer average of around 2.46x.

Simply Wall St’s Fair Ratio framework estimates what a reasonable price to sales multiple could be for Stellantis given its specific growth outlook, profitability, industry, size and risk profile. Because it is tailored to the company rather than just comparing it with a broad peer group, this Fair Ratio of about 0.42x provides a more nuanced benchmark. With the market only asking 0.19x, significantly below this Fair Ratio, the shares appear attractively priced on a sales basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Stellantis Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page where you connect your view of Stellantis’ story to your own forecast for its future revenue, earnings and margins. This then flows through to a Fair Value you can compare against today’s share price to help guide buy or sell decisions. The Fair Value is dynamically updated as new news or earnings arrive. For example, one investor might build a bullish Stellantis Narrative around accelerating EV adoption and margin recovery that supports a Fair Value closer to the highest analyst target near €14 per share. Another, more cautious investor could create a Narrative focused on tariff risks, BEV margin pressure and European weakness that leads to a Fair Value nearer the low end around €6. Both are using the same tool to turn their story into numbers and to see, in real time, whether the current market price still matches their thesis.

Do you think there's more to the story for Stellantis? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:STLAM

Stellantis

Engages in the design, engineering, manufacturing, distribution, and sale of automobiles and light commercial vehicles, engines, transmission systems, metallurgical products, mobility services, and production systems worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion