Allcargo Gati Limited's (NSE:ACLGATI) Share Price Matching Investor Opinion

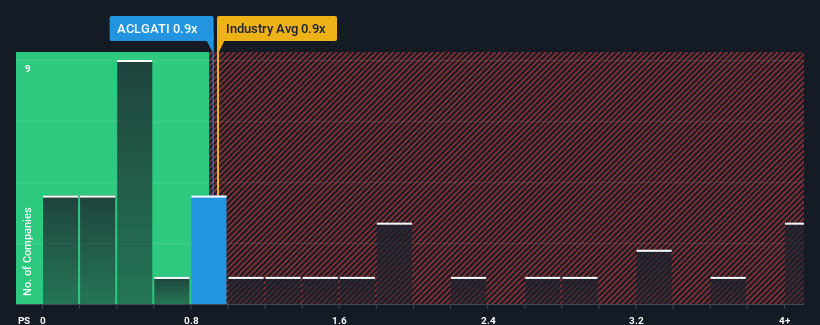

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Logistics industry in India, you could be forgiven for feeling indifferent about Allcargo Gati Limited's (NSE:ACLGATI) P/S ratio, which comes in at about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Allcargo Gati

How Has Allcargo Gati Performed Recently?

Recent times have been pleasing for Allcargo Gati as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Allcargo Gati will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Allcargo Gati?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Allcargo Gati's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.5% last year. The latest three year period has also seen an excellent 32% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the one analyst following the company. That's shaping up to be similar to the 16% growth forecast for the broader industry.

In light of this, it's understandable that Allcargo Gati's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Allcargo Gati's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Logistics industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Allcargo Gati that you should be aware of.

If you're unsure about the strength of Allcargo Gati's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ACLGATI

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives