3 Indian Stocks That Could Be Trading At Discounts Of Up To 49.9%

Reviewed by Simply Wall St

The Indian market has seen a remarkable 44% rise over the past 12 months, with the Utilities sector gaining 3.5% even as the overall market remained flat last week. With earnings forecasted to grow by 17% annually, identifying undervalued stocks that could be trading at significant discounts becomes crucial for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹201.72 | ₹306.48 | 34.2% |

| Apollo Pipes (BSE:531761) | ₹598.70 | ₹1136.93 | 47.3% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2207.05 | ₹4368.96 | 49.5% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1317.90 | ₹2159.43 | 39% |

| Patel Engineering (BSE:531120) | ₹60.24 | ₹93.52 | 35.6% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹881.95 | ₹1509.79 | 41.6% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1399.40 | ₹2142.32 | 34.7% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹506.10 | ₹1009.21 | 49.9% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹290.10 | ₹445.15 | 34.8% |

| Tarsons Products (NSEI:TARSONS) | ₹470.50 | ₹709.12 | 33.7% |

Let's uncover some gems from our specialized screener.

Prataap Snacks (NSEI:DIAMONDYD)

Overview: Prataap Snacks Limited manufactures and sells packaged snacks in India and internationally, with a market cap of ₹21.06 billion.

Operations: Prataap Snacks generates revenue primarily from its Snacks Food segment, which amounted to ₹16.52 billion.

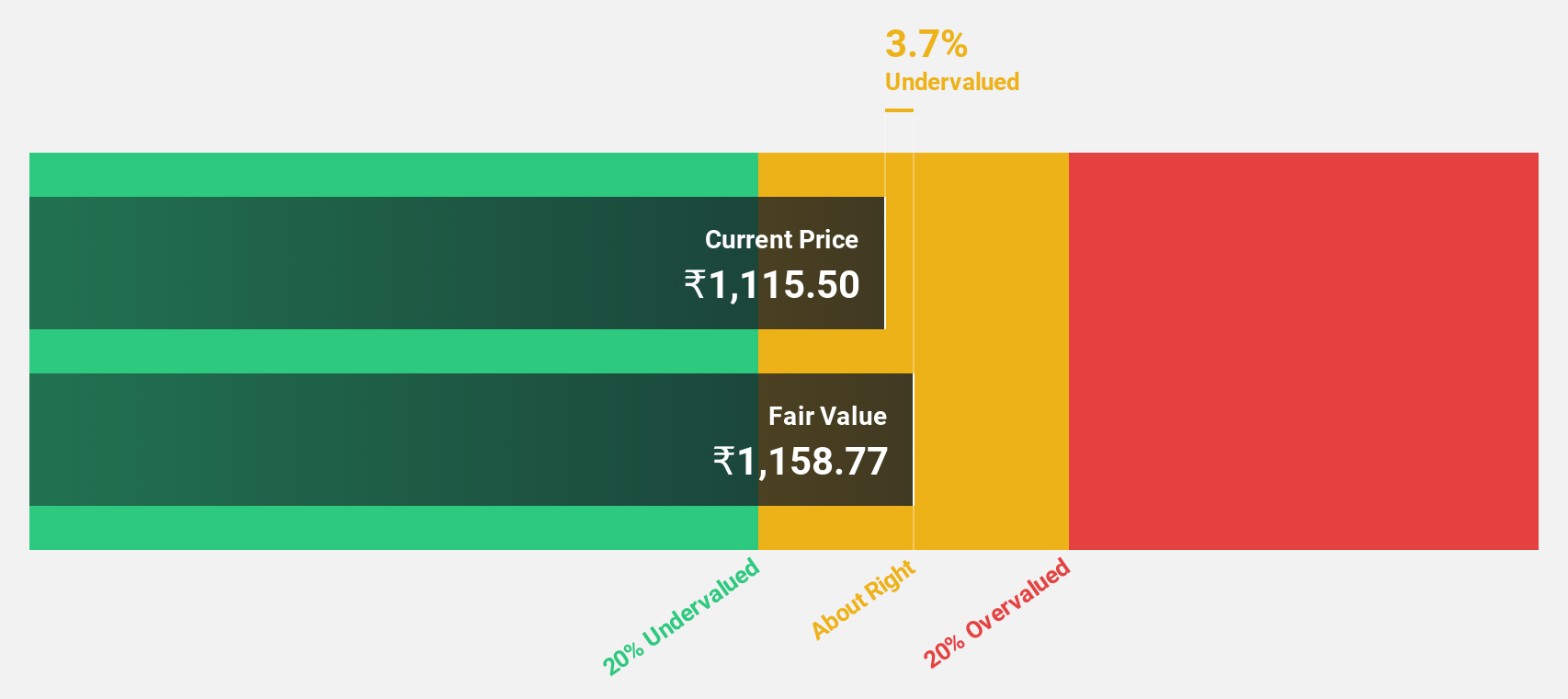

Estimated Discount To Fair Value: 41.6%

Prataap Snacks appears undervalued based on its discounted cash flow analysis, trading at ₹881.95 compared to an estimated fair value of ₹1509.79. Despite a recent dip in net income for Q1 2024, the company has demonstrated consistent revenue growth over the past five years and is forecasted to continue growing faster than the Indian market. Earnings are expected to grow significantly at 25.2% annually over the next three years, indicating strong future potential despite current low return on equity forecasts.

