- India

- /

- Trade Distributors

- /

- NSEI:TARACHAND

Here's Why Tara Chand Logistic Solutions (NSE:TARACHAND) Is Weighed Down By Its Debt Load

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Tara Chand Logistic Solutions Limited (NSE:TARACHAND) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Tara Chand Logistic Solutions

What Is Tara Chand Logistic Solutions's Net Debt?

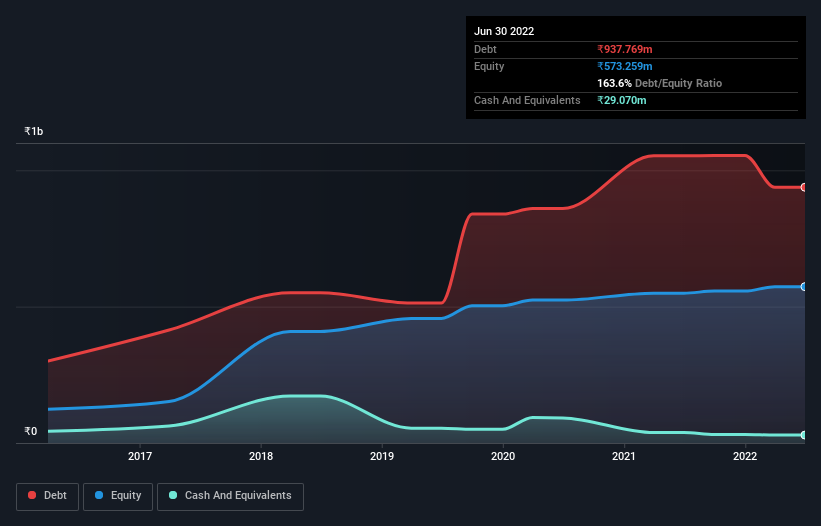

You can click the graphic below for the historical numbers, but it shows that Tara Chand Logistic Solutions had ₹937.8m of debt in March 2022, down from ₹1.05b, one year before. However, it does have ₹29.1m in cash offsetting this, leading to net debt of about ₹908.7m.

How Strong Is Tara Chand Logistic Solutions' Balance Sheet?

We can see from the most recent balance sheet that Tara Chand Logistic Solutions had liabilities of ₹559.5m falling due within a year, and liabilities of ₹898.9m due beyond that. Offsetting this, it had ₹29.1m in cash and ₹623.1m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹806.2m.

When you consider that this deficiency exceeds the company's ₹755.9m market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While we wouldn't worry about Tara Chand Logistic Solutions's net debt to EBITDA ratio of 3.0, we think its super-low interest cover of 0.91 times is a sign of high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Worse, Tara Chand Logistic Solutions's EBIT was down 53% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Tara Chand Logistic Solutions's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Tara Chand Logistic Solutions saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, Tara Chand Logistic Solutions's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. And even its level of total liabilities fails to inspire much confidence. Taking into account all the aforementioned factors, it looks like Tara Chand Logistic Solutions has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 6 warning signs for Tara Chand Logistic Solutions you should be aware of, and 4 of them make us uncomfortable.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Tara Chand Infralogistic Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TARACHAND

Tara Chand Infralogistic Solutions

Provides logistics solutions in India.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026