- India

- /

- Wireless Telecom

- /

- NSEI:AIRTELPP

Shareholders Should Be Pleased With Bharti Airtel Limited's (NSE:AIRTELPP) Price

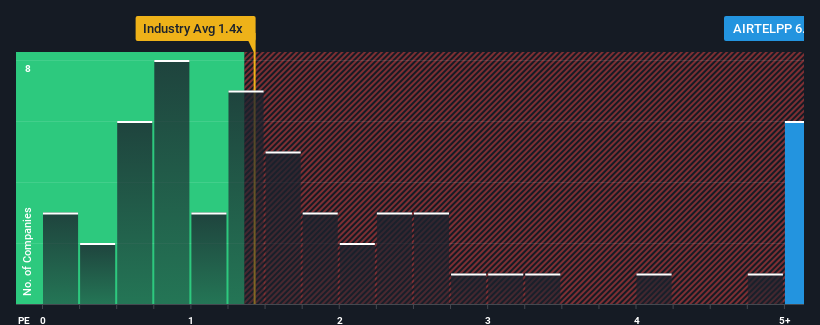

Bharti Airtel Limited's (NSE:AIRTELPP) price-to-sales (or "P/S") ratio of 6.4x may look like a poor investment opportunity when you consider close to half the companies in the Wireless Telecom industry in India have P/S ratios below 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Bharti Airtel

How Bharti Airtel Has Been Performing

Bharti Airtel certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Bharti Airtel's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Bharti Airtel?

In order to justify its P/S ratio, Bharti Airtel would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.3%. The latest three year period has also seen an excellent 45% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 13% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 6.2% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Bharti Airtel's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Bharti Airtel maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Wireless Telecom industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Bharti Airtel (of which 1 is concerning!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bharti Airtel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AIRTELPP

Bharti Airtel

Operates as a telecommunications company in India and internationally.

Outstanding track record average dividend payer.

Similar Companies

Market Insights

Community Narratives