- India

- /

- Renewable Energy

- /

- NSEI:JPPOWER

Despite shrinking by ₹4.7b in the past week, Jaiprakash Power Ventures (NSE:JPPOWER) shareholders are still up 837% over 5 years

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. Don't believe it? Then look at the Jaiprakash Power Ventures Limited (NSE:JPPOWER) share price. It's 837% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. The last week saw the share price soften some 3.7%. Anyone who held for that rewarding ride would probably be keen to talk about it.

Although Jaiprakash Power Ventures has shed ₹4.7b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Jaiprakash Power Ventures

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

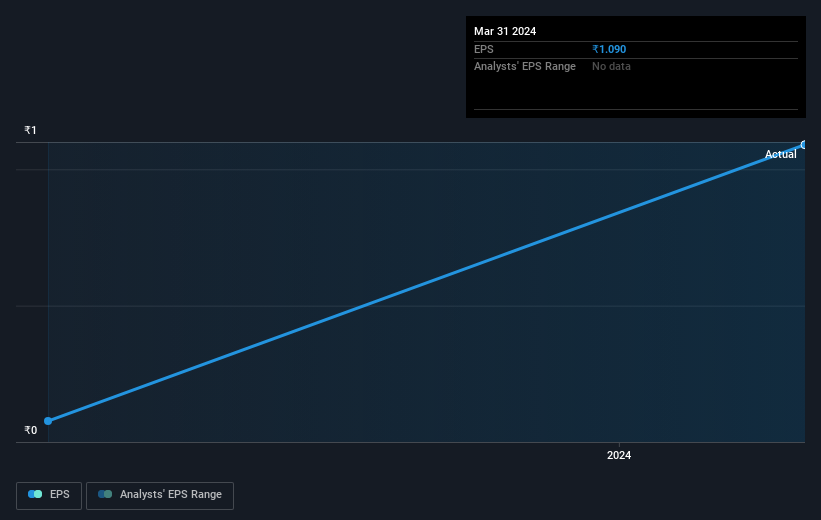

During the five years of share price growth, Jaiprakash Power Ventures moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Jaiprakash Power Ventures share price is up 230% in the last three years. In the same period, EPS is up 70% per year. This EPS growth is higher than the 49% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days. This unenthusiastic sentiment is reflected in the stock's reasonably modest P/E ratio of 11.94.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We're pleased to report that Jaiprakash Power Ventures shareholders have received a total shareholder return of 197% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 56% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Jaiprakash Power Ventures better, we need to consider many other factors. For instance, we've identified 1 warning sign for Jaiprakash Power Ventures that you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JPPOWER

Jaiprakash Power Ventures

Engages in the power generation and cement grinding businesses in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives