- India

- /

- Renewable Energy

- /

- NSEI:JPPOWER

Increases to Jaiprakash Power Ventures Limited's (NSE:JPPOWER) CEO Compensation Might Cool off for now

Performance at Jaiprakash Power Ventures Limited (NSE:JPPOWER) has been reasonably good and CEO Suren Jain has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 24 September 2022. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Jaiprakash Power Ventures

How Does Total Compensation For Suren Jain Compare With Other Companies In The Industry?

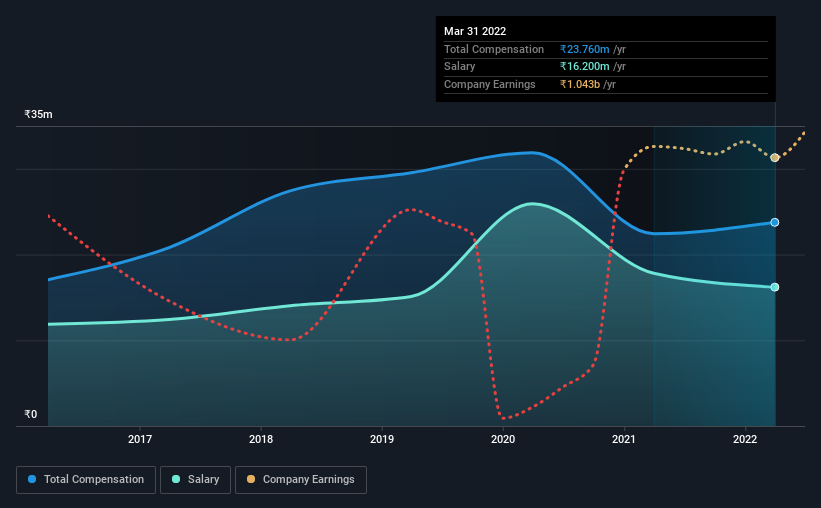

According to our data, Jaiprakash Power Ventures Limited has a market capitalization of ₹56b, and paid its CEO total annual compensation worth ₹24m over the year to March 2022. That's a fairly small increase of 5.9% over the previous year. Notably, the salary which is ₹16.2m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from ₹32b to ₹127b, the reported median CEO total compensation was ₹10m. Hence, we can conclude that Suren Jain is remunerated higher than the industry median.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹16m | ₹18m | 68% |

| Other | ₹7.6m | ₹4.6m | 32% |

| Total Compensation | ₹24m | ₹22m | 100% |

Speaking on an industry level, nearly 81% of total compensation represents salary, while the remainder of 19% is other remuneration. Jaiprakash Power Ventures sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Jaiprakash Power Ventures Limited's Growth Numbers

Jaiprakash Power Ventures Limited has seen its earnings per share (EPS) increase by 60% a year over the past three years. Its revenue is up 57% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Jaiprakash Power Ventures Limited Been A Good Investment?

We think that the total shareholder return of 382%, over three years, would leave most Jaiprakash Power Ventures Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Jaiprakash Power Ventures (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JPPOWER

Jaiprakash Power Ventures

Engages in the power generation and cement grinding businesses in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion