- India

- /

- Renewable Energy

- /

- NSEI:PTC

Top 3 Indian Dividend Stocks To Watch In September 2024

Reviewed by Simply Wall St

The Indian market has stayed flat over the past 7 days but is up 44% over the past year, with earnings expected to grow by 17% per annum over the next few years. In this dynamic environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for investors seeking stability and growth.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Balmer Lawrie Investments (BSE:532485) | 3.88% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.11% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.33% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 7.95% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 5.91% | ★★★★★☆ |

| NMDC (BSE:526371) | 3.37% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.04% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.08% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.03% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.61% | ★★★★★☆ |

Click here to see the full list of 16 stocks from our Top Indian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

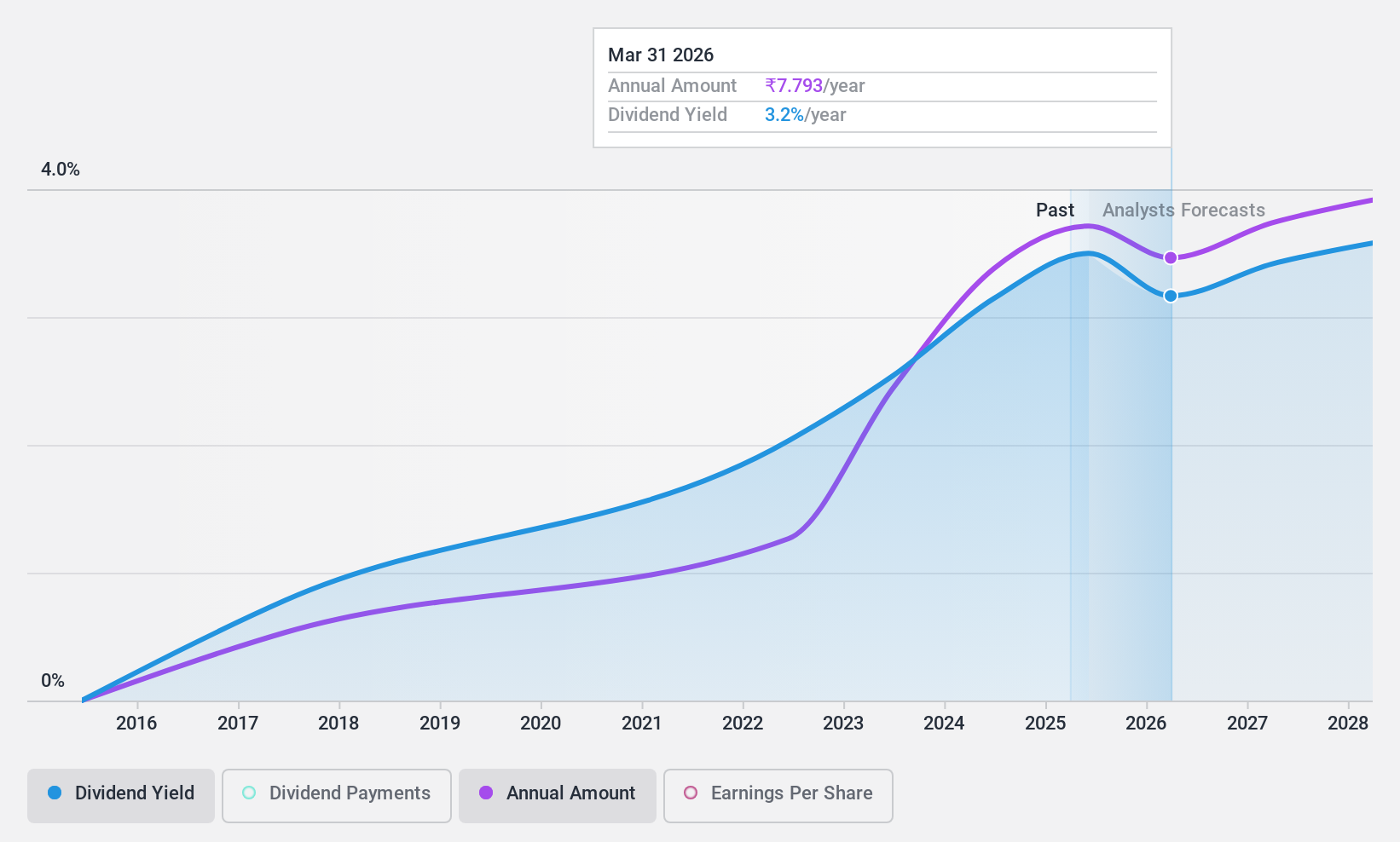

Bank of Baroda (NSEI:BANKBARODA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Baroda Limited offers a range of banking products and services to individuals, government departments, and corporate customers both in India and internationally, with a market cap of ₹1.30 trillion.

Operations: Bank of Baroda Limited's revenue segments include Treasury (₹316.82 billion), Other Banking Operations (₹110.76 billion), Corporate/Wholesale Banking (₹502.78 billion), and Retail Banking, which is divided into Digital Banking (₹7.40 million) and Other Retail Banking (₹512.25 billion).

Dividend Yield: 3%

Bank of Baroda has a low payout ratio of 20.9%, indicating its dividends are well-covered by earnings, and this is expected to remain consistent over the next three years. However, its dividend payments have been volatile and unreliable over the past decade despite recent increases. The bank's high level of bad loans (2.9%) poses a risk, but it trades at good value compared to peers and industry standards. Recent earnings growth has been strong at 56.5% per year over five years, supporting dividend sustainability despite historical instability in payouts.

- Dive into the specifics of Bank of Baroda here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Bank of Baroda is trading behind its estimated value.

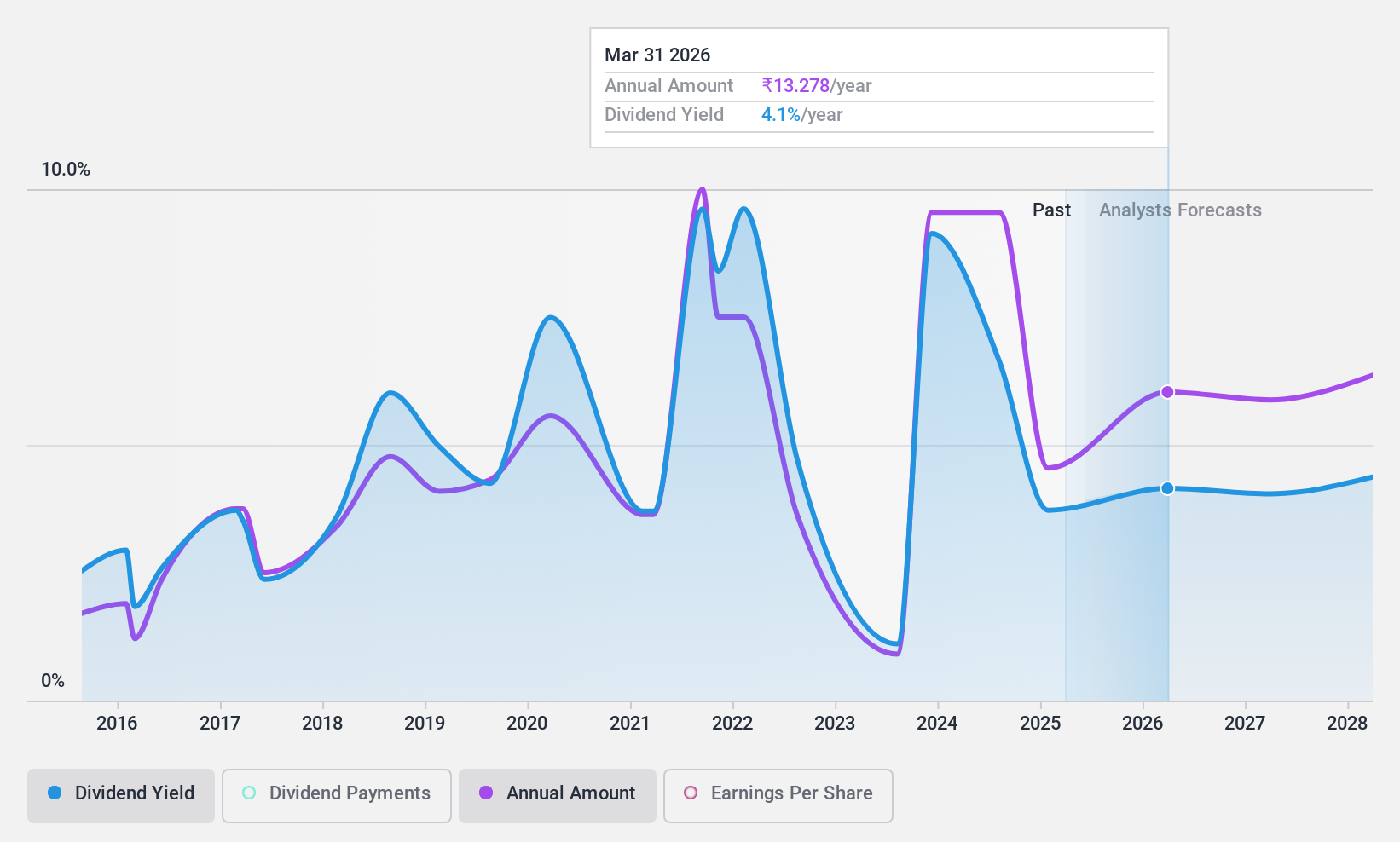

Bharat Petroleum (NSEI:BPCL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bharat Petroleum Corporation Limited primarily engages in refining crude oil and marketing petroleum products in India and internationally, with a market cap of ₹1.54 trillion.

Operations: Bharat Petroleum Corporation Limited generates revenue primarily from its Downstream Petroleum segment, amounting to ₹5.07 billion, and from Exploration & Production of Hydrocarbons, which contributes ₹1.92 billion.

Dividend Yield: 5.9%

Bharat Petroleum Corporation Limited offers a compelling dividend yield in the top 25% of Indian market payers, supported by a low payout ratio (33.3%) and cash payout ratio (34.6%). Despite its high debt levels and volatile dividend history over the past decade, BPCL's dividends are well-covered by earnings and cash flows. Recent financials show declining net income but stable sales, with key executive changes potentially impacting future performance.

- Click to explore a detailed breakdown of our findings in Bharat Petroleum's dividend report.

- Our valuation report unveils the possibility Bharat Petroleum's shares may be trading at a discount.

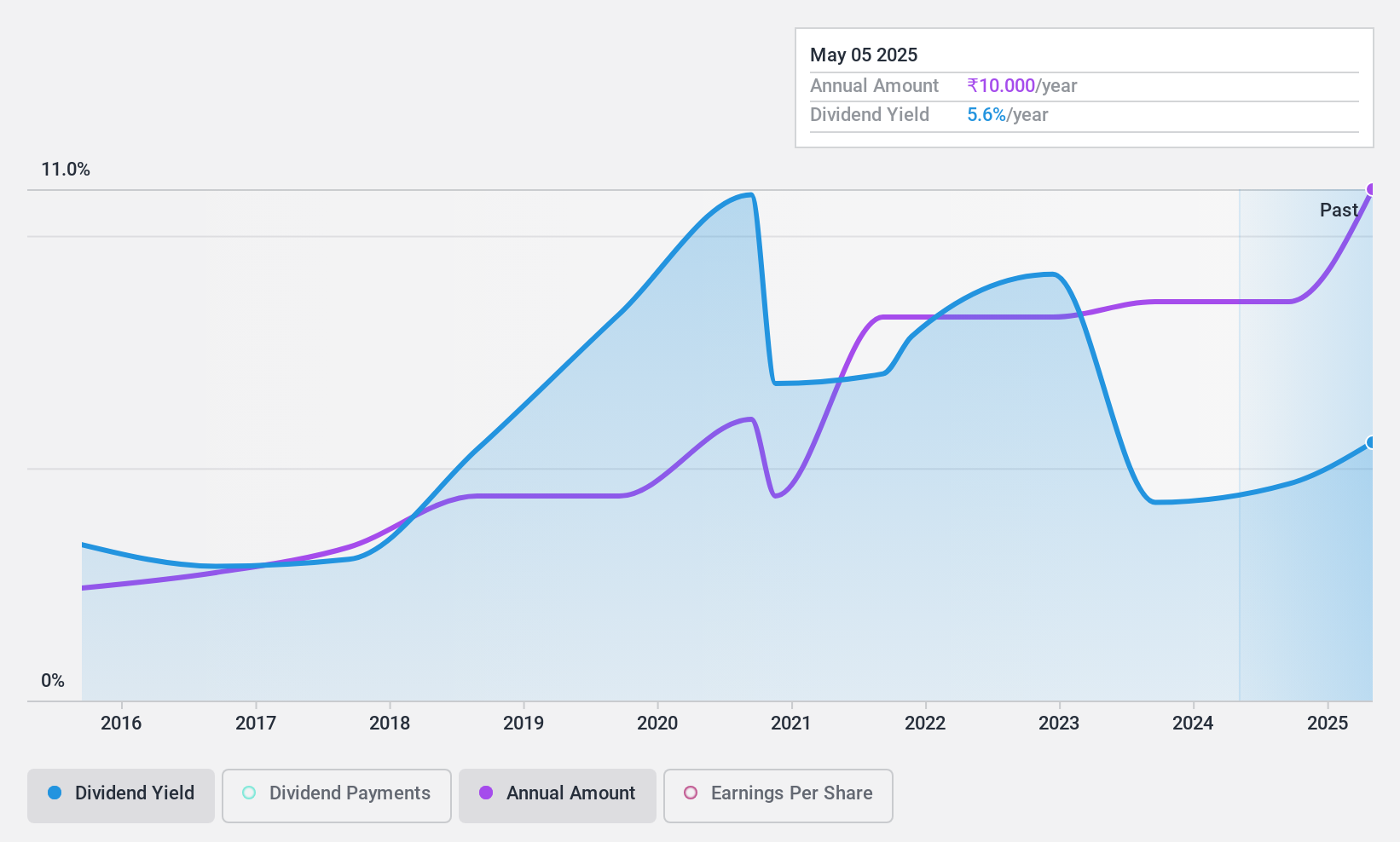

PTC India (NSEI:PTC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited, with a market cap of ₹64.03 billion, engages in the trading of power across India, Nepal, Bhutan, and Bangladesh through its subsidiaries.

Operations: PTC India Limited generates revenue primarily from its power trading segment, amounting to ₹159.67 billion, and its financing business, which contributes ₹7.35 billion.

Dividend Yield: 3.6%

PTC India Limited offers a strong dividend yield in the top 25% of Indian market payers, supported by a reasonable payout ratio (54%) and low cash payout ratio (9.4%). Despite its volatile dividend history over the past decade, recent earnings show an increase in net income to INR 1.74 billion for Q1 2024 from INR 1.30 billion a year ago. However, executive changes and regulatory issues may affect future stability.

- Click here and access our complete dividend analysis report to understand the dynamics of PTC India.

- In light of our recent valuation report, it seems possible that PTC India is trading beyond its estimated value.

Seize The Opportunity

- Investigate our full lineup of 16 Top Indian Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PTC

PTC India

Engages in the trading and generating of power in India, Nepal, Bhutan, and Bangladesh.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives