- India

- /

- Electronic Equipment and Components

- /

- NSEI:CENTUM

Here's Why Centum Electronics Limited's (NSE:CENTUM) CEO Compensation Is The Least Of Shareholders' Concerns

Key Insights

- Centum Electronics' Annual General Meeting to take place on 5th of August

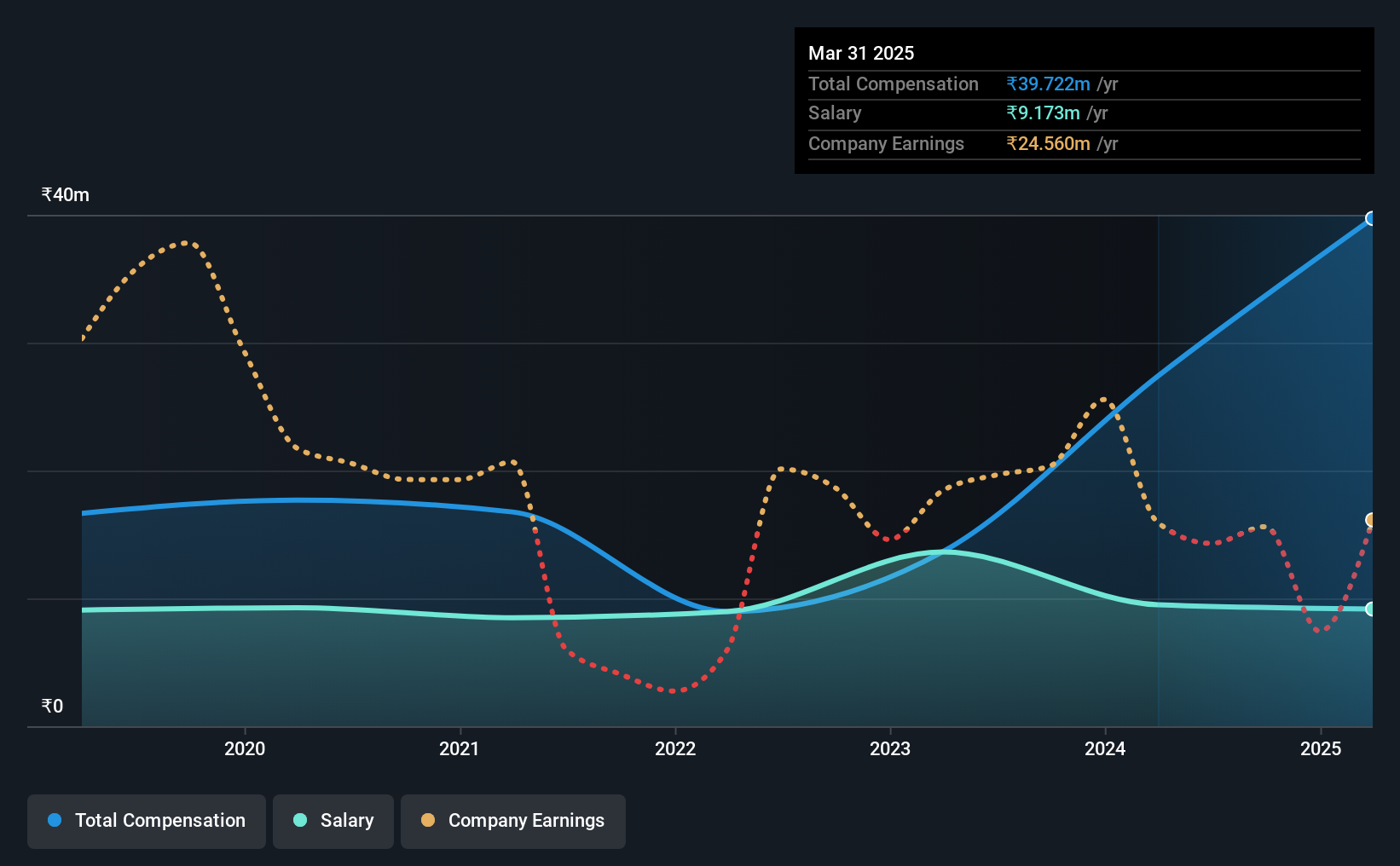

- CEO Rao Mallavarapu's total compensation includes salary of ₹9.17m

- Total compensation is similar to the industry average

- Centum Electronics' EPS grew by 3.0% over the past three years while total shareholder return over the past three years was 423%

Under the guidance of CEO Rao Mallavarapu, Centum Electronics Limited (NSE:CENTUM) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 5th of August. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for Centum Electronics

Comparing Centum Electronics Limited's CEO Compensation With The Industry

According to our data, Centum Electronics Limited has a market capitalization of ₹33b, and paid its CEO total annual compensation worth ₹40m over the year to March 2025. That's a notable increase of 45% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at ₹9.2m.

On comparing similar companies from the Indian Electronic industry with market caps ranging from ₹17b to ₹69b, we found that the median CEO total compensation was ₹34m. From this we gather that Rao Mallavarapu is paid around the median for CEOs in the industry. Furthermore, Rao Mallavarapu directly owns ₹13b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹9.2m | ₹9.5m | 23% |

| Other | ₹31m | ₹18m | 77% |

| Total Compensation | ₹40m | ₹27m | 100% |

On an industry level, it's fascinating to see that all of total compensation represents salary and non-salary benefits do not factor into the equation at all. It's interesting to note that Centum Electronics allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Centum Electronics Limited's Growth Numbers

Centum Electronics Limited's earnings per share (EPS) grew 3.0% per year over the last three years. It achieved revenue growth of 5.9% over the last year.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but it is good to see modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Centum Electronics Limited Been A Good Investment?

We think that the total shareholder return of 423%, over three years, would leave most Centum Electronics Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 2 warning signs for Centum Electronics (1 is significant!) that you should be aware of before investing here.

Switching gears from Centum Electronics, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CENTUM

Centum Electronics

Designs, manufactures, exports, and sells electronic products in India, the United Kingdom, Canada, France, Belgium, Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion