- India

- /

- Infrastructure

- /

- NSEI:MEP

It's Unlikely That Shareholders Will Increase MEP Infrastructure Developers Limited's (NSE:MEP) Compensation By Much This Year

The disappointing performance at MEP Infrastructure Developers Limited (NSE:MEP) will make some shareholders rather disheartened. The next AGM coming up on 30 September 2021 will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. From our analysis below, we think CEO compensation looks appropriate for now.

See our latest analysis for MEP Infrastructure Developers

How Does Total Compensation For Jayant Mhaiskar Compare With Other Companies In The Industry?

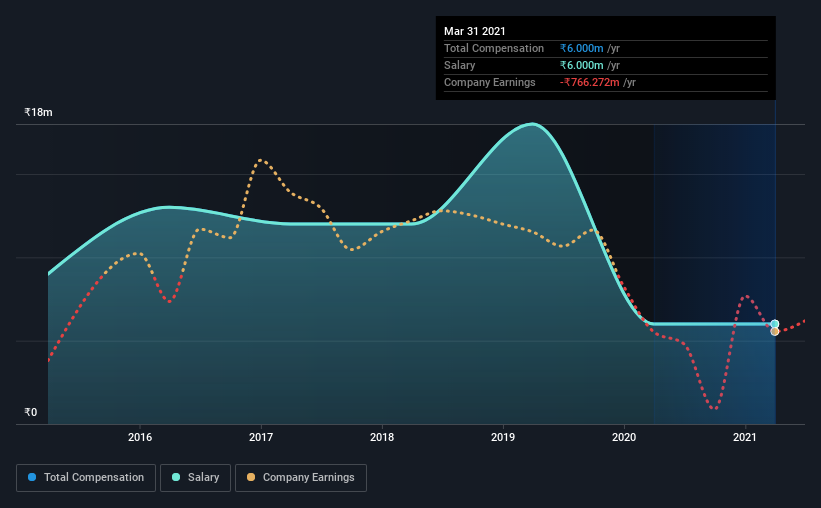

At the time of writing, our data shows that MEP Infrastructure Developers Limited has a market capitalization of ₹3.8b, and reported total annual CEO compensation of ₹6.0m for the year to March 2021. There was no change in the compensation compared to last year. Notably, the salary of ₹6.0m is the entirety of the CEO compensation.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹9.2m. That is to say, Jayant Mhaiskar is paid under the industry median. What's more, Jayant Mhaiskar holds ₹297m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹6.0m | ₹6.0m | 100% |

| Other | - | - | - |

| Total Compensation | ₹6.0m | ₹6.0m | 100% |

Talking in terms of the industry, salary represented approximately 79% of total compensation out of all the companies we analyzed, while other remuneration made up 21% of the pie. Speaking on a company level, MEP Infrastructure Developers prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at MEP Infrastructure Developers Limited's Growth Numbers

MEP Infrastructure Developers Limited has reduced its earnings per share by 112% a year over the last three years. It saw its revenue drop 29% over the last year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has MEP Infrastructure Developers Limited Been A Good Investment?

The return of -56% over three years would not have pleased MEP Infrastructure Developers Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

MEP Infrastructure Developers pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 4 warning signs for MEP Infrastructure Developers you should be aware of, and 2 of them make us uncomfortable.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade MEP Infrastructure Developers, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:MEP

MEP Infrastructure Developers

Engages in the construction, operation, and maintenance of road infrastructure in India.

Very low risk with weak fundamentals.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion