- India

- /

- Electronic Equipment and Components

- /

- NSEI:KAYNES

Exploring Kaynes Technology India And 2 Other High Growth Tech Stocks

Reviewed by Simply Wall St

Over the past 7 days, the Indian market has risen 1.8% and is up 41% over the last 12 months, with earnings expected to grow by 17% per annum over the next few years. In such a dynamic environment, identifying high-growth tech stocks like Kaynes Technology India and two others can be crucial for investors looking to capitalize on this upward trend.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Coforge | 14.32% | 22.54% | ★★★★★☆ |

| Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| Avalon Technologies | 20.11% | 42.50% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Kaynes Technology India (NSEI:KAYNES)

Simply Wall St Growth Rating: ★★★★★☆

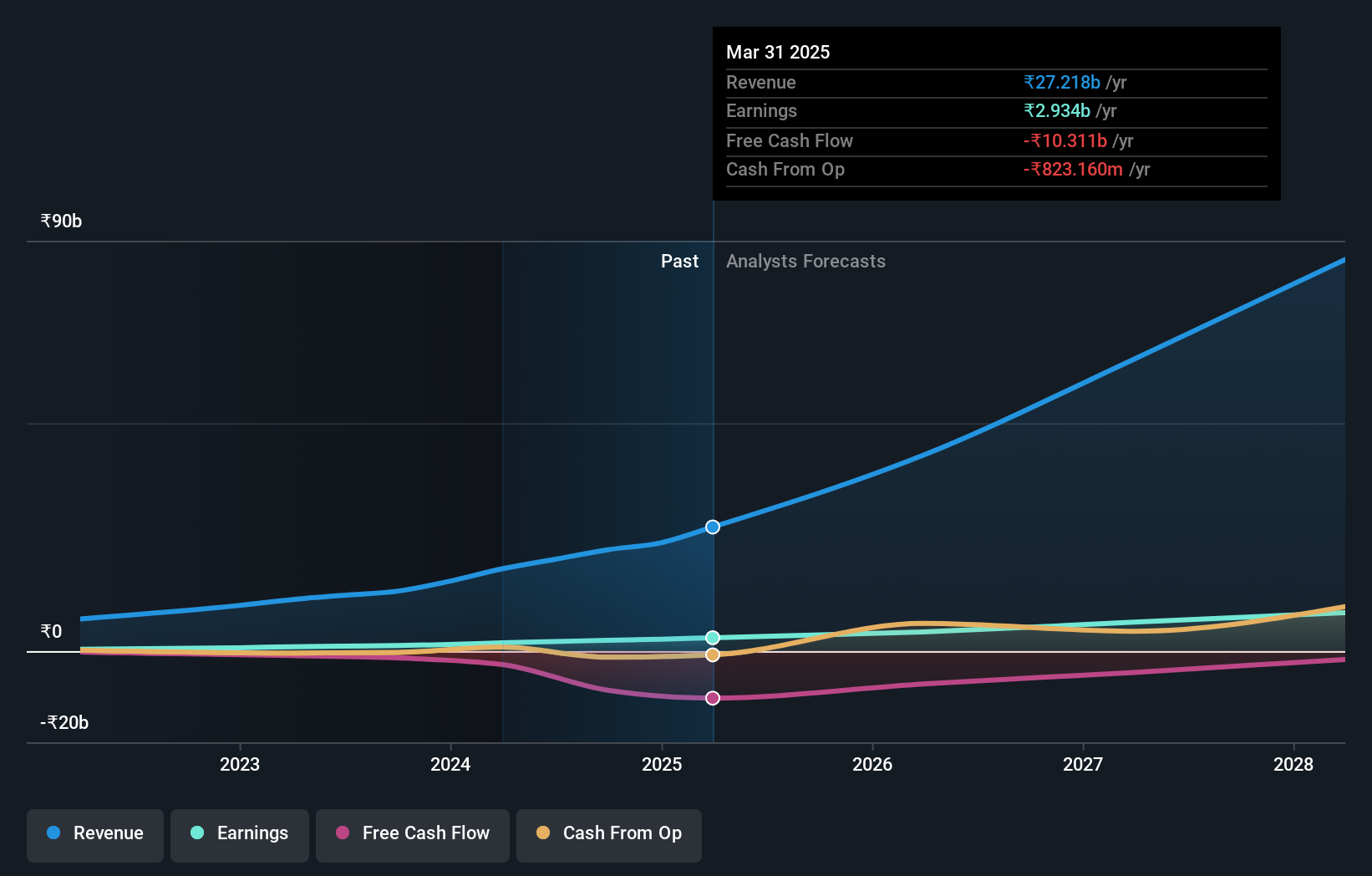

Overview: Kaynes Technology India Limited operates as an end-to-end and IoT solutions-enabled integrated electronics manufacturer in India and internationally, with a market cap of ₹355.34 billion.

Operations: Kaynes Technology India Limited generates revenue primarily from its Electronics System Design and Manufacturing (ESDM) segment, which contributed ₹20.11 billion. The company specializes in providing integrated electronics manufacturing and IoT solutions both domestically and internationally.

Kaynes Technology India has demonstrated impressive growth, with earnings surging by 90.7% over the past year and revenue projected to grow at 28.5% annually, outpacing the Indian market's 10.2%. The recent inauguration of their state-of-the-art manufacturing facility in Hyderabad underscores their commitment to innovation and sustainability, catering to diverse sectors like industrial, automotive, and aerospace. With R&D expenses playing a crucial role in driving advancements in high-precision electronic assembly and AI-enabled inspection systems, Kaynes is well-positioned for continued expansion.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

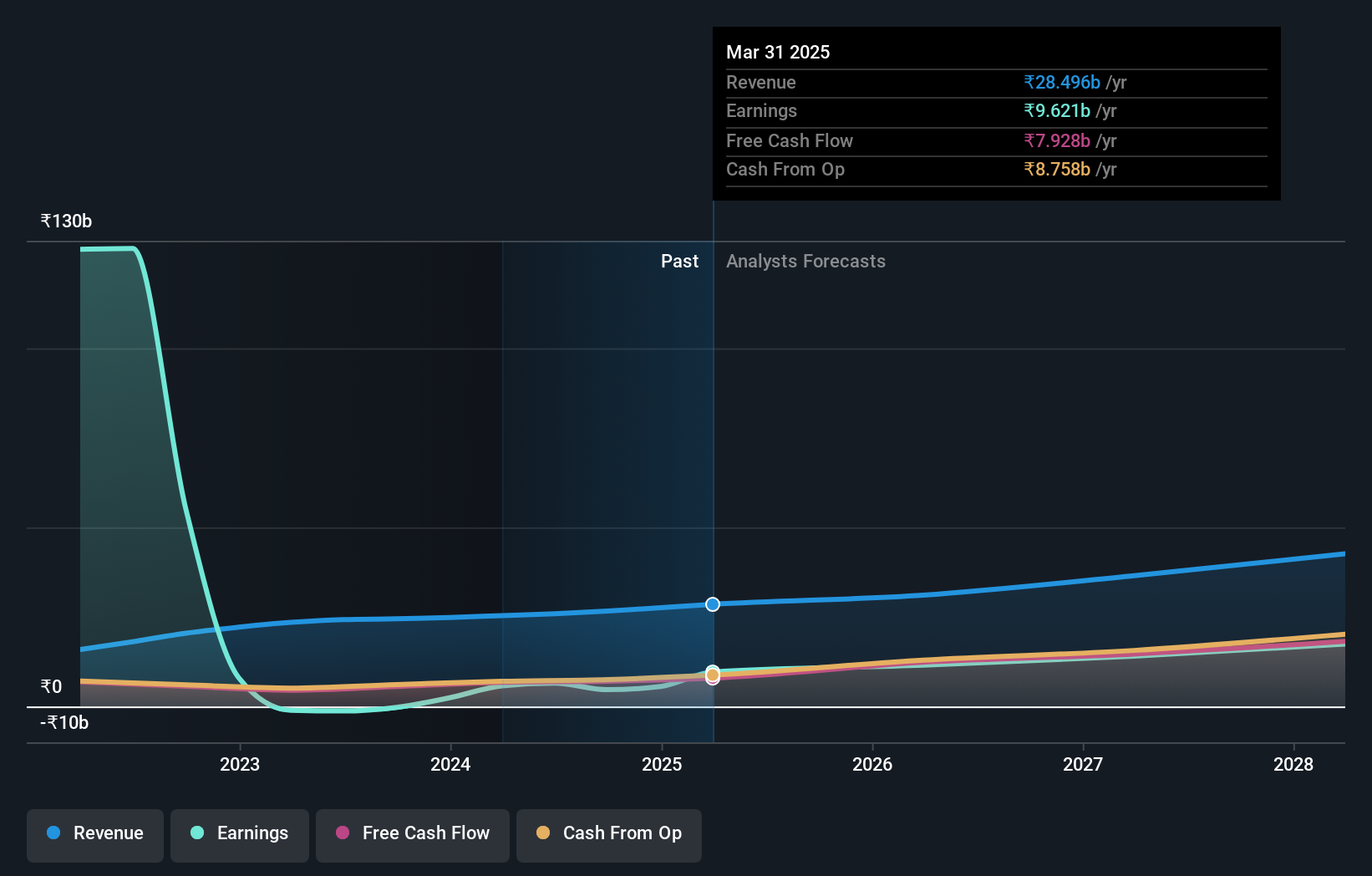

Overview: Info Edge (India) Limited operates as an online classifieds company focusing on recruitment, matrimony, real estate, and education services in India and internationally, with a market cap of ₹1.01 trillion.

Operations: The company generates revenue primarily from recruitment solutions (₹19.05 billion) and real estate services (₹3.67 billion). The business spans across India and international markets, focusing on online classifieds in key sectors such as recruitment, matrimony, real estate, and education.

Info Edge (India) has shown robust growth, with earnings increasing by 46.83% year-over-year to ₹2.33 billion in Q1 2024, driven by a strong performance in its Naukri segment. The company's R&D expenses have facilitated significant advancements, with ₹1.29 billion spent on innovation last year alone, representing 13% of revenue and contributing to a forecasted annual earnings growth rate of 23.6%. This strategic focus on technology and innovation positions Info Edge well within India's dynamic tech landscape.

Tech Mahindra (NSEI:TECHM)

Simply Wall St Growth Rating: ★★★★☆☆

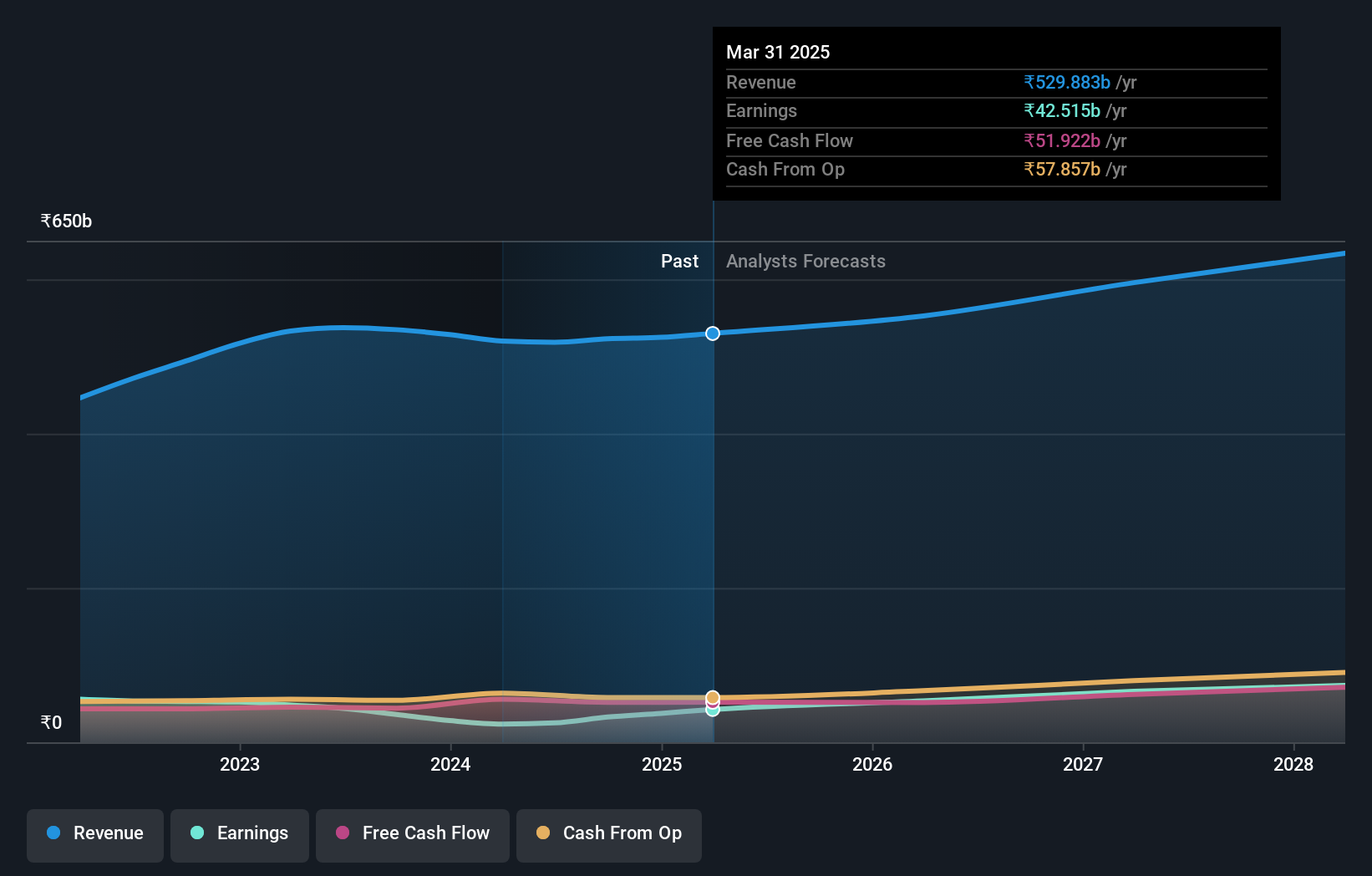

Overview: Tech Mahindra Limited provides information technology services and solutions in the Americas, Europe, India, and internationally with a market cap of ₹1.46 trillion.

Operations: Tech Mahindra's primary revenue streams are IT Services, generating ₹439.48 billion, and Business Process Outsourcing (BPO), contributing ₹78.94 billion. The company operates in multiple regions including the Americas, Europe, and India.

Tech Mahindra is making significant strides in the tech sector, particularly with its strategic focus on ORAN and 6G technologies. The company's collaboration with Northeastern University aims to accelerate innovation in wireless networks, leveraging Tech Mahindra's expertise in telecom. Despite facing regulatory penalties totaling ₹10.28 million recently, the company is optimistic about favorable appellate outcomes. R&D expenses of ₹9 billion last year underscore its commitment to innovation, contributing to a forecasted earnings growth rate of 28.9% annually over the next three years.

- Delve into the full analysis health report here for a deeper understanding of Tech Mahindra.

Evaluate Tech Mahindra's historical performance by accessing our past performance report.

Taking Advantage

- Click here to access our complete index of 38 Indian High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kaynes Technology India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KAYNES

Kaynes Technology India

Operates as an end-to-end and IoT solutions-enabled integrated electronics manufacturer in India and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)