- India

- /

- Electronic Equipment and Components

- /

- NSEI:REDINGTON

There May Be Underlying Issues With The Quality Of Redington's (NSE:REDINGTON) Earnings

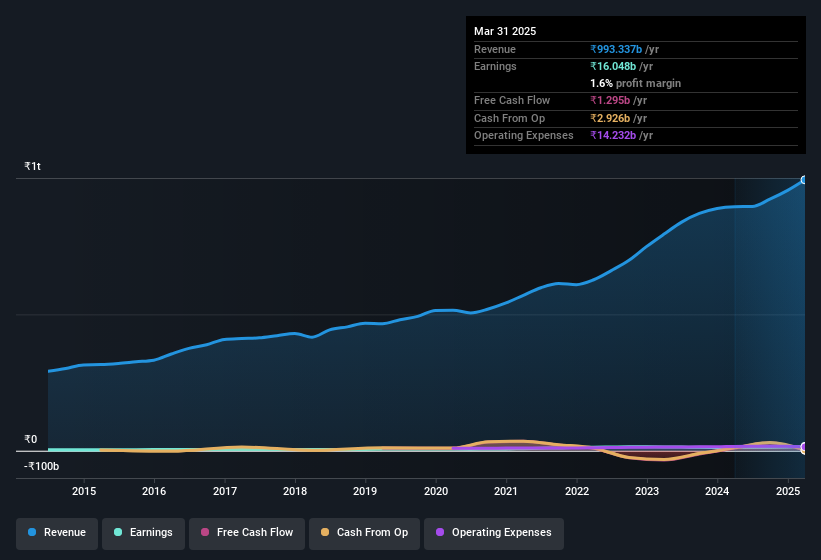

Despite posting some strong earnings, the market for Redington Limited's (NSE:REDINGTON) stock hasn't moved much. We did some digging, and we found some concerning factors in the details.

How Do Unusual Items Influence Profit?

For anyone who wants to understand Redington's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from ₹6.0b worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that Redington's positive unusual items were quite significant relative to its profit in the year to March 2025. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Redington's Profit Performance

As previously mentioned, Redington's large boost from unusual items won't be there indefinitely, so its statutory earnings are probably a poor guide to its underlying profitability. For this reason, we think that Redington's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But at least holders can take some solace from the 25% per annum growth in EPS for the last three. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Every company has risks, and we've spotted 2 warning signs for Redington you should know about.

Today we've zoomed in on a single data point to better understand the nature of Redington's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:REDINGTON

Redington

Distributes information technology, mobility, and other technology products in India, the Middle East, Turkey, Africa, and South Asian countries.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion