High Growth Tech Stocks In India Featuring Cyient DLM And 2 More

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat, although it is up 45% over the past year and earnings are expected to grow by 17% per annum over the next few years. In this dynamic environment, identifying high growth tech stocks such as Cyient DLM and others can be crucial for investors looking to capitalize on India's robust economic trajectory.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Industries | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.83% | 22.72% | ★★★★★★ |

| Happiest Minds Technologies | 21.99% | 21.80% | ★★★★★★ |

| Sonata Software | 13.29% | 29.79% | ★★★★★☆ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| Avalon Technologies | 20.12% | 41.74% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Cyient DLM (NSEI:CYIENTDLM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cyient DLM Limited offers electronic manufacturing solutions both in India and internationally, with a market cap of ₹59.74 billion.

Operations: Specializing in electronic manufacturing solutions, Cyient DLM Limited generated a revenue of ₹12.33 billion from this segment. The company operates both domestically and internationally, leveraging its expertise to serve a diverse client base.

Cyient DLM's earnings are projected to grow at an impressive 37.8% annually, significantly outpacing the Indian market's 17% forecast. Their revenue is expected to rise by 23.1% per year, driven by strategic contracts like the recent Boeing deal for the 787 Dreamliner's Battery Diode Module production. The company's R&D expenses of ₹2 billion underscore a commitment to innovation in aerospace and defense sectors, positioning them well within India's high-growth tech landscape.

- Unlock comprehensive insights into our analysis of Cyient DLM stock in this health report.

Understand Cyient DLM's track record by examining our Past report.

C. E. Info Systems (NSEI:MAPMYINDIA)

Simply Wall St Growth Rating: ★★★★★★

Overview: C. E. Info Systems Limited offers digital mapping, geospatial software, and location-based Internet of Things (IoT) technology solutions in India, with a market cap of ₹113.83 billion.

