- India

- /

- Electronic Equipment and Components

- /

- NSEI:KAYNES

High Growth Tech Stocks in India for October 2024

Reviewed by Simply Wall St

The Indian market has remained flat over the past week but has surged by 40% over the last year, with earnings anticipated to grow by 17% annually in the coming years. In this dynamic environment, identifying high growth tech stocks involves focusing on companies that demonstrate strong innovation and adaptability to capitalize on these promising growth prospects.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Sonata Software | 13.45% | 29.64% | ★★★★★☆ |

| Firstsource Solutions | 12.35% | 20.03% | ★★★★★☆ |

| C. E. Info Systems | 29.86% | 26.39% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Kaynes Technology India (NSEI:KAYNES)

Simply Wall St Growth Rating: ★★★★★☆

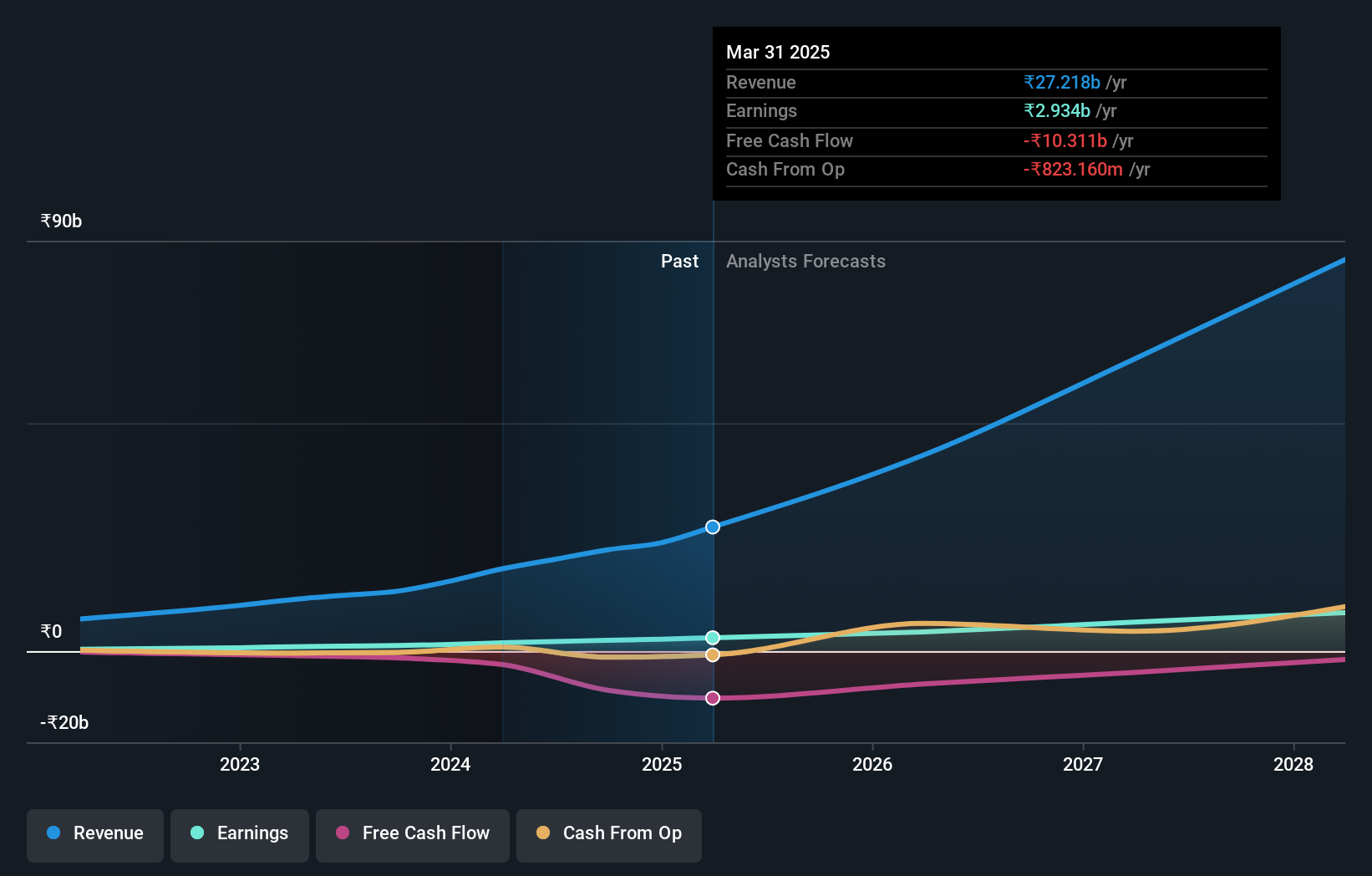

Overview: Kaynes Technology India Limited is an integrated electronics manufacturer providing end-to-end and IoT solutions both domestically and internationally, with a market cap of ₹357.32 billion.

Operations: Kaynes Technology India focuses on Electronics System Design and Manufacturing (ESDM), generating revenue of ₹20.11 billion.

Kaynes Technology India is setting a robust pace in the high-growth tech landscape of India, with projected annual revenue growth at 28.8%, significantly outpacing the broader Indian market's 10.2% expansion rate. This surge is mirrored in its earnings, expected to climb by 31.4% annually, dwarfing the industry average of 17.3%. Recently, Kaynes has further solidified its market position through strategic expansions like its new electronics manufacturing facility in Hyderabad, equipped with advanced AI-enabled systems and environmentally conscious processes. These initiatives not only enhance its production capabilities but also align with global sustainability trends, potentially boosting its appeal across various high-tech industries from automotive to aerospace.

KPIT Technologies (NSEI:KPITTECH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: KPIT Technologies Limited specializes in delivering embedded software, artificial intelligence, and digital solutions to the automobile and mobility sectors across the Americas, the United Kingdom, Europe, and globally, with a market cap of ₹485.22 billion.

Operations: KPIT Technologies focuses on providing innovative software and AI-driven solutions tailored for the automotive and mobility industries, spanning multiple regions including the Americas, UK, and Europe. The company leverages its expertise in embedded systems to address sector-specific challenges and opportunities.

KPIT Technologies, a contender in India's tech sector, is navigating through an impressive growth phase with its earnings set to rise by 19.3% annually, outperforming the broader market's 17.3%. This growth is supported by a robust commitment to R&D, as evidenced by their increased expenditure in this area which aligns with their strategic focus on enhancing technological capabilities. Additionally, KPIT has announced significant dividends and leadership changes aimed at bolstering their strategic initiatives across Europe, indicating a proactive approach to both shareholder returns and geographic expansion. These moves underscore KPIT’s agility in adapting to dynamic market conditions while investing heavily in future technologies—an approach that could well position them for sustained growth amidst evolving industry demands.

- Take a closer look at KPIT Technologies' potential here in our health report.

Understand KPIT Technologies' track record by examining our Past report.

Tech Mahindra (NSEI:TECHM)

Simply Wall St Growth Rating: ★★★★☆☆

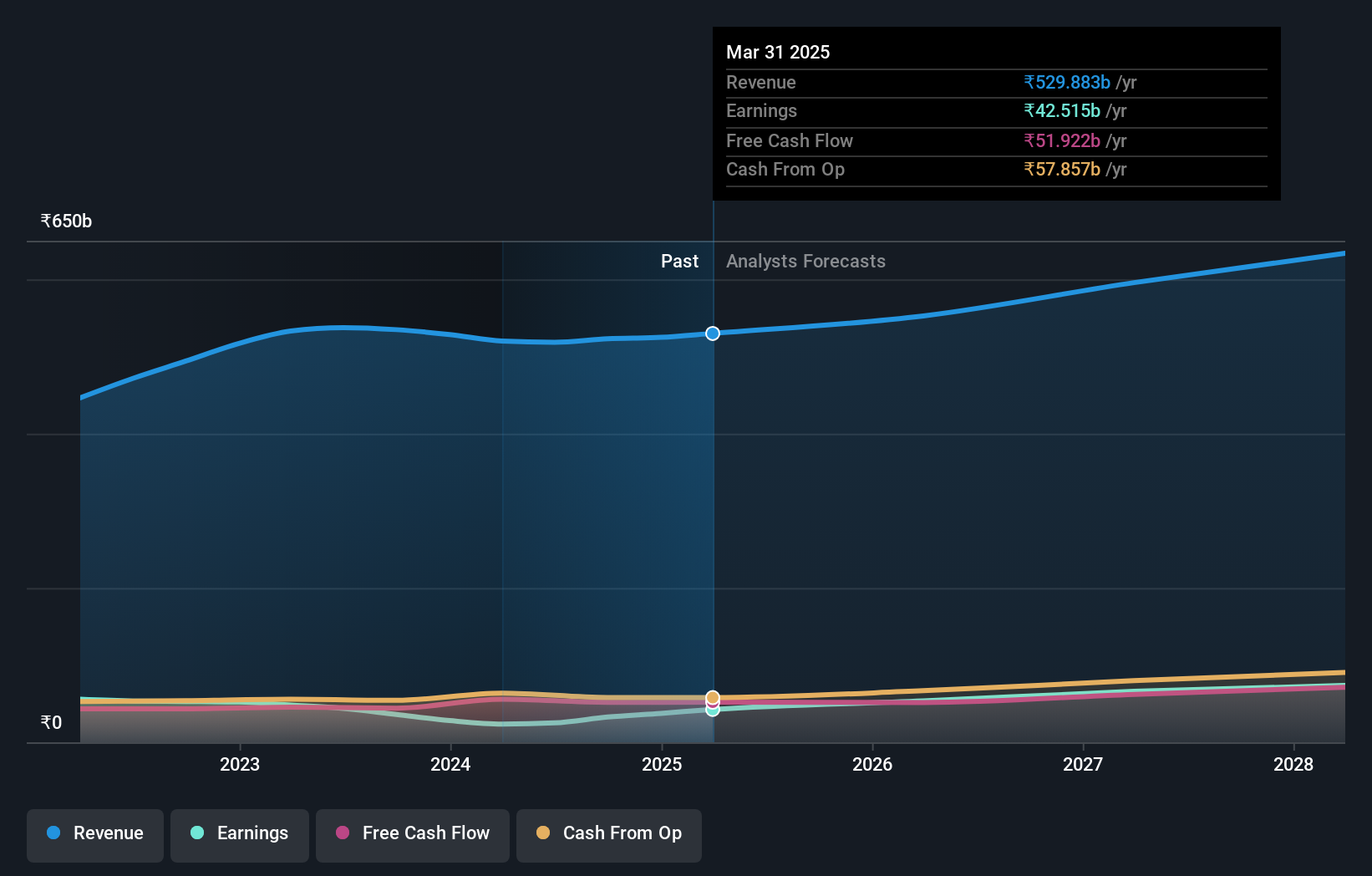

Overview: Tech Mahindra Limited offers information technology services and solutions across the Americas, Europe, India, and globally, with a market cap of ₹1.46 trillion.

Operations: With a market cap of ₹1.46 trillion, Tech Mahindra Limited generates revenue primarily from IT Services and Business Process Outsourcing (BPO), contributing ₹439.48 billion and ₹78.94 billion respectively.

Tech Mahindra, amidst a bustling Indian tech landscape, has demonstrated a robust commitment to innovation, underscored by its substantial R&D expenditures which have consistently aligned with its strategic goals. With an expected annual profit growth of 28.9%, the company outpaces the broader Indian market forecast of 17.3%. This financial vigor is further evidenced by a projected revenue increase of 6.9% annually. Recent executive board reshuffles and strategic alliances, like the collaboration with Northeastern University for ORAN and 6G advancements, signal Tech Mahindra's proactive stance in harnessing next-generation technologies to sustain its growth trajectory and enhance global connectivity solutions.

- Delve into the full analysis health report here for a deeper understanding of Tech Mahindra.

Gain insights into Tech Mahindra's past trends and performance with our Past report.

Seize The Opportunity

- Explore the 41 names from our Indian High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaynes Technology India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KAYNES

Kaynes Technology India

Operates as an end-to-end and IoT solutions-enabled integrated electronics manufacturer in India and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives