Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Adani Power Limited (NSE:ADANIPOWER) share price slid 34% over twelve months. That falls noticeably short of the market decline of around 18%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 1.7% in three years. It's down 46% in about a quarter. However, one could argue that the price has been influenced by the general market, which is down 23% in the same timeframe.

Check out our latest analysis for Adani Power

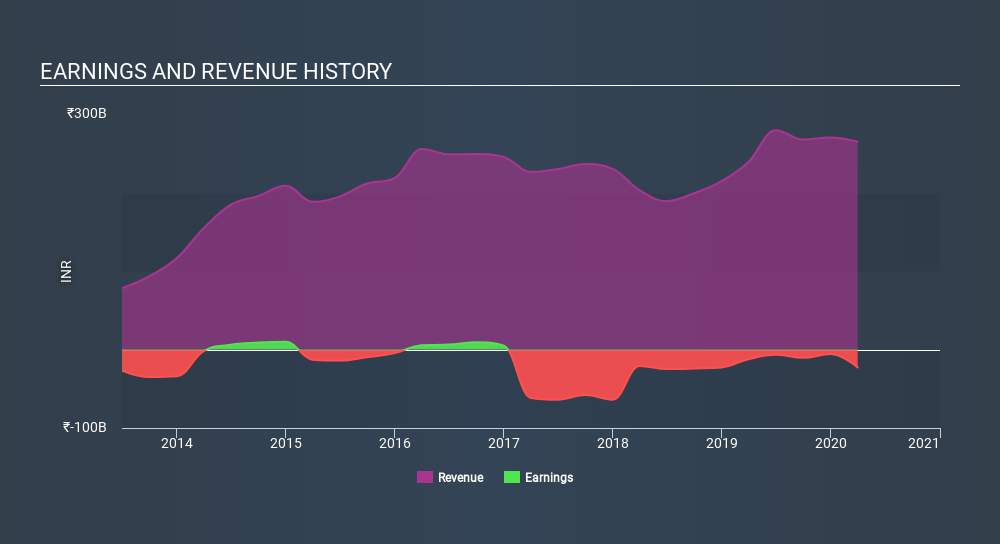

Because Adani Power made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Adani Power grew its revenue by 11% over the last year. That's not a very high growth rate considering it doesn't make profits. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 34% in a year. In a hot market it's easy to forget growth is the life-blood of a loss making company. So remember, if you buy a profitless company then you risk being a profitless investor.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Adani Power stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We regret to report that Adani Power shareholders are down 34% for the year. Unfortunately, that's worse than the broader market decline of 18%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5.2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Adani Power , and understanding them should be part of your investment process.

Adani Power is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:ADANIPOWER

Adani Power

Engages in the generation, transmission, and sale of electricity under long term power purchase agreements (PPAs), supplemental PPAs, medium and short term PPAs, and on merchant basis in India.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives