R Systems International (NSE:RSYSTEMS) Seems To Use Debt Rather Sparingly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, R Systems International Limited (NSE:RSYSTEMS) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for R Systems International

What Is R Systems International's Debt?

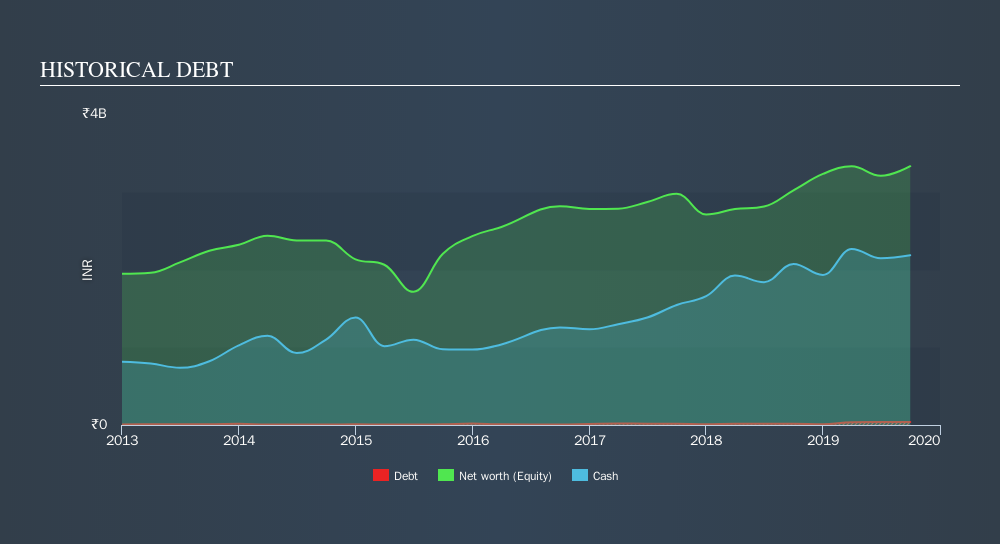

You can click the graphic below for the historical numbers, but it shows that as of September 2019 R Systems International had ₹29.3m of debt, an increase on ₹14.8m, over one year. But it also has ₹2.18b in cash to offset that, meaning it has ₹2.15b net cash.

A Look At R Systems International's Liabilities

Zooming in on the latest balance sheet data, we can see that R Systems International had liabilities of ₹1.04b due within 12 months and liabilities of ₹251.7m due beyond that. Offsetting this, it had ₹2.18b in cash and ₹1.25b in receivables that were due within 12 months. So it can boast ₹2.14b more liquid assets than total liabilities.

This luscious liquidity implies that R Systems International's balance sheet is sturdy like a giant sequoia tree. With this in mind one could posit that its balance sheet is as strong as beautiful a rare rhino. Succinctly put, R Systems International boasts net cash, so it's fair to say it does not have a heavy debt load!

On top of that, R Systems International grew its EBIT by 52% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since R Systems International will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While R Systems International has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, R Systems International recorded free cash flow worth 64% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While it is always sensible to investigate a company's debt, in this case R Systems International has ₹2.15b in net cash and a decent-looking balance sheet. And we liked the look of last year's 52% year-on-year EBIT growth. The bottom line is that we do not find R Systems International's debt levels at all concerning. Over time, share prices tend to follow earnings per share, so if you're interested in R Systems International, you may well want to click here to check an interactive graph of its earnings per share history.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:RSYSTEMS

R Systems International

A digital product engineering company, designs and builds chip-to-cloud software products and platforms.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion