Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies MRO-TEK Realty Limited (NSE:MRO-TEK) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for MRO-TEK Realty

How Much Debt Does MRO-TEK Realty Carry?

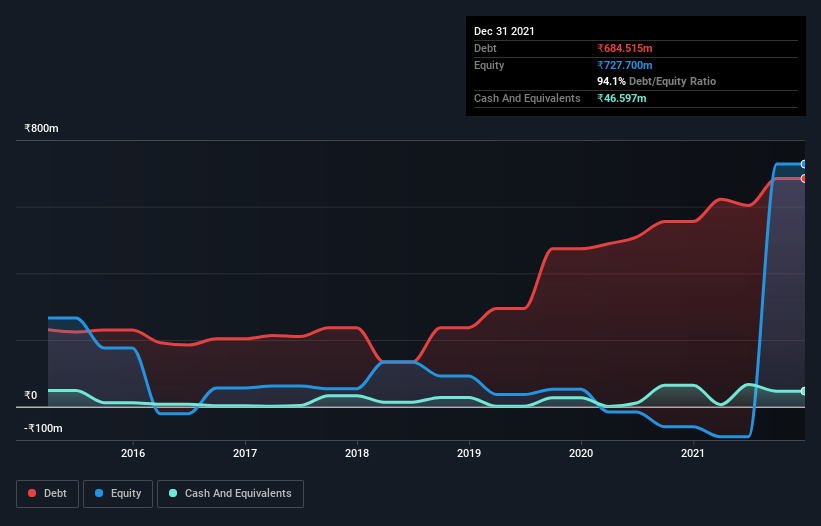

You can click the graphic below for the historical numbers, but it shows that as of September 2021 MRO-TEK Realty had ₹684.5m of debt, an increase on ₹555.4m, over one year. However, it does have ₹46.6m in cash offsetting this, leading to net debt of about ₹637.9m.

How Strong Is MRO-TEK Realty's Balance Sheet?

According to the last reported balance sheet, MRO-TEK Realty had liabilities of ₹682.9m due within 12 months, and liabilities of ₹341.6m due beyond 12 months. On the other hand, it had cash of ₹46.6m and ₹87.7m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹890.2m.

This is a mountain of leverage relative to its market capitalization of ₹1.08b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

MRO-TEK Realty's net debt is only 0.72 times its EBITDA. And its EBIT easily covers its interest expense, being 14.9 times the size. So we're pretty relaxed about its super-conservative use of debt. It was also good to see that despite losing money on the EBIT line last year, MRO-TEK Realty turned things around in the last 12 months, delivering and EBIT of ₹867m. When analysing debt levels, the balance sheet is the obvious place to start. But it is MRO-TEK Realty's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. During the last year, MRO-TEK Realty generated free cash flow amounting to a very robust 96% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that MRO-TEK Realty's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But, on a more sombre note, we are a little concerned by its level of total liabilities. All these things considered, it appears that MRO-TEK Realty can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that MRO-TEK Realty is showing 2 warning signs in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UMIYA-MRO

Umiya Buildcon

Engages in the manufacture, supply, and distribution of access and networking equipment and solutions in India and internationally.

Outstanding track record with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026