- India

- /

- Infrastructure

- /

- NSEI:JSWINFRA

There May Be Underlying Issues With The Quality Of JSW Infrastructure's (NSE:JSWINFRA) Earnings

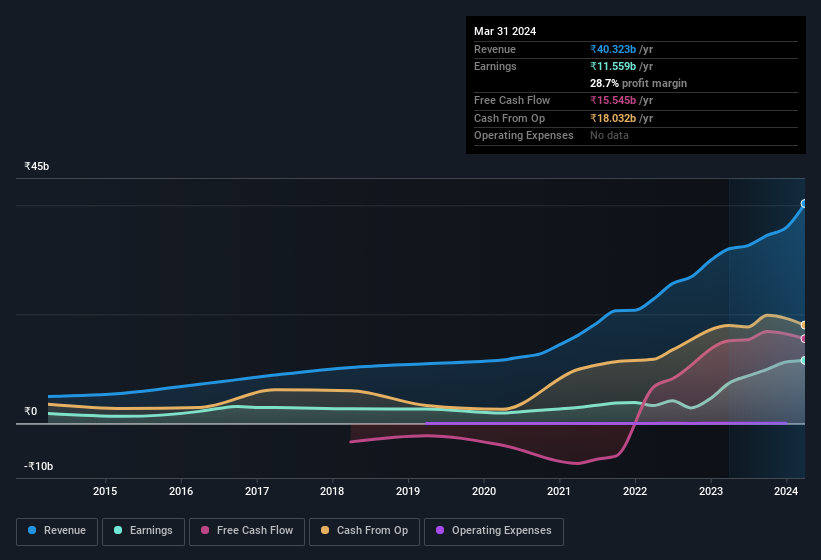

Despite posting some strong earnings, the market for JSW Infrastructure Limited's (NSE:JSWINFRA) stock hasn't moved much. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

See our latest analysis for JSW Infrastructure

Operating Revenue Or Not?

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Oftentimes, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has made a very large contribution to total profit. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. Notably, JSW Infrastructure had a significant increase in non-operating revenue over the last year. In fact, our data indicates that non-operating revenue increased from ₹82.6m to ₹2.69b. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On JSW Infrastructure's Profit Performance

Since JSW Infrastructure saw a big increase in its non-operating revenue over the last twelve months, we'd be very cautious about relying too heavily on the statutory profit number, which would have benefitted from this potentially unsustainable change. For this reason, we think that JSW Infrastructure's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the good news is that its EPS growth over the last three years has been very impressive. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Ultimately, this article has formed an opinion based on historical data. However, it can also be great to think about what analysts are forecasting for the future. At Simply Wall St, we have analyst estimates which you can view by clicking here.

Today we've zoomed in on a single data point to better understand the nature of JSW Infrastructure's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JSWINFRA

JSW Infrastructure

An infrastructure development company, operates commercial ports in India and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026