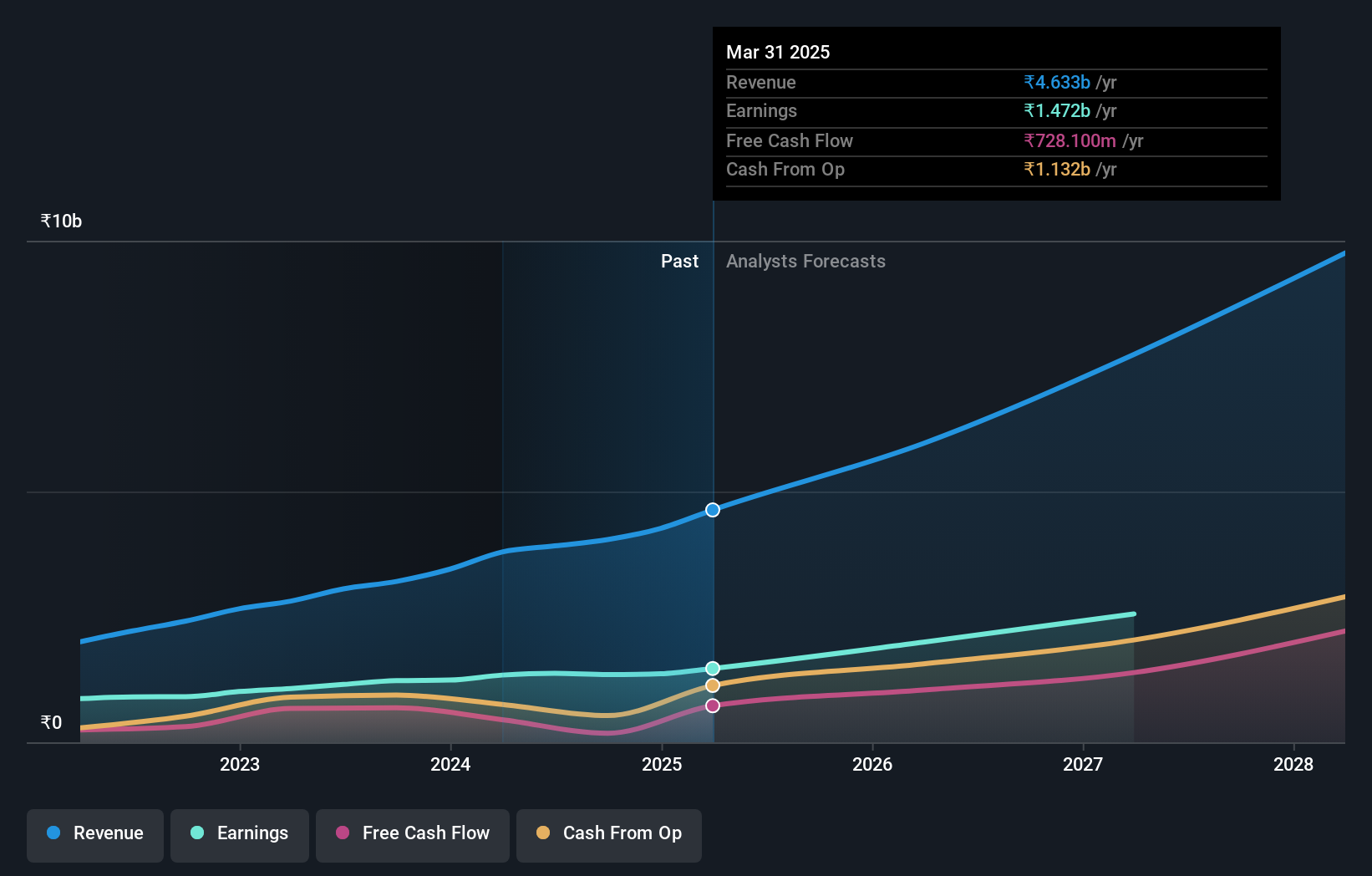

Operations: The company generates revenue primarily from its Map Data and Map Data Related Services, including GPS Navigation, Location-Based Services, and IoT solutions, amounting to ₹3.92 billion. The focus is on leveraging digital mapping and geospatial software for diverse applications in India.

C. E. Info Systems, known for its MapmyIndia brand, is making strides in India's tech landscape with a projected revenue growth of 29.9% annually, significantly outpacing the market's 10%. Recent developments include the launch of ClarityX, an AI-driven data analytics and consulting arm that enhances their enterprise offerings. The company's R&D expenses stand at ₹1 billion, reflecting a solid commitment to innovation in geospatial software and IoT solutions. Additionally, earnings are forecasted to grow by 27% per year, positioning them well for future expansion.

- Dive into the specifics of C. E. Info Systems here with our thorough health report.

Gain insights into C. E. Info Systems' past trends and performance with our Past report.

Nazara Technologies (NSEI:NAZARA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nazara Technologies Limited operates a gaming and sports media platform in India and internationally, with a market cap of ₹72.06 billion.

Operations: The company generates revenue primarily from three segments: Gaming (₹3.90 billion), E-Sports (₹6.46 billion), and AD Tech Business (₹1.02 billion). The E-Sports segment is the largest contributor to its revenue streams.

Nazara Technologies, a prominent player in India's gaming and entertainment sector, is forecasted to achieve annual revenue growth of 17.7%, surpassing the broader market's 10% pace. With a notable earnings growth rate of 24.4% per year, Nazara's commitment to innovation is evident through its R&D expenses that stand at ₹1 billion. Recent strategic moves include seeking small tuck-in acquisitions and expanding internationally with subsidiaries in the UK and US, enhancing their global footprint and potential for future growth.

- Take a closer look at Nazara Technologies' potential here in our health report.

Explore historical data to track Nazara Technologies' performance over time in our Past section.

Make It Happen

- Dive into all 38 of the Indian High Growth Tech and AI Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MAPMYINDIA

C. E. Info Systems

Provides digital mapping, geospatial, and Internet of Things (IoT) platform solutions in India and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion