Should You Buy Saksoft Limited (NSE:SAKSOFT) For Its Upcoming Dividend?

Saksoft Limited (NSE:SAKSOFT) stock is about to trade ex-dividend in three days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Therefore, if you purchase Saksoft's shares on or after the 29th of July, you won't be eligible to receive the dividend, when it is paid on the 9th of September.

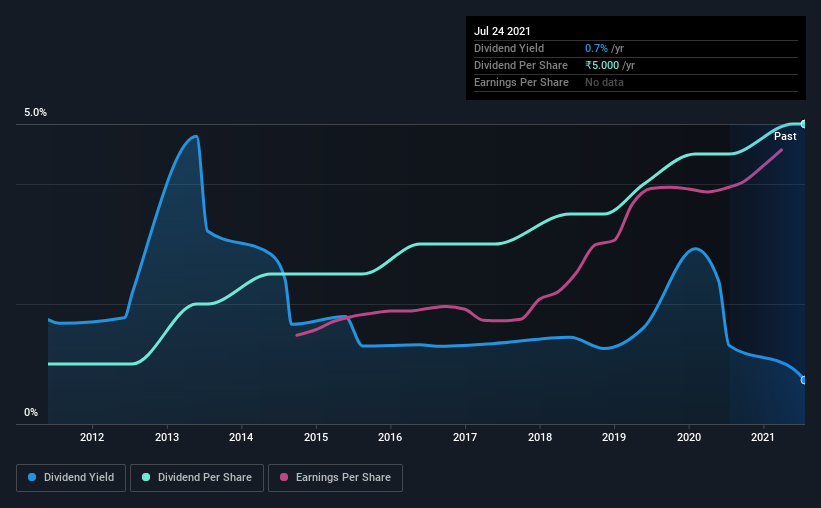

The company's next dividend payment will be ₹2.50 per share. Last year, in total, the company distributed ₹5.00 to shareholders. Based on the last year's worth of payments, Saksoft stock has a trailing yield of around 0.7% on the current share price of ₹682.4. If you buy this business for its dividend, you should have an idea of whether Saksoft's dividend is reliable and sustainable. So we need to investigate whether Saksoft can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Saksoft

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Saksoft is paying out just 11% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events. A useful secondary check can be to evaluate whether Saksoft generated enough free cash flow to afford its dividend. It paid out 4.0% of its free cash flow as dividends last year, which is conservatively low.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Saksoft paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Fortunately for readers, Saksoft's earnings per share have been growing at 19% a year for the past five years. Earnings per share are growing rapidly and the company is keeping more than half of its earnings within the business; an attractive combination which could suggest the company is focused on reinvesting to grow earnings further. Fast-growing businesses that are reinvesting heavily are enticing from a dividend perspective, especially since they can often increase the payout ratio later.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the last 10 years, Saksoft has lifted its dividend by approximately 17% a year on average. It's great to see earnings per share growing rapidly over several years, and dividends per share growing right along with it.

To Sum It Up

Has Saksoft got what it takes to maintain its dividend payments? We love that Saksoft is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. These characteristics suggest the company is reinvesting in growing its business, while the conservative payout ratio also implies a reduced risk of the dividend being cut in the future. Overall we think this is an attractive combination and worthy of further research.

In light of that, while Saksoft has an appealing dividend, it's worth knowing the risks involved with this stock. To help with this, we've discovered 2 warning signs for Saksoft that you should be aware of before investing in their shares.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Saksoft, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SAKSOFT

Saksoft

An information technology company, provides digital transformation solutions in Europe, the United States, the Asia Pacific, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion