Here's Why Shareholders May Want To Be Cautious With Increasing Transport Corporation of India Limited's (NSE:TCI) CEO Pay Packet

Performance at Transport Corporation of India Limited (NSE:TCI) has been reasonably good and CEO Dharmpal Agarwal has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 03 August 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Transport Corporation of India

Comparing Transport Corporation of India Limited's CEO Compensation With the industry

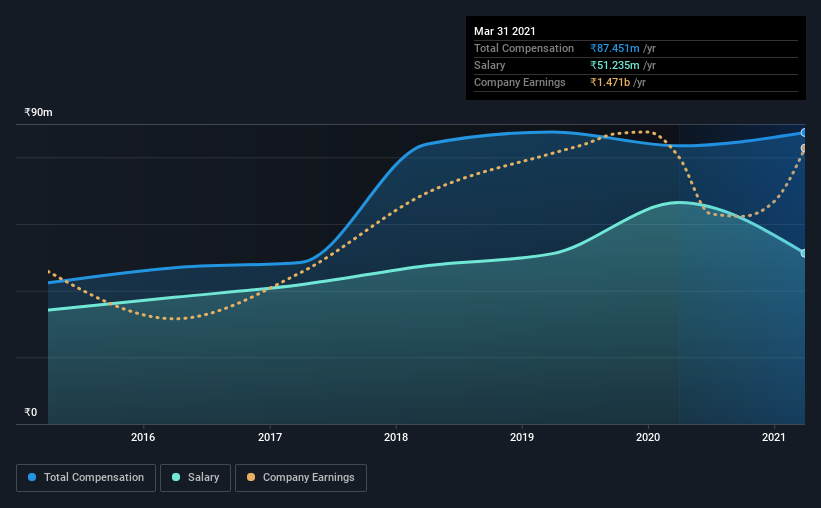

Our data indicates that Transport Corporation of India Limited has a market capitalization of ₹33b, and total annual CEO compensation was reported as ₹87m for the year to March 2021. That's a fairly small increase of 4.8% over the previous year. In particular, the salary of ₹51.2m, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from ₹15b to ₹60b, we found that the median CEO total compensation was ₹9.0m. Hence, we can conclude that Dharmpal Agarwal is remunerated higher than the industry median. What's more, Dharmpal Agarwal holds ₹3.4b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹51m | ₹66m | 59% |

| Other | ₹36m | ₹17m | 41% |

| Total Compensation | ₹87m | ₹83m | 100% |

On an industry level, roughly 97% of total compensation represents salary and 3% is other remuneration. It's interesting to note that Transport Corporation of India allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Transport Corporation of India Limited's Growth

Over the past three years, Transport Corporation of India Limited has seen its earnings per share (EPS) grow by 5.9% per year. Its revenue is up 3.2% over the last year.

We're not particularly impressed by the revenue growth, but the modest improvement in EPS is good. Considering these factors we'd say performance has been pretty decent, though not amazing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Transport Corporation of India Limited Been A Good Investment?

We think that the total shareholder return of 56%, over three years, would leave most Transport Corporation of India Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 3 warning signs for Transport Corporation of India that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Transport Corporation of India, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Transport Corporation of India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TCI

Transport Corporation of India

Provides end-to-end integrated supply chain and logistics solutions in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026