- The growth report we've compiled suggests that Prataap Snacks' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Prataap Snacks' balance sheet health report.

Kalpataru Projects International (NSEI:KPIL)

Overview: Kalpataru Projects International Limited offers engineering, procurement, and construction (EPC) services across multiple sectors including power transmission and distribution, buildings and factories, water, railways, oil and gas, and urban infrastructure in India and globally with a market cap of ₹215.48 billion.

Operations: The company's revenue segments include ₹194.92 billion from Engineering, Procurement and Construction (EPC) services and ₹2.81 billion from Development Projects.

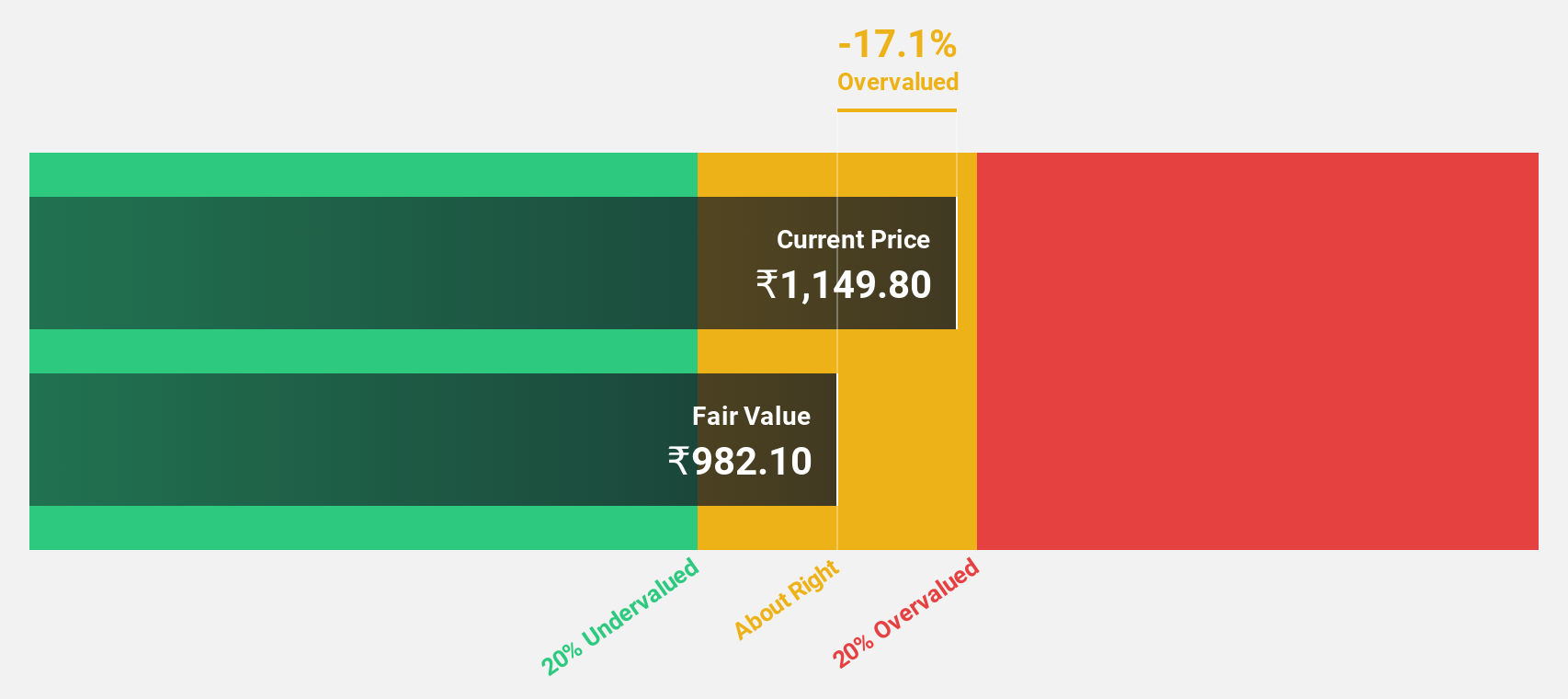

Estimated Discount To Fair Value: 23.6%

Kalpataru Projects International Limited, trading at ₹1326.45, is significantly undervalued with an estimated fair value of ₹1735.26 based on discounted cash flow analysis. Despite facing regulatory challenges and penalties related to GST issues, the company has secured substantial new orders worth ₹27.74 billion in diverse sectors including Transmission & Distribution and airport extension projects. Earnings are forecasted to grow at 29% annually over the next three years, outpacing the Indian market's growth rate of 17.3%.

- According our earnings growth report, there's an indication that Kalpataru Projects International might be ready to expand.

- Click here to discover the nuances of Kalpataru Projects International with our detailed financial health report.

Mahindra Logistics (NSEI:MAHLOG)

Overview: Mahindra Logistics Limited offers integrated logistics and mobility solutions both in India and internationally, with a market cap of ₹36.46 billion.

Operations: Revenue segments include ₹53.04 billion from Supply Chain Management and ₹3.29 billion from Enterprise Mobility Services.

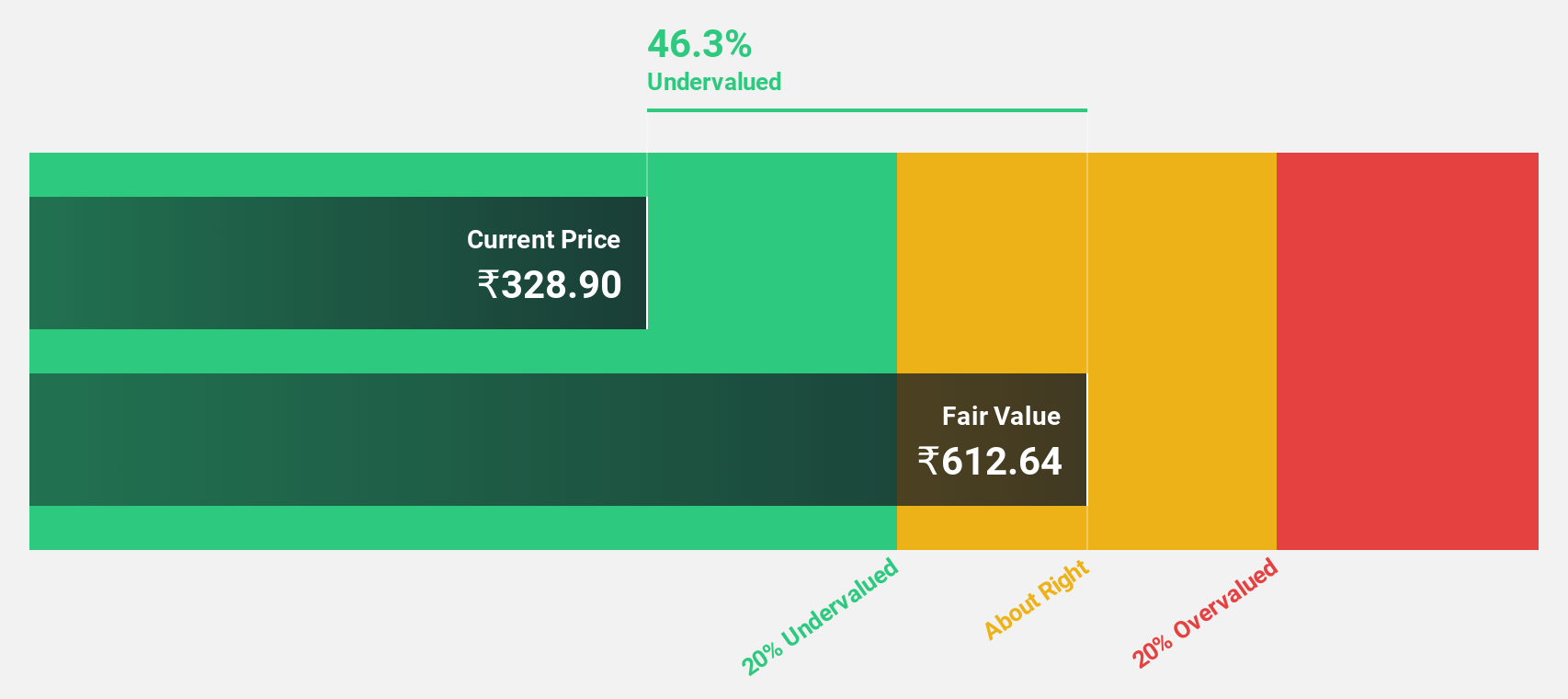

Estimated Discount To Fair Value: 49.9%

Mahindra Logistics Limited, trading at ₹506.1, is undervalued by more than 20% compared to its estimated fair value of ₹1009.21 based on discounted cash flow analysis. Despite recent regulatory penalties related to GST assessments, the company is forecasted to achieve profitability within three years with earnings expected to grow at 64.29% annually. However, interest payments are not well covered by earnings and its dividend yield of 0.49% is unsustainable under current conditions.

- Our expertly prepared growth report on Mahindra Logistics implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Mahindra Logistics with our comprehensive financial health report here.

Key Takeaways

- Embark on your investment journey to our 26 Undervalued Indian Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DIAMONDYD

Prataap Snacks

Manufactures and sells packaged snacks in India and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives