Ferrari’s (BIT:RACE) Buyback Completion and Earnings Beat Could Be a Game Changer

Reviewed by Sasha Jovanovic

- Ferrari N.V. recently completed a repurchase of 648,406 shares for €258 million and reported third quarter earnings, with sales reaching €1.73 billion and net income at €381.32 million, both higher than the previous year.

- The company has now finished its multi-year share buyback program initiated in June 2022, having repurchased 5.62 million shares totaling €1.88 billion and representing 3.12% of its outstanding shares.

- We'll explore how Ferrari's latest quarterly results, reflecting ongoing year-over-year growth in both sales and net income, influence its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Ferrari Investment Narrative Recap

To be a Ferrari shareholder, you need to believe in the company's ability to maintain its brand exclusivity, pricing power, and long-term demand among ultra-high-net-worth clients, even as it adapts to global trends like electrification. The recent completion of Ferrari's multi-year buyback program and its Q3 earnings growth reinforce its narrative of financial discipline and profitability. However, these updates do not materially change the biggest near-term catalyst, successful new model launches, or the central risk of slower progress in electrification and evolving consumer preferences.

Ferrari's latest third-quarter results, with growing sales and net income, stand out as the most relevant recent announcement, supporting confidence in current execution and ongoing demand for the brand. While strong financial performance helps buffer some near-term pressures, the challenges around hybrid and electric transitions and evolving luxury market dynamics remain important factors in the broader story. Unlike short-term noise, there is persistent uncertainty around Ferrari's ability to accelerate its electric vehicle strategy, and investors should be aware of...

Read the full narrative on Ferrari (it's free!)

Ferrari's projections anticipate €8.8 billion in revenue and €2.1 billion in earnings by 2028. This outlook requires an annual revenue growth rate of 8.1% and a €0.5 billion increase in earnings from the current €1.6 billion.

Uncover how Ferrari's forecasts yield a €404.54 fair value, a 10% upside to its current price.

Exploring Other Perspectives

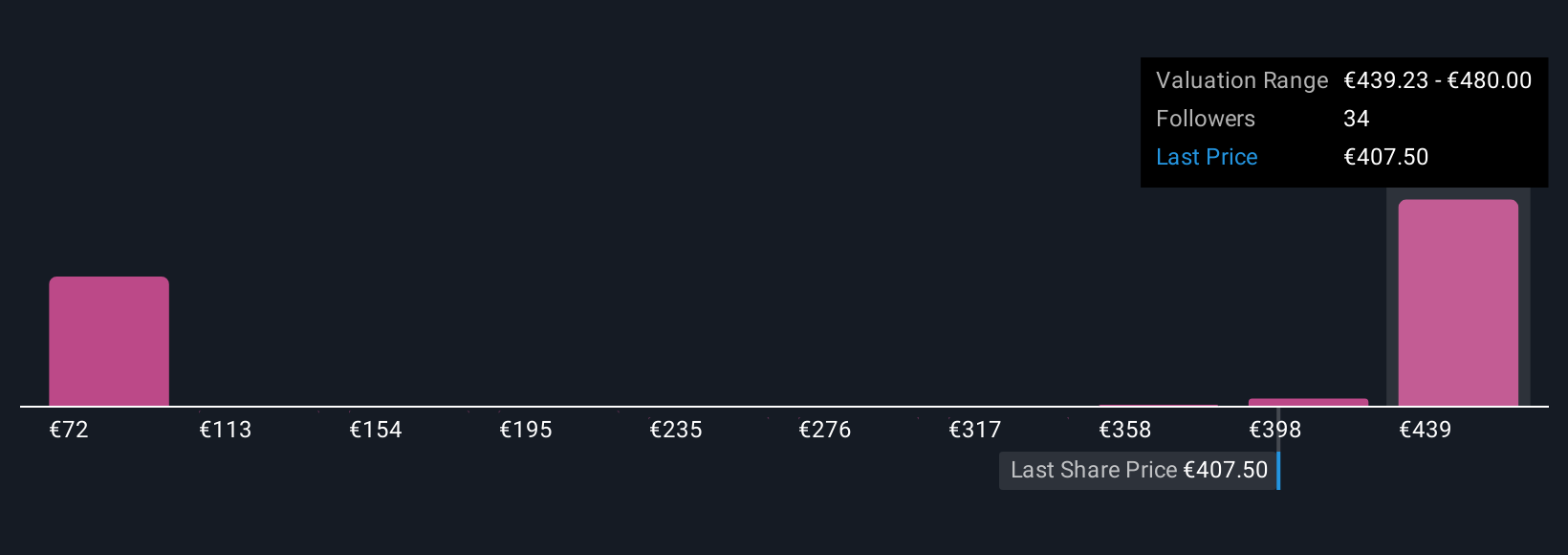

Sixteen members of the Simply Wall St Community estimate Ferrari’s fair value between €90.64 and €545.09 per share. While views are split, many point to the importance of electrification as a driver of future performance trends.

Explore 16 other fair value estimates on Ferrari - why the stock might be worth less than half the current price!

Build Your Own Ferrari Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ferrari research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ferrari research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ferrari's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives