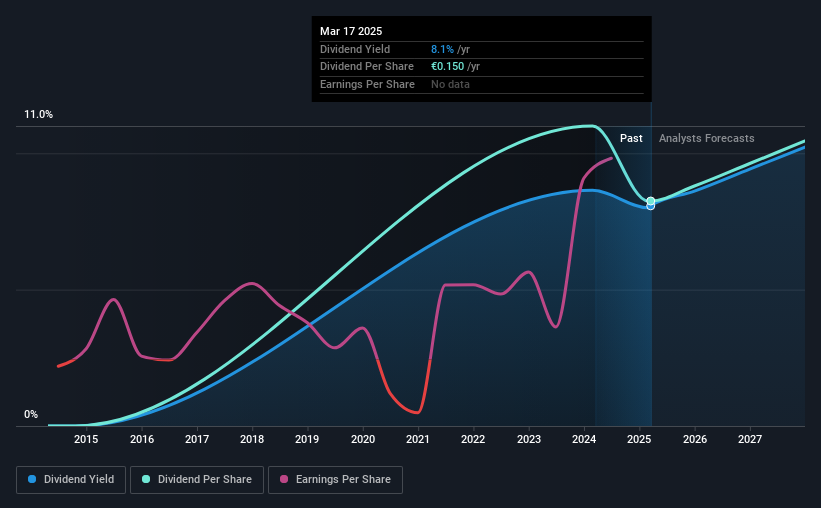

Sogefi S.p.A. (BIT:SGF) has announced that on 14th of May, it will be paying a dividend of€0.15, which a reduction from last year's comparable dividend. This means the annual payment is 8.1% of the current stock price, which is above the average for the industry.

View our latest analysis for Sogefi

Sogefi's Future Dividends May Potentially Be At Risk

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, Sogefi was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

Over the next year, EPS is forecast to expand by 23.3%. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio getting very high over the next year.

Sogefi Doesn't Have A Long Payment History

It's not possible for us to make a backward looking judgement just based on a short payment history. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Sogefi Could Grow Its Dividend

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. It's encouraging to see that Sogefi has been growing its earnings per share at 6.6% a year over the past five years. Sogefi definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

Our Thoughts On Sogefi's Dividend

Overall, we think that Sogefi could make a reasonable income stock, even though it did cut the dividend this year. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Sogefi that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:SGF

Sogefi

Designs, develops, and produces filtration systems, suspension components, air intake products, and engine cooling systems for the automotive industry in Europe, South America, North America, China, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026