- India

- /

- Tech Hardware

- /

- NSEI:NETWEB

Netweb Technologies India Limited's (NSE:NETWEB) Stock Has Fared Decently: Is the Market Following Strong Financials?

Netweb Technologies India's (NSE:NETWEB) stock is up by 4.4% over the past month. Given its impressive performance, we decided to study the company's key financial indicators as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Netweb Technologies India's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Netweb Technologies India

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Netweb Technologies India is:

21% = ₹968m ÷ ₹4.6b (Based on the trailing twelve months to September 2024).

The 'return' is the income the business earned over the last year. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.21 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Netweb Technologies India's Earnings Growth And 21% ROE

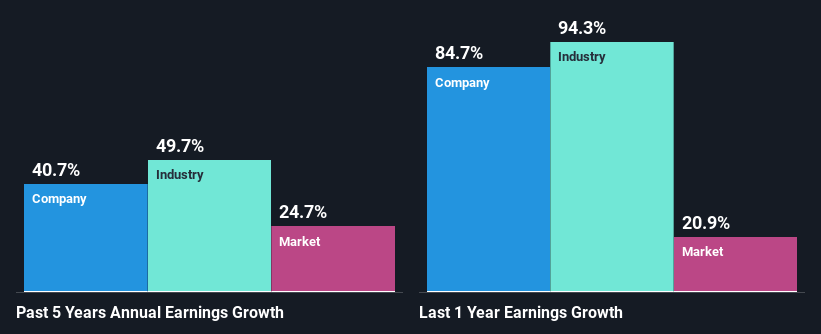

At first glance, Netweb Technologies India seems to have a decent ROE. On comparing with the average industry ROE of 17% the company's ROE looks pretty remarkable. This probably laid the ground for Netweb Technologies India's significant 41% net income growth seen over the past five years. We reckon that there could also be other factors at play here. Such as - high earnings retention or an efficient management in place.

As a next step, we compared Netweb Technologies India's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 50% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is Netweb Technologies India fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Netweb Technologies India Using Its Retained Earnings Effectively?

Netweb Technologies India's three-year median payout ratio to shareholders is 14%, which is quite low. This implies that the company is retaining 86% of its profits. So it seems like the management is reinvesting profits heavily to grow its business and this reflects in its earnings growth number.

Looking at the current analyst consensus data, we can see that the company's future payout ratio is expected to rise to 22% over the next three years. Regardless, the future ROE for Netweb Technologies India is speculated to rise to 30% despite the anticipated increase in the payout ratio. There could probably be other factors that could be driving the future growth in the ROE.

Summary

On the whole, we feel that Netweb Technologies India's performance has been quite good. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. On studying current analyst estimates, we found that analysts expect the company to continue its recent growth streak. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if Netweb Technologies India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NETWEB

Netweb Technologies India

Designs, manufactures, and sells high-end computing solutions (HCS) in India.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives