- Italy

- /

- Auto Components

- /

- BIT:BRE

Brembo (BIT:BRE): Taking Stock of Valuation After Recent Price Movement

Reviewed by Kshitija Bhandaru

If you’re following Brembo (BIT:BRE), you might have raised your eyebrows at the recent dip in the stock price. While there hasn’t been a big headline or obvious news event to spark the latest move, shifts like this can prompt investors to wonder whether the market is quietly signaling something about the company’s prospects, or if short-term holders are simply shuffling their portfolios. Either way, when a stock makes even a modest move without an apparent trigger, it’s worth pausing to take a closer look at the fundamentals and broader picture.

Brembo’s share price has drifted in both directions over the past year, with a small decline of around 2% and only modest gains so far this year. However, looking at the longer sweep, there has been real momentum. Returns are up 18% over the past three months and nearly 17% for holders who stuck with it the past three years. Alongside these market moves, the company has delivered healthy annual growth in both revenue and net income, though not every quarter has been smooth sailing.

So, with the latest price wobble and long-term growth still intact, is this the start of a bargain entry point, or is the market already banking on the next chapter of Brembo’s story?

Price-to-Earnings of 14.4x: Is it justified?

Brembo is valued at a price-to-earnings (P/E) ratio of 14.4x, which puts it above the peer average (12.5x) and the European Auto Components industry average (12.9x), but below the Italian market average (17.8x). This means investors are paying more per euro of Brembo's earnings compared to most direct competitors, but not as much as the overall market demands for profits.

The P/E ratio is a widely used valuation metric that compares a company's current share price to its per-share earnings. In the auto parts sector, the P/E ratio is important because it helps investors assess whether future growth prospects are already priced in, or if the market is underestimating or overestimating profitability going forward.

Brembo's higher P/E compared to sector peers suggests that the market has higher expectations for its future growth and earnings quality. However, this premium may not be fully justified because Brembo's recent earnings performance and growth forecasts are more modest relative to some benchmarks. Investors should be aware that paying a higher multiple requires confidence in management's ability to deliver above-average results in the future.

Result: Fair Value of €9.22 (ABOUT RIGHT)

See our latest analysis for Brembo.However, if revenue growth is slower than expected or there is a decline in net income momentum, market sentiment could shift and this could impact Brembo’s future valuation.

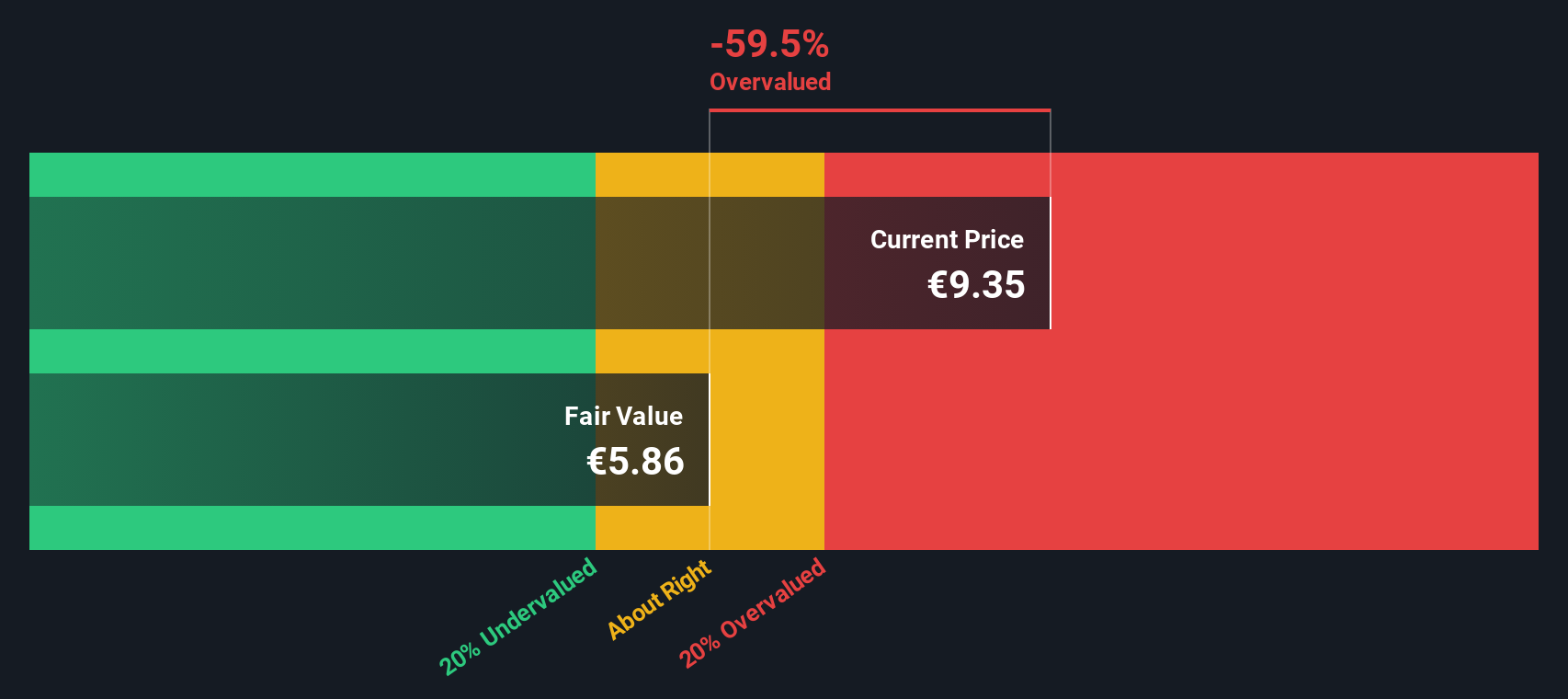

Find out about the key risks to this Brembo narrative.Another View: SWS DCF Model Puts a Different Spin

However, if we switch gears to our DCF model, the outlook is less rosy than what the market appears to be pricing in. According to this method, the stock may actually be trading above its true value. Has the market gotten ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Brembo Narrative

If you'd like to take a closer look or arrive at your own conclusion, you can easily build your personal view using our tools in just a few minutes: Do it your way.

A great starting point for your Brembo research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let the next opportunity pass you by. Use Simply Wall St’s smart tools to tap into stocks with the right mix of growth, innovation, and income.

- Capture strong payouts and a steady income stream by scanning for dividend stocks with yields > 3% with healthy yields above 3%.

- Target future-focused sectors and see which AI penny stocks could transform our world with game-changing technology.

- Unearth high-potential stocks trading below fair value by reviewing undervalued stocks based on cash flows built around solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brembo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BRE

Brembo

Designs, develops, and distributes braking systems and components for cars, motorbikes, and commercial vehicles.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives