- India

- /

- Gas Utilities

- /

- NSEI:ATGL

Here's Why I Think Adani Total Gas (NSE:ADANIGAS) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Adani Total Gas (NSE:ADANIGAS). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Adani Total Gas

Adani Total Gas's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Adani Total Gas grew its EPS by 11% per year. That growth rate is fairly good, assuming the company can keep it up.

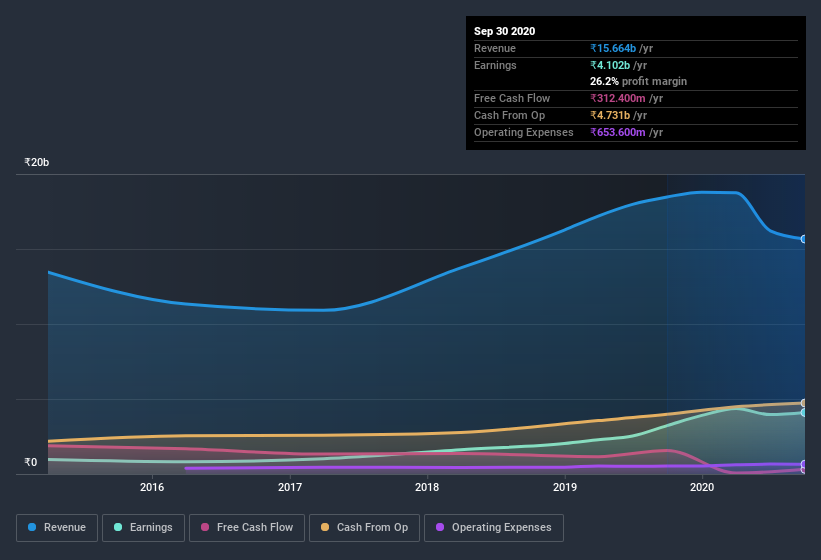

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Unfortunately, Adani Total Gas's revenue dropped 15% last year, but the silver lining is that EBIT margins improved from 25% to 35%. That's not ideal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Adani Total Gas's balance sheet strength, before getting too excited.

Are Adani Total Gas Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Like a sturdy phalanx Adani Total Gas insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the , Malay Mahadevia, paid ₹5.9m to buy shares at an average price of ₹169.

Along with the insider buying, another encouraging sign for Adani Total Gas is that insiders, as a group, have a considerable shareholding. To be specific, they have ₹3.3b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.8% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Suresh Manglani, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Adani Total Gas with market caps between ₹293b and ₹879b is about ₹60m.

The Adani Total Gas CEO received total compensation of just ₹24m in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Adani Total Gas Deserve A Spot On Your Watchlist?

One positive for Adani Total Gas is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. We don't want to rain on the parade too much, but we did also find 2 warning signs for Adani Total Gas (1 makes us a bit uncomfortable!) that you need to be mindful of.

As a growth investor I do like to see insider buying. But Adani Total Gas isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Adani Total Gas or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Adani Total Gas, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ATGL

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives