- India

- /

- Infrastructure

- /

- NSEI:GMRAIRPORT

Investors Appear Satisfied With GMR Airports Infrastructure Limited's (NSE:GMRINFRA) Prospects As Shares Rocket 32%

The GMR Airports Infrastructure Limited (NSE:GMRINFRA) share price has done very well over the last month, posting an excellent gain of 32%. Looking back a bit further, it's encouraging to see the stock is up 87% in the last year.

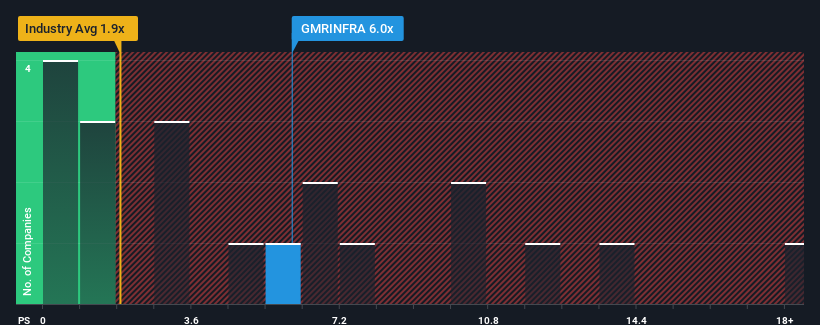

Since its price has surged higher, given around half the companies in India's Infrastructure industry have price-to-sales ratios (or "P/S") below 3.5x, you may consider GMR Airports Infrastructure as a stock to avoid entirely with its 6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for GMR Airports Infrastructure

How Has GMR Airports Infrastructure Performed Recently?

GMR Airports Infrastructure's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think GMR Airports Infrastructure's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For GMR Airports Infrastructure?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like GMR Airports Infrastructure's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 36%. Revenue has also lifted 14% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 27% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 21% growth forecast for the broader industry.

With this information, we can see why GMR Airports Infrastructure is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

GMR Airports Infrastructure's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into GMR Airports Infrastructure shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for GMR Airports Infrastructure with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GMRAIRPORT

GMR Airports

GMR Airports Limited development, maintenance, and operation of airports in India.

High growth potential and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.