Unpleasant Surprises Could Be In Store For Tata Elxsi Limited's (NSE:TATAELXSI) Shares

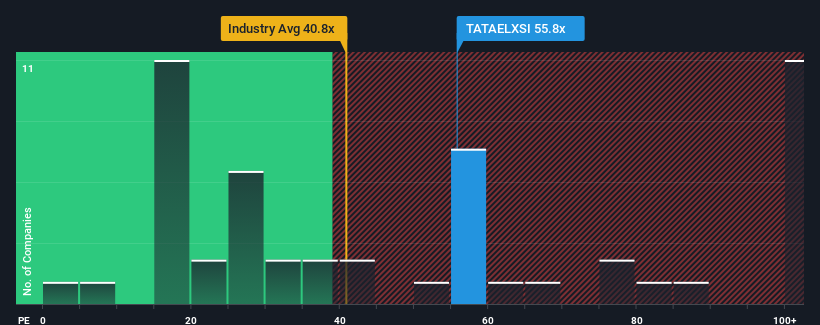

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 31x, you may consider Tata Elxsi Limited (NSE:TATAELXSI) as a stock to avoid entirely with its 55.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times haven't been advantageous for Tata Elxsi as its earnings have been rising slower than most other companies. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Tata Elxsi

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Tata Elxsi's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 12%. This was backed up an excellent period prior to see EPS up by 138% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 12% per year over the next three years. That's shaping up to be materially lower than the 20% per annum growth forecast for the broader market.

In light of this, it's alarming that Tata Elxsi's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Tata Elxsi currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Tata Elxsi with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tata Elxsi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TATAELXSI

Tata Elxsi

Engages in the provision of product design and engineering, and systems integration and support services in India, the United States, Europe, and Internationally.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives