- India

- /

- Auto Components

- /

- NSEI:TSFINV

Undiscovered Gems in India to Watch This September 2024

Reviewed by Simply Wall St

The Indian market has climbed 1.0% over the last week and is up 45% over the last 12 months, with earnings expected to grow by 17% per annum over the next few years. In this favorable environment, identifying stocks with strong growth potential and solid fundamentals can offer promising opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| Pearl Global Industries | 72.24% | 19.89% | 41.91% | ★★★★★☆ |

| Network People Services Technologies | 0.24% | 81.82% | 86.36% | ★★★★★☆ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| BLS E-Services | 1.67% | 15.04% | 51.58% | ★★★★★☆ |

| Share India Securities | 24.23% | 37.66% | 48.98% | ★★★★☆☆ |

| Sanstar | 50.30% | -8.41% | 48.59% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Value Rating: ★★★★★★

Overview: Netweb Technologies India Limited designs, manufactures, and sells high-end computing solutions (HCS) in India with a market cap of ₹153.40 billion.

Operations: Netweb Technologies India Limited generates revenue primarily from the manufacturing and sale of computer servers, amounting to ₹8.14 billion.

Netweb Technologies India has demonstrated impressive growth, with earnings increasing by 85.8% over the past year, significantly outpacing the tech industry's 10.8%. The company's debt to equity ratio has improved dramatically from 108% to just 2.3% in five years, indicating robust financial health. Recent Q1 results show net income rising to INR 154 million from INR 51 million a year ago, reflecting strong operational performance and high-quality earnings.

Orchid Pharma (NSEI:ORCHPHARMA)

Simply Wall St Value Rating: ★★★★★★

Overview: Orchid Pharma Limited is a pharmaceutical company involved in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals in India with a market cap of ₹77.14 billion.

Operations: Orchid Pharma Limited generates revenue primarily from its pharmaceuticals segment, amounting to ₹8.81 billion.

Orchid Pharma has shown impressive earnings growth of 44.6% over the past year, outperforming the broader pharmaceuticals industry at 19.3%. The company’s net debt to equity ratio stands at a satisfactory 11.3%, indicating strong financial health. Recent regulatory issues have surfaced with a GST audit revealing liabilities totaling INR 49.95 million for FY2019-2020, but this hasn't hindered their performance as Q1 sales for FY2024 reached INR 2,444 million compared to INR 1,829 million last year.

Sundaram Finance Holdings (NSEI:SUNDARMHLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sundaram Finance Holdings Limited engages in investments, business processing, and support services across India, Australia, and the United Kingdom with a market cap of ₹89.89 billion.

Operations: Sundaram Finance Holdings Limited generates revenue primarily from investments (₹2.51 billion), domestic shared services (₹105.51 million), and overseas shared services (₹489.78 million). The company operates across India, Australia, and the United Kingdom.

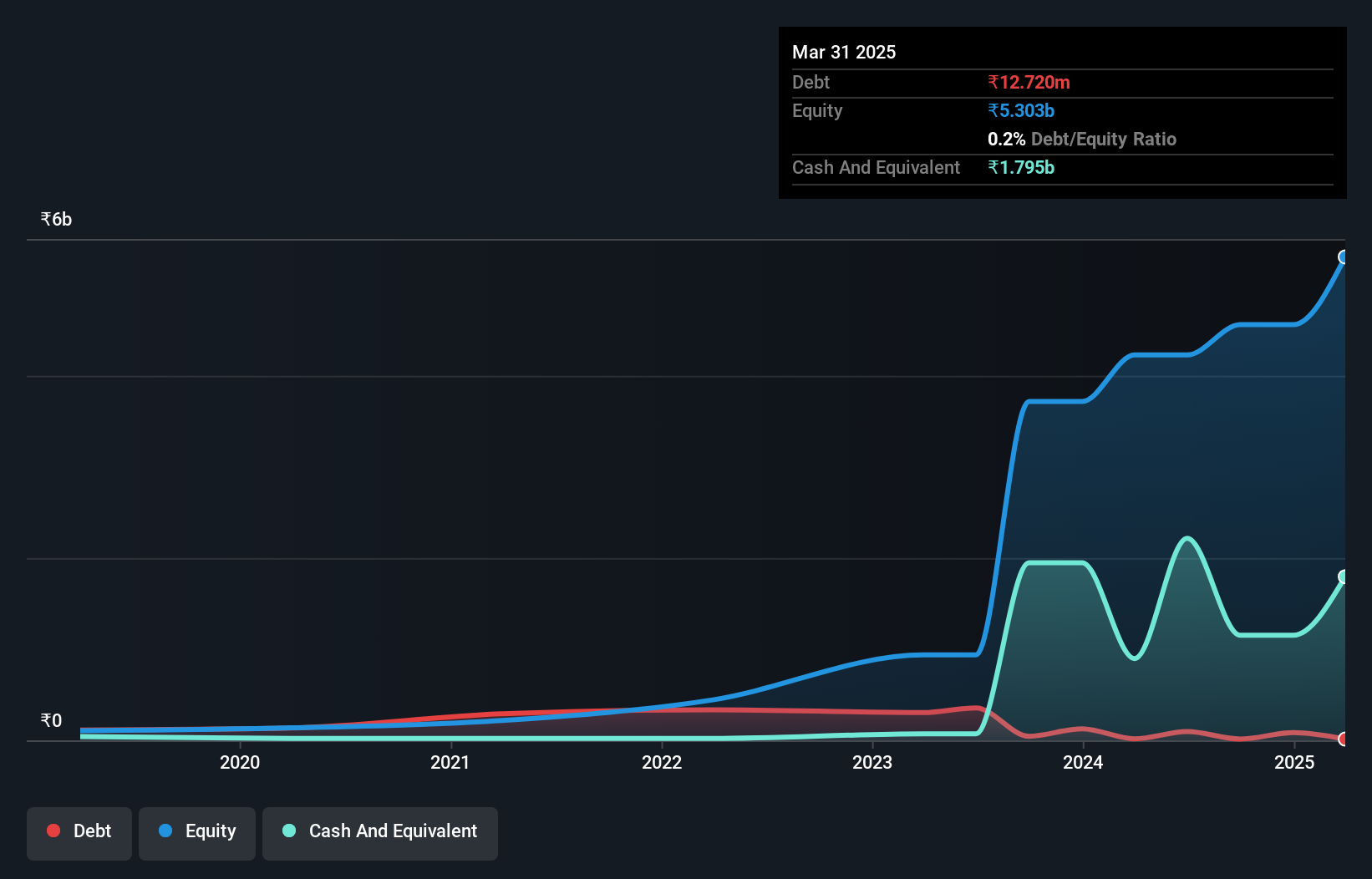

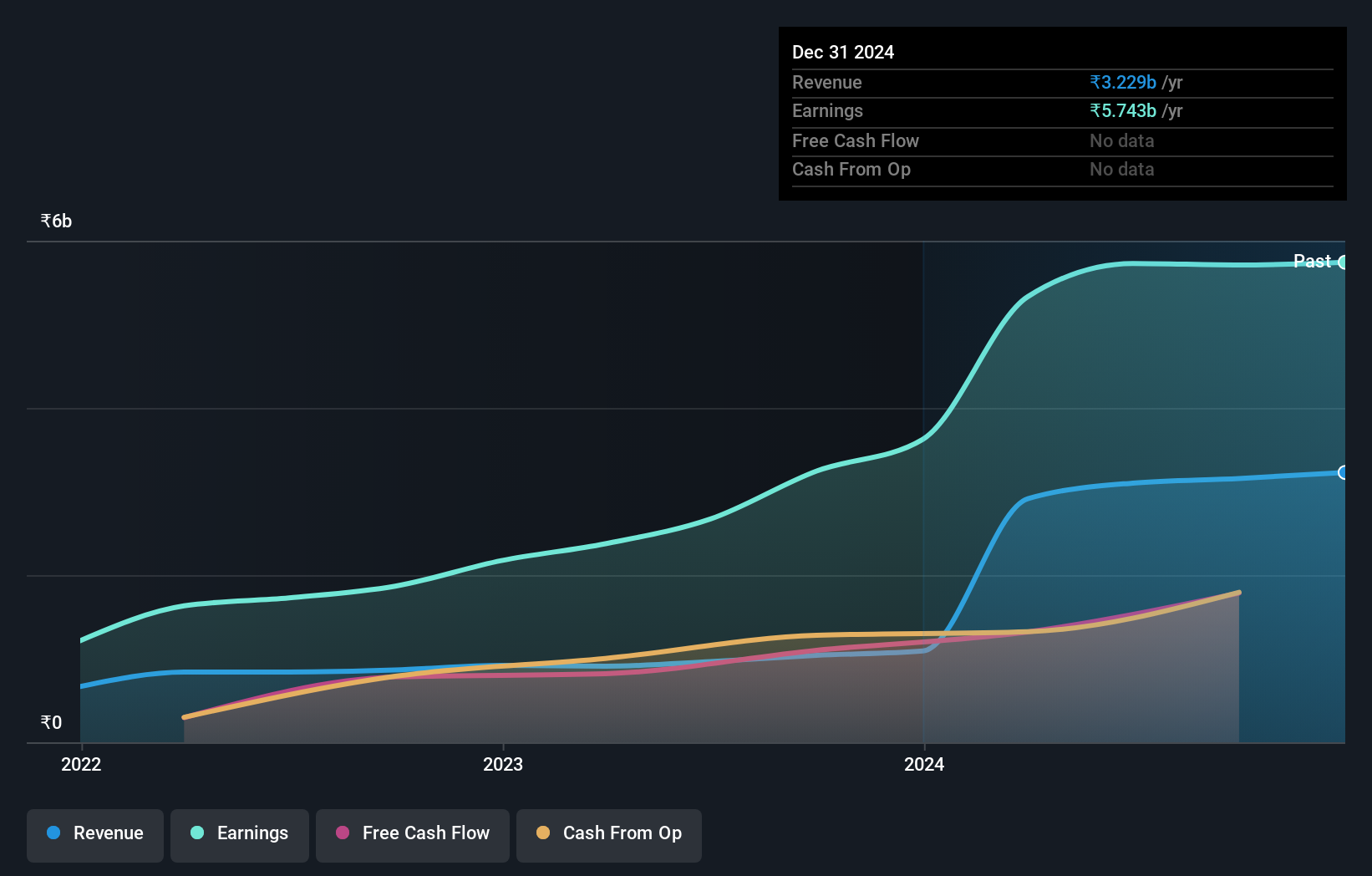

Sundaram Finance Holdings, a relatively small player in the auto components industry, has shown impressive earnings growth of 114.5% over the past year, outpacing the sector's 20.1%. The company’s debt to equity ratio has increased from 0% to 0.4% over five years, yet it holds more cash than its total debt. Recent quarterly revenue reached ₹442.78 million (US$5.97 million), with net income at ₹1,103.35 million (US$14.87 million).

- Click to explore a detailed breakdown of our findings in Sundaram Finance Holdings' health report.

Understand Sundaram Finance Holdings' track record by examining our Past report.

Where To Now?

- Click here to access our complete index of 470 Indian Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSF Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TSFINV

TSF Investments

Engages in the business of investments, and business processing and support services in India and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives