Sildarvinnslan Hf (ICE:SVN) investors are up 3.9% in the past week, but earnings have declined over the last year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. For example, the Sildarvinnslan Hf. (ICE:SVN) share price is up 33% in the last 1 year, clearly besting the market decline of around 6.8% (not including dividends). That's a solid performance by our standards! Sildarvinnslan Hf hasn't been listed for long, so it's still not clear if it is a long term winner.

Since the stock has added Kr8.2b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Sildarvinnslan Hf

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, Sildarvinnslan Hf actually saw its earnings per share drop 4.3%.

Sometimes companies will sacrifice EPS in the short term for longer term gains; and in that case we may be able to find other positives. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We think that the revenue growth of 44% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

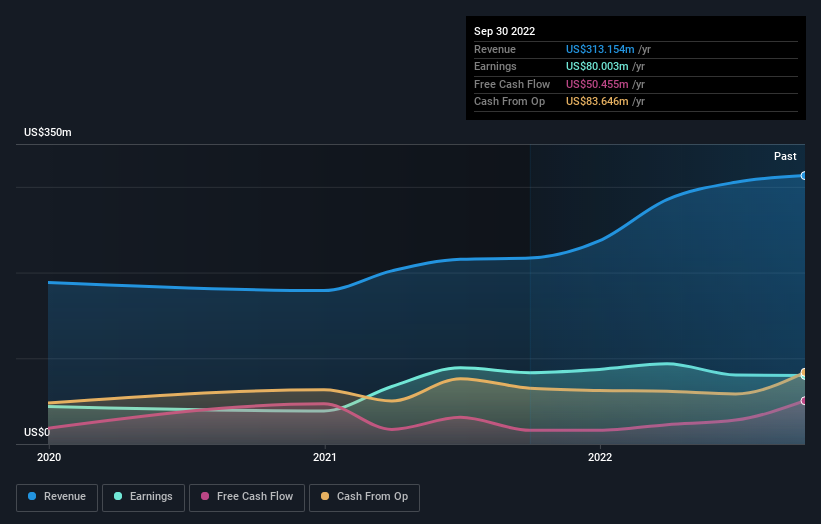

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Sildarvinnslan Hf's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered Sildarvinnslan Hf's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Sildarvinnslan Hf's TSR, at 35% is higher than its share price return of 33%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Sildarvinnslan Hf shareholders should be happy with the total gain of 35% over the last twelve months. It's always interesting to track share price performance over the longer term. But to understand Sildarvinnslan Hf better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Sildarvinnslan Hf , and understanding them should be part of your investment process.

Of course Sildarvinnslan Hf may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IS exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ICSE:SVN

Sildarvinnslan Hf

Operates in the fish processing and fishing activities in Iceland, Germany, Spain, and Greece.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives