- China

- /

- Communications

- /

- SHSE:600990

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

The global markets have been buoyed by a significant rally in U.S. stocks, driven by expectations of economic growth and favorable tax policies following the recent election, with the small-cap Russell 2000 Index experiencing notable gains despite remaining below its record high. In this climate of optimism and potential regulatory changes, identifying high-growth tech stocks involves looking for companies that are well-positioned to benefit from these economic shifts and exhibit strong innovation capabilities amidst evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 26.75% | 31.99% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

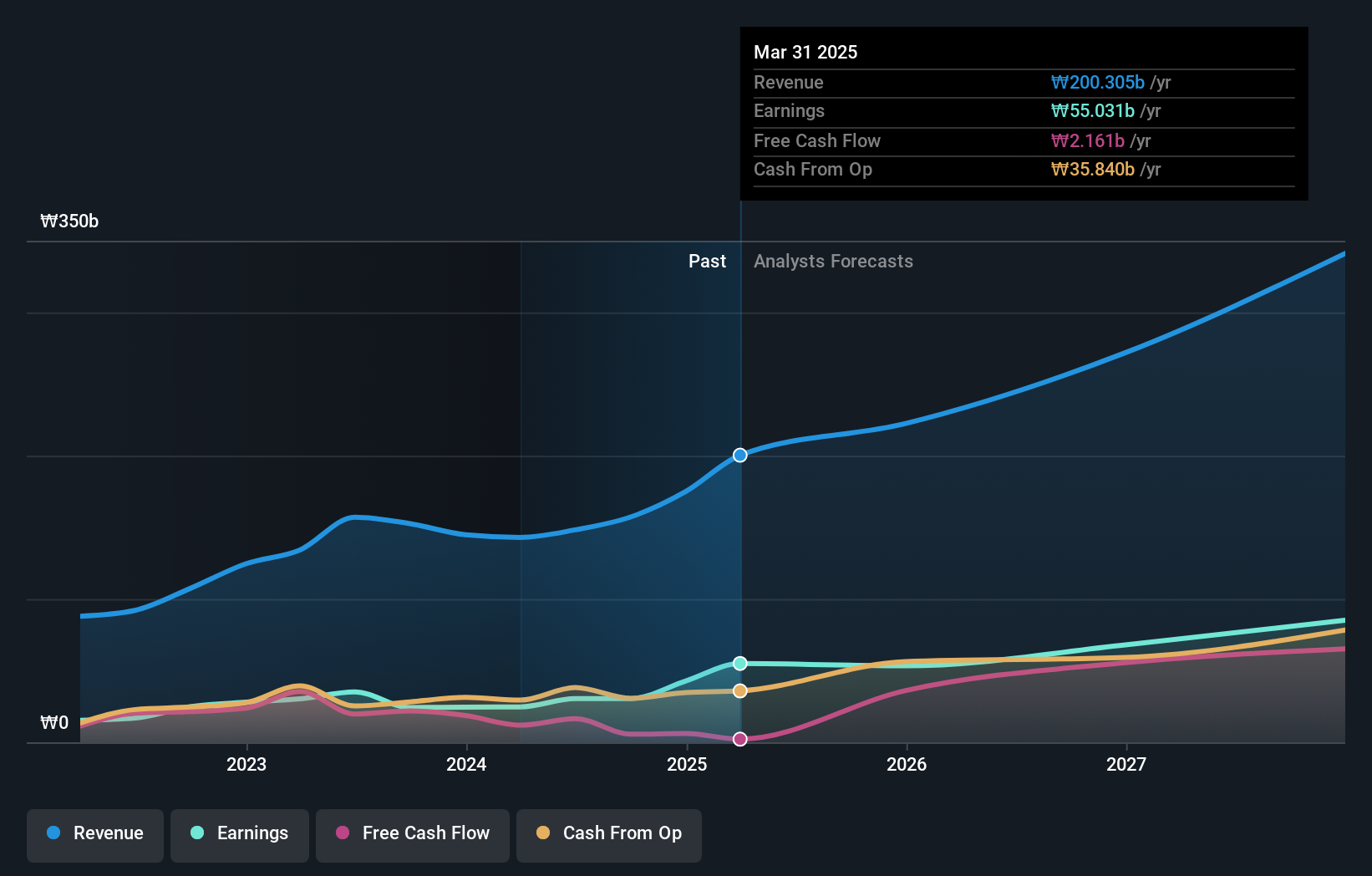

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★★★

Overview: Park Systems Corp. is a company that develops, manufactures, and sells atomic force microscopy (AFM) systems globally, with a market cap of ₩1.30 trillion.

Operations: Park Systems generates revenue primarily from the sale of scientific and technical instruments, specifically atomic force microscopy systems, amounting to ₩148.23 billion.

Park Systems is making significant strides in the high-tech sector, particularly through its recent partnership aimed at expanding its footprint in India's burgeoning semiconductor industry. This move aligns with the India Semiconductor Mission, positioning Park Systems to capitalize on the anticipated growth in this sector. Financially, Park Systems is poised for robust growth with projected annual revenue increases of 23.5% and earnings growth of 33.7%, outpacing both the broader KR market and industry averages. The company's commitment to R&D is evident from its strategic alliances and participation in major international conferences, enhancing its technological edge and market presence globally.

- Unlock comprehensive insights into our analysis of Park Systems stock in this health report.

Gain insights into Park Systems' historical performance by reviewing our past performance report.

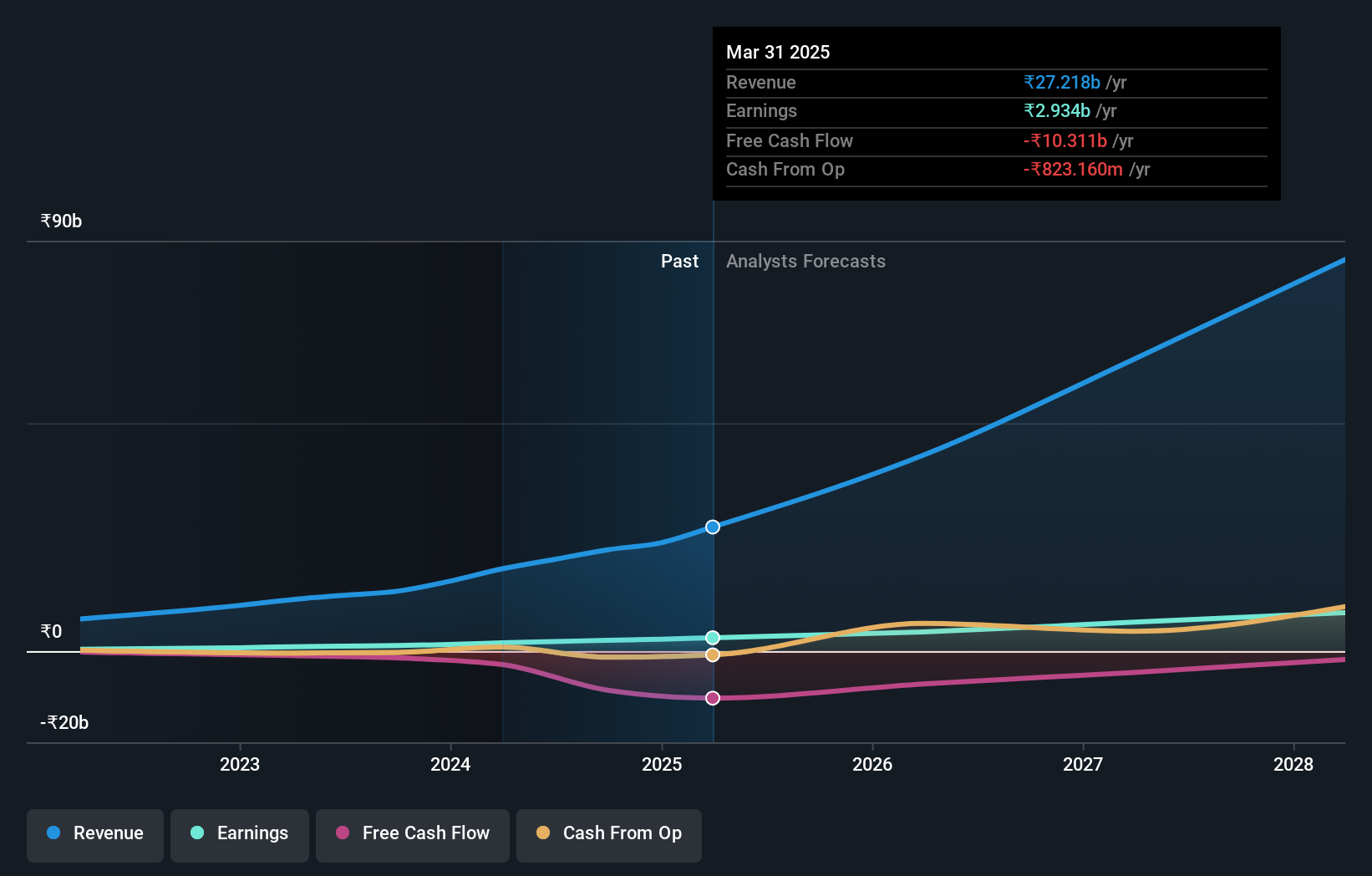

Kaynes Technology India (NSEI:KAYNES)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kaynes Technology India Limited is an integrated electronics manufacturer providing end-to-end and IoT solutions both domestically and internationally, with a market capitalization of ₹347.58 billion.

Operations: Kaynes Technology India Limited focuses on Electronics System Design and Manufacturing (ESDM), generating revenue of ₹22.23 billion. The company operates both in India and internationally, offering comprehensive electronics manufacturing services with a focus on IoT solutions.

Kaynes Technology India has demonstrated robust growth, with revenue and earnings increasing significantly. Over the past year, earnings surged by 96%, outpacing the electronic industry's average of 22.1%. This trend is expected to continue, with projected annual revenue growth at 30% and earnings anticipated to rise by 32.5% annually over the next three years. The company's aggressive investment in R&D, which aligns well with its strategic acquisitions like Iskraemeco India Private Limited, bolsters its innovation pipeline and market expansion efforts, positioning it favorably within the high-tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Kaynes Technology India.

Understand Kaynes Technology India's track record by examining our Past report.

Sun Create Electronics (SHSE:600990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sun Create Electronics Co., Ltd focuses on the research and development, design, manufacture, and marketing of radar and security systems with a market cap of CN¥6.98 billion.

Operations: Sun Create Electronics Co., Ltd generates revenue primarily from the electronic industry, totaling CN¥1.94 billion. The company's operations are centered on radar and security systems, reflecting its focus on advanced technology solutions within this sector.

Sun Create Electronics, despite a challenging year, is showing signs of a strong rebound with projected revenue growth at 20.5% annually, outpacing the Chinese market's average of 14%. This uptick is underpinned by significant R&D investments which have positioned the company to capitalize on emerging tech trends. Moreover, earnings are expected to surge by an impressive 116.1% annually over the next three years as operational efficiencies improve and market conditions stabilize. The firm's recent reduction in net loss from CNY 87.56 million to CNY 40.44 million further underscores its recovery trajectory and potential for profitability, marking it as a contender in the high-tech sector's competitive landscape.

- Take a closer look at Sun Create Electronics' potential here in our health report.

Assess Sun Create Electronics' past performance with our detailed historical performance reports.

Where To Now?

- Navigate through the entire inventory of 1279 High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600990

Sun Create Electronics

Engages in the research and development, design, manufacture, and marketing of radar and security systems.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives