- India

- /

- Marine and Shipping

- /

- NSEI:ARVINDPORT

Market Cool On Arvind and Company Shipping Agencies Limited's (NSE:ACSAL) Earnings Pushing Shares 26% Lower

Arvind and Company Shipping Agencies Limited (NSE:ACSAL) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Longer-term, the stock has been solid despite a difficult 30 days, gaining 22% in the last year.

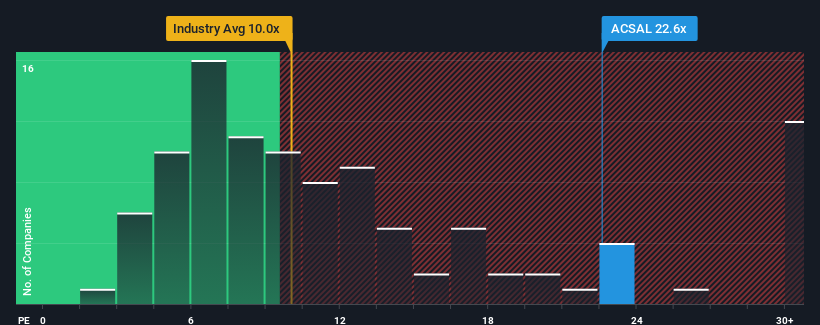

In spite of the heavy fall in price, Arvind and Company Shipping Agencies' price-to-earnings (or "P/E") ratio of 22.6x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 33x and even P/E's above 62x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

We'd have to say that with no tangible growth over the last year, Arvind and Company Shipping Agencies' earnings have been unimpressive. It might be that many expect the uninspiring earnings performance to worsen, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Arvind and Company Shipping Agencies

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Arvind and Company Shipping Agencies' is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Although pleasingly EPS has lifted 1,272% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 26% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Arvind and Company Shipping Agencies' P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Arvind and Company Shipping Agencies' P/E?

Arvind and Company Shipping Agencies' P/E has taken a tumble along with its share price. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Arvind and Company Shipping Agencies revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 4 warning signs for Arvind and Company Shipping Agencies that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ARVINDPORT

Arvind Port and Infra

Arvind Port and Infra Limited charters barges and hotel and hospitality businesses in India.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives