Shree Vasu Logistics Limited's (NSE:SVLL) P/S Is Still On The Mark Following 29% Share Price Bounce

Despite an already strong run, Shree Vasu Logistics Limited (NSE:SVLL) shares have been powering on, with a gain of 29% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 86% in the last year.

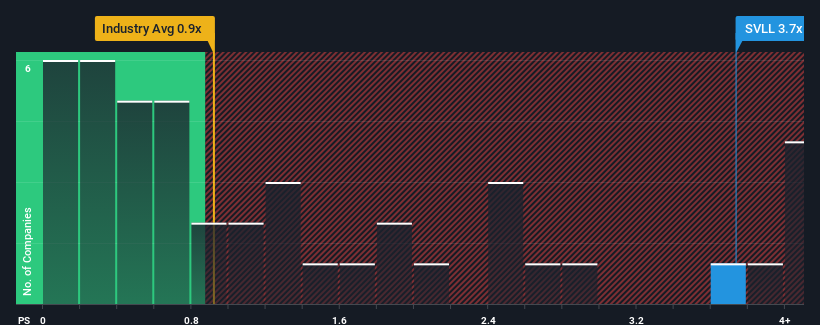

Following the firm bounce in price, given around half the companies in India's Logistics industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Shree Vasu Logistics as a stock to avoid entirely with its 3.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Shree Vasu Logistics

How Shree Vasu Logistics Has Been Performing

The revenue growth achieved at Shree Vasu Logistics over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shree Vasu Logistics' earnings, revenue and cash flow.How Is Shree Vasu Logistics' Revenue Growth Trending?

In order to justify its P/S ratio, Shree Vasu Logistics would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 73% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

In light of this, it's understandable that Shree Vasu Logistics' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Shares in Shree Vasu Logistics have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Shree Vasu Logistics can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Shree Vasu Logistics (including 2 which make us uncomfortable).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SVLL

Slight with poor track record.

Similar Companies

Market Insights

Community Narratives