- India

- /

- Electronic Equipment and Components

- /

- NSEI:CENTUM

Investors Who Bought Centum Electronics (NSE:CENTUM) Shares A Year Ago Are Now Up 36%

We believe investing is smart because history shows that stock markets go higher in the long term. But not every stock you buy will perform as well as the overall market. For example, the Centum Electronics Limited (NSE:CENTUM), share price is up over the last year, but its gain of 36% trails the market return. On the other hand, longer term shareholders have had a tougher run, with the stock falling 21% in three years.

See our latest analysis for Centum Electronics

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Centum Electronics actually saw its earnings per share drop 63%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We are skeptical of the suggestion that the 0.5% dividend yield would entice buyers to the stock. Centum Electronics' revenue actually dropped 8.9% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

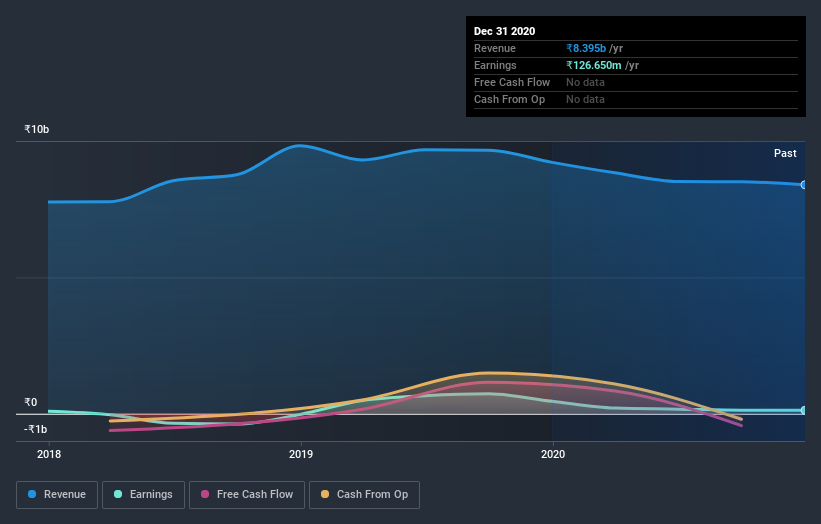

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Centum Electronics' financial health with this free report on its balance sheet.

A Different Perspective

Centum Electronics shareholders gained a total return of 38% during the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 2% per year, over five years. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 6 warning signs we've spotted with Centum Electronics (including 1 which is a bit unpleasant) .

Of course Centum Electronics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Centum Electronics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CENTUM

Centum Electronics

Designs, manufactures, exports, and sells electronic products in India, the United Kingdom, Canada, France, Belgium, Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion