- India

- /

- Renewable Energy

- /

- NSEI:GREENPOWER

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Orient Green Power Company Limited's (NSE:GREENPOWER) CEO For Now

Key Insights

- Orient Green Power's Annual General Meeting to take place on 30th of June

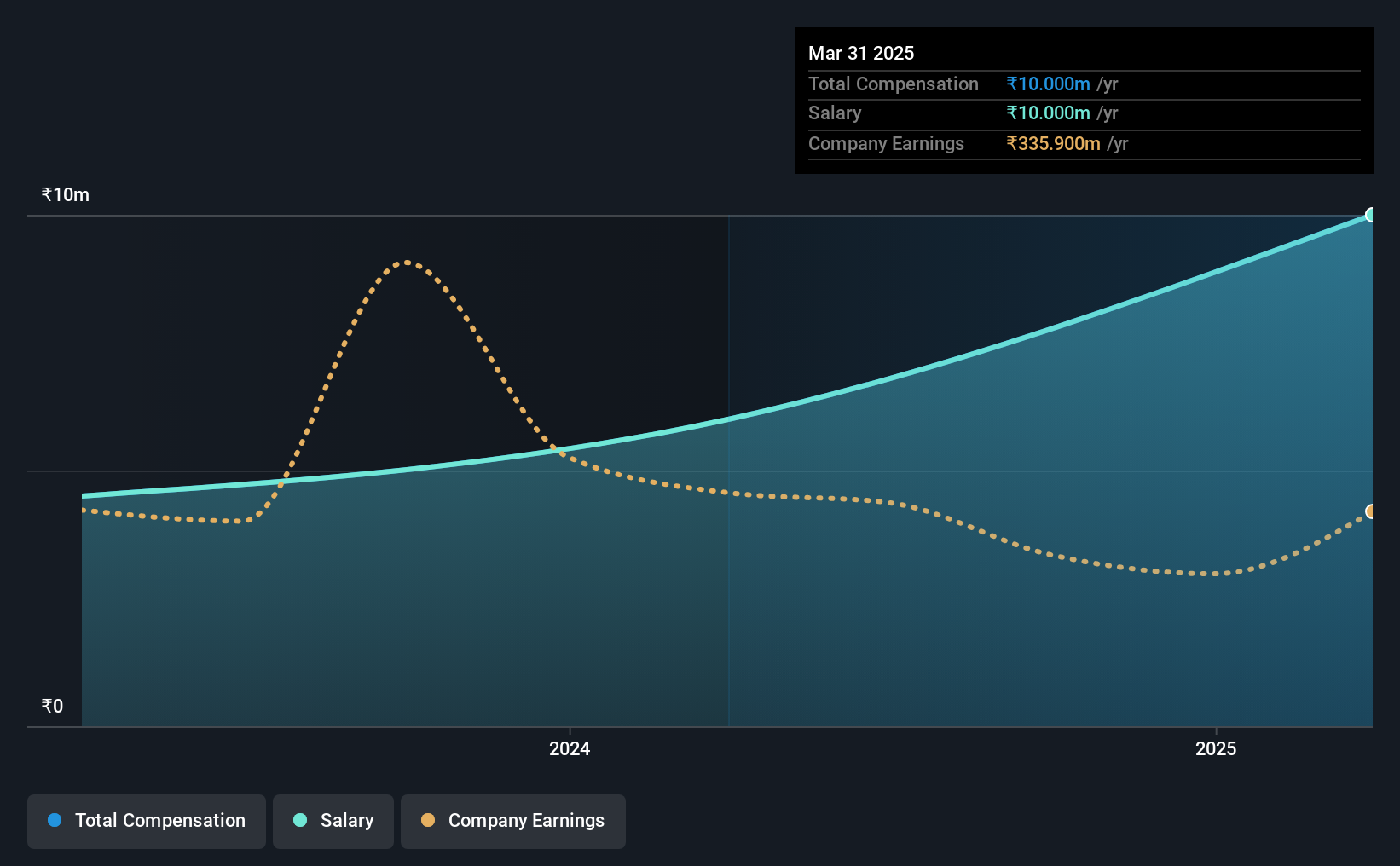

- Total pay for CEO Thyagarajan Shivaraman includes ₹10.0m salary

- The total compensation is 130% higher than the average for the industry

- Orient Green Power's EPS declined by 21% over the past three years while total shareholder return over the past three years was 114%

Orient Green Power Company Limited (NSE:GREENPOWER) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 30th of June. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

Check out our latest analysis for Orient Green Power

Comparing Orient Green Power Company Limited's CEO Compensation With The Industry

Our data indicates that Orient Green Power Company Limited has a market capitalization of ₹16b, and total annual CEO compensation was reported as ₹10m for the year to March 2025. Notably, that's an increase of 67% over the year before. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹10m.

On examining similar-sized companies in the Indian Renewable Energy industry with market capitalizations between ₹8.7b and ₹35b, we discovered that the median CEO total compensation of that group was ₹4.4m. This suggests that Thyagarajan Shivaraman is paid more than the median for the industry. What's more, Thyagarajan Shivaraman holds ₹4.0m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹10m | ₹6.0m | 100% |

| Other | - | - | - |

| Total Compensation | ₹10m | ₹6.0m | 100% |

On an industry level, roughly 86% of total compensation represents salary and 14% is other remuneration. At the company level, Orient Green Power pays Thyagarajan Shivaraman solely through a salary, preferring to go down a conventional route. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Orient Green Power Company Limited's Growth

Orient Green Power Company Limited has reduced its earnings per share by 21% a year over the last three years. Its revenue is up 1.5% over the last year.

Few shareholders would be pleased to read that EPS have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Orient Green Power Company Limited Been A Good Investment?

We think that the total shareholder return of 114%, over three years, would leave most Orient Green Power Company Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Orient Green Power rewards its CEO solely through a salary, ignoring non-salary benefits completely. Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for Orient Green Power (1 is concerning!) that you should be aware of before investing here.

Important note: Orient Green Power is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GREENPOWER

Orient Green Power

An independent power producer of renewable power, engages in the generation and sale of wind energy in India and Croatia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success