The CEO of Tera Software Limited (NSE:TERASOFT) is Gopi Tummala, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Tera Software

Comparing Tera Software Limited's CEO Compensation With the industry

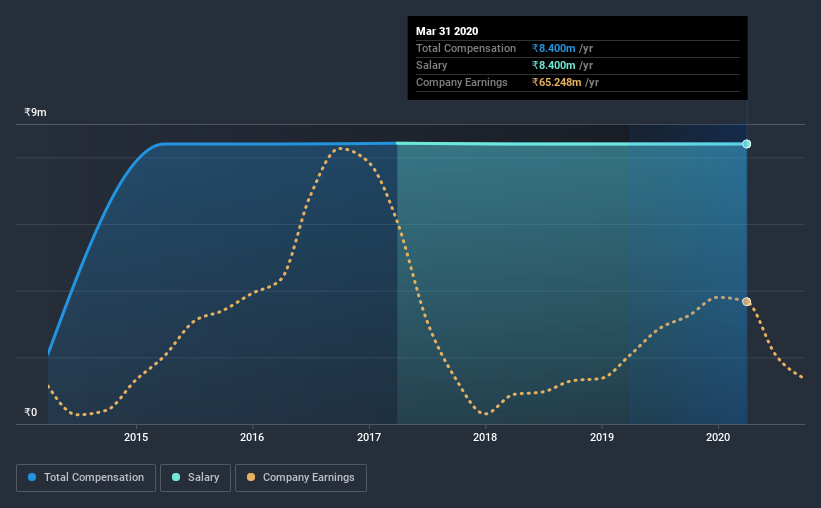

At the time of writing, our data shows that Tera Software Limited has a market capitalization of ₹651m, and reported total annual CEO compensation of ₹8.4m for the year to March 2020. That is, the compensation was roughly the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹8.4m.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹3.0m. Accordingly, our analysis reveals that Tera Software Limited pays Gopi Tummala north of the industry median. Furthermore, Gopi Tummala directly owns ₹147m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹8.4m | ₹8.4m | 100% |

| Other | - | - | - |

| Total Compensation | ₹8.4m | ₹8.4m | 100% |

On an industry level, it's fascinating to see that all of total compensation represents salary and non-salary benefits do not factor into the equation at all. Speaking on a company level, Tera Software prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Tera Software Limited's Growth Numbers

Over the last three years, Tera Software Limited has not seen its earnings per share change much, though there is a slight positive movement. Revenue was pretty flat on last year.

We'd prefer higher revenue growth, but the modest improvement in EPS is good. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Tera Software Limited Been A Good Investment?

Given the total shareholder loss of 23% over three years, many shareholders in Tera Software Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Tera Software rewards its CEO solely through a salary, ignoring non-salary benefits completely. As previously discussed, Gopi is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. While we have not been overly impressed by the business performance, the shareholder returns have been utterly depressing, over the last three years. And the situation doesn't look all that good when you see Gopi is remunerated higher than the industry average. Taking all this into account, it could be hard to get shareholder support for giving Gopi a raise.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 5 warning signs for Tera Software you should be aware of, and 3 of them are a bit unpleasant.

Switching gears from Tera Software, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Tera Software or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tera Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TERASOFT

Tera Software

Provides IT and integrated related products and services worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)