- India

- /

- Renewable Energy

- /

- NSEI:KPIGREEN

Should You Be Adding KPI Green Energy (NSE:KPIGREEN) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like KPI Green Energy (NSE:KPIGREEN), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for KPI Green Energy

KPI Green Energy's Improving Profits

In the last three years KPI Green Energy's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, KPI Green Energy's EPS grew from ₹11.97 to ₹30.34, over the previous 12 months. It's a rarity to see 154% year-on-year growth like that. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

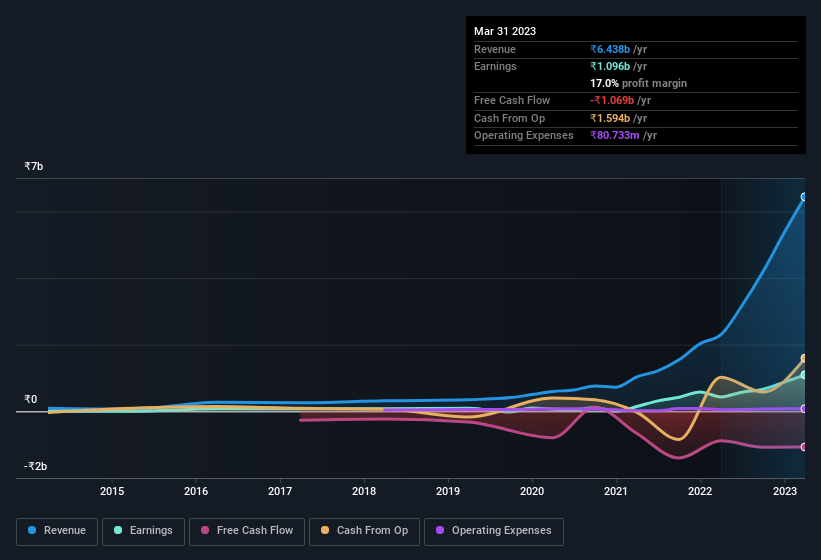

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the revenue front, KPI Green Energy has done well over the past year, growing revenue by 180% to ₹6.4b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

KPI Green Energy isn't a huge company, given its market capitalisation of ₹20b. That makes it extra important to check on its balance sheet strength.

Are KPI Green Energy Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see KPI Green Energy insiders walking the walk, by spending ₹20m on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. It is also worth noting that it was Chairman & MD Farukbhai Patel who made the biggest single purchase, worth ₹7.6m, paying ₹381 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for KPI Green Energy will reveal that insiders own a significant piece of the pie. To be exact, company insiders hold 65% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. In terms of absolute value, insiders have ₹13b invested in the business, at the current share price. That's nothing to sneeze at!

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because KPI Green Energy's CEO, Farukbhai Patel, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like KPI Green Energy with market caps between ₹8.2b and ₹33b is about ₹17m.

The CEO of KPI Green Energy only received ₹7.2m in total compensation for the year ending March 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is KPI Green Energy Worth Keeping An Eye On?

KPI Green Energy's earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe KPI Green Energy deserves timely attention. What about risks? Every company has them, and we've spotted 2 warning signs for KPI Green Energy (of which 1 makes us a bit uncomfortable!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of KPI Green Energy, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if KPI Green Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KPIGREEN

KPI Green Energy

Operates as an independent power producer that focuses on the development, construction, ownership, operation, and maintenance of renewable energy projects under Solarism brand name in India.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion