- Italy

- /

- Auto Components

- /

- BIT:LNDR

Landi Renzo S.p.A. (BIT:LNDR) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

Unfortunately for some shareholders, the Landi Renzo S.p.A. (BIT:LNDR) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

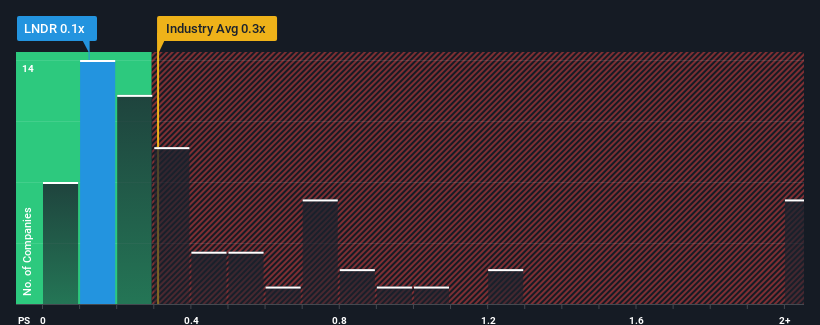

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Landi Renzo's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in Italy is also close to 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Landi Renzo

How Has Landi Renzo Performed Recently?

Landi Renzo hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Landi Renzo will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Landi Renzo's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 7.3% decrease to the company's top line. Still, the latest three year period has seen an excellent 63% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 1.5% during the coming year according to the one analyst following the company. Meanwhile, the industry is forecast to moderate by 1.8%, which suggests the company won't escape the wider industry forces.

With this information, it's not too hard to see why Landi Renzo is trading at a fairly similar P/S in comparison. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There is still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What Does Landi Renzo's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Landi Renzo looks to be in line with the rest of the Auto Components industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our findings align with our suspicions - a closer look at Landi Renzo's analyst forecasts shows that the company's similarly unstable outlook compared to the industry is keeping its price-to-sales ratio in line with the industry's average. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to justify a high or low P/S ratio. However, we're slightly cautious about the company's ability to resist further pain to its business from the broader industry turmoil. For now though, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Landi Renzo that we have uncovered.

If you're unsure about the strength of Landi Renzo's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:LNDR

Landi Renzo

Engages in the design, manufacture, marketing, installation, and sale of LPG and CNG fuel supply systems in Italy, rest of Europe, America, Asia, and Internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success