- India

- /

- Renewable Energy

- /

- NSEI:GREENPOWER

Easy Come, Easy Go: How Orient Green Power (NSE:GREENPOWER) Shareholders Got Unlucky And Saw 86% Of Their Cash Evaporate

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Anyone who held Orient Green Power Company Limited (NSE:GREENPOWER) for five years would be nursing their metaphorical wounds since the share price dropped 86% in that time. And it's not just long term holders hurting, because the stock is down 66% in the last year. Unfortunately the share price momentum is still quite negative, with prices down 12% in thirty days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Orient Green Power

Orient Green Power isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Orient Green Power reduced its trailing twelve month revenue by 7.2% for each year. That's not what investors generally want to see. If a business loses money, you want it to grow, so no surprises that the share price has dropped 33% each year in that time. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. Fear of becoming a 'bagholder' may be keeping people away from this stock.

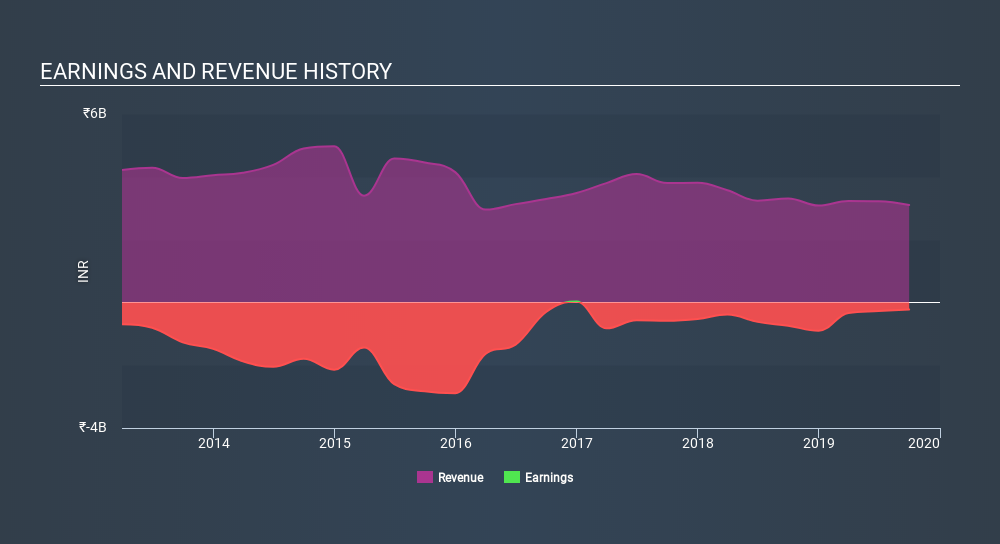

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Orient Green Power's financial health with this free report on its balance sheet.

A Different Perspective

Orient Green Power shareholders are down 66% for the year, but the market itself is up 5.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 33% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Orient Green Power which any shareholder or potential investor should be aware of.

Of course Orient Green Power may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:GREENPOWER

Orient Green Power

An independent renewable energy company, owns, develops, and operates a portfolio of wind energy projects in India and Europe.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives