- Italy

- /

- Auto Components

- /

- BIT:BRE

Assessing Brembo (BIT:BRE) Valuation After Recent Share Rebound and Industry Comparisons

Reviewed by Simply Wall St

Price-to-Earnings of 14.4x: Is it justified?

Brembo is currently valued at a price-to-earnings (P/E) ratio of 14.4x. This is higher than both the European Auto Components industry average of 13.1x and the peer average of 12.5x. This suggests the stock may be priced at a premium relative to its sector.

The price-to-earnings multiple measures how much investors are willing to pay for each euro of earnings. In the auto parts space, this ratio often reflects expectations for future growth, profitability, and stability within a cyclical industry.

The market appears to expect more from Brembo compared to its peers, possibly due to its history of high quality earnings or anticipated profit growth. However, paying a premium in this sector usually requires strong evidence of outperformance in the years to come.

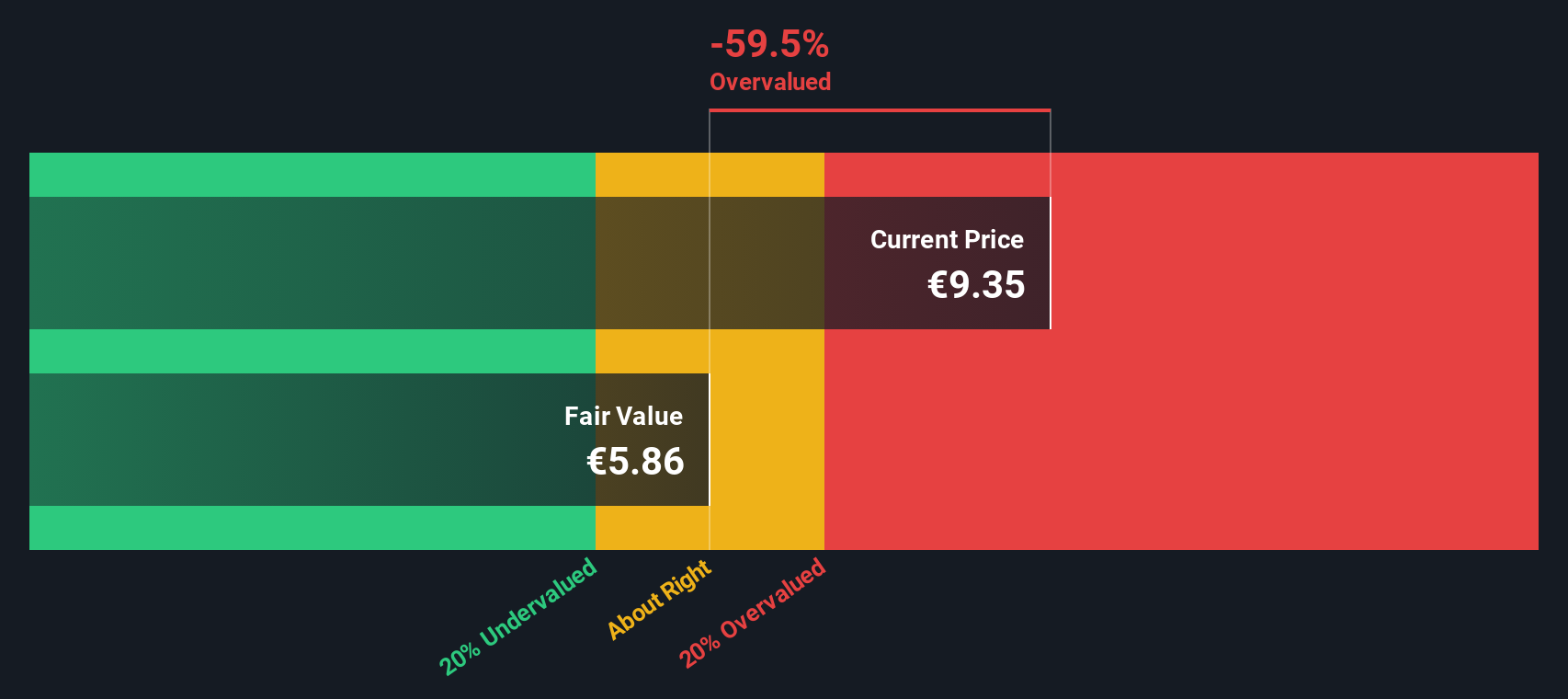

Result: Fair Value of €9.20 (OVERVALUED)

See our latest analysis for Brembo.However, lingering industry challenges or slower than expected profit growth could quickly unravel the current optimism and pressure the share price once again.

Find out about the key risks to this Brembo narrative.Another View: Discounted Cash Flow

Looking through the lens of our DCF model, a different picture emerges. This approach suggests Brembo is actually trading above what the fundamentals justify, presenting a distinct challenge to the value seen in market multiples. Could this mean market optimism is running ahead of reality, or is something else missed in the forecasts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Brembo Narrative

Of course, if you see the data differently or want to shape your own perspective, you can easily craft a personal narrative in just a few minutes using our platform. Do it your way.

A great starting point for your Brembo research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give yourself every advantage by using the Simply Wall Street Screener to find high potential stocks that match your goals. If you hesitate, you might just miss tomorrow’s biggest opportunity.

- Boost your dividend income and stay ahead of changing markets by tapping into a selection of dividend stocks with yields > 3%.

- Tap into future innovations with a curated group of quantum computing stocks paving new ground in advanced computing and technology.

- Unlock value plays with stocks trading below their intrinsic worth. This gives you access to undervalued stocks based on cash flows others may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brembo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BRE

Brembo

Designs, develops, and distributes braking systems and components for cars, motorbikes, and commercial vehicles.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives