- India

- /

- Consumer Finance

- /

- NSEI:FIVESTAR

3 High Growth Companies On The Indian Exchange With Strong Insider Ownership

Reviewed by Simply Wall St

The Indian market has experienced a 4.7% decline over the past week, yet it has shown impressive resilience with a 39% increase over the last year and anticipated earnings growth of 17% annually in the coming years. In this context, identifying high-growth companies with significant insider ownership can be advantageous as they often indicate confidence from those who know the business best and may offer potential stability amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.3% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.1% |

| KEI Industries (BSE:517569) | 19.2% | 22.4% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.8% |

Let's review some notable picks from our screened stocks.

Mrs. Bectors Food Specialities (NSEI:BECTORFOOD)

Simply Wall St Growth Rating: ★★★★★☆

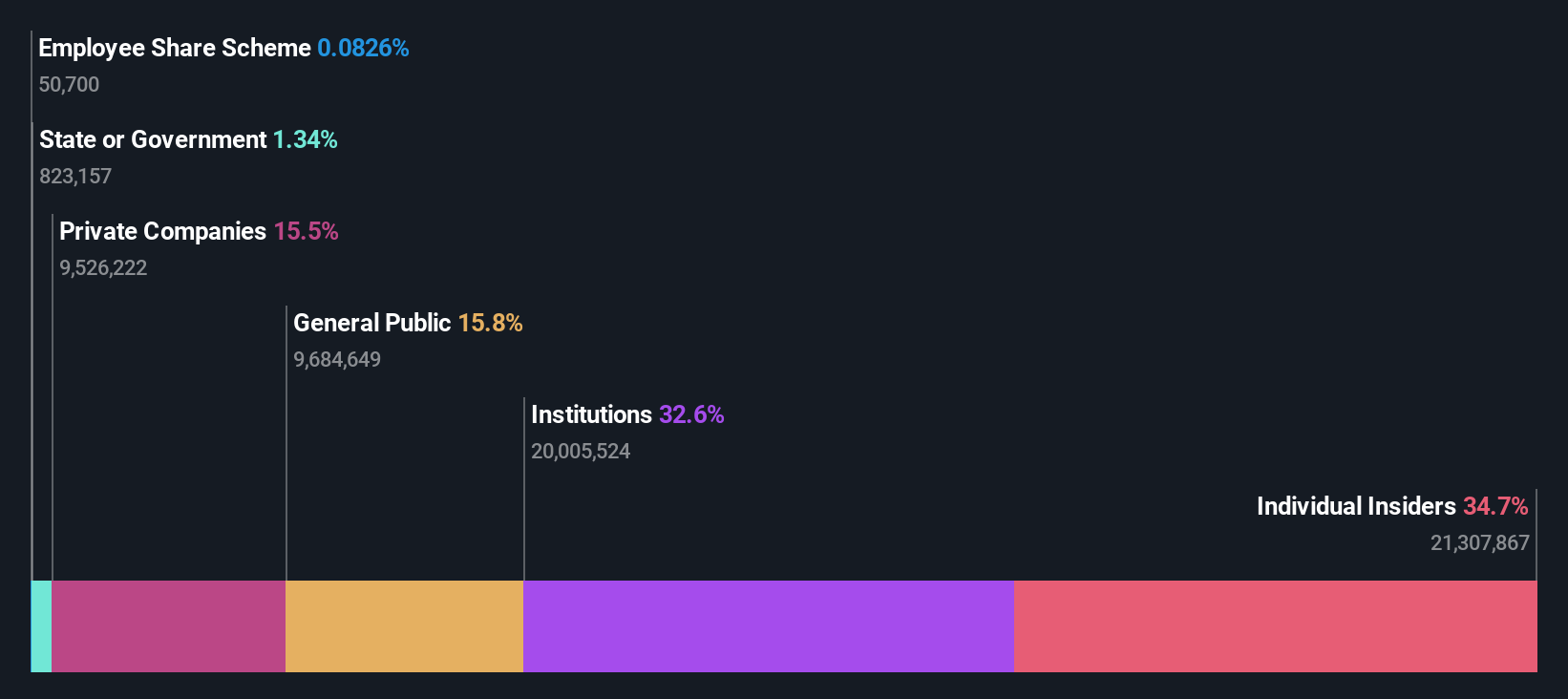

Overview: Mrs. Bectors Food Specialities Limited is an Indian company that manufactures and distributes various food products, with a market cap of ₹111.17 billion.

Operations: The company generates revenue of ₹16.89 billion from its food products segment in India.

Insider Ownership: 34.7%

Revenue Growth Forecast: 15.1% p.a.

Mrs. Bectors Food Specialities is poised for significant earnings growth, projected at 20.9% annually over the next three years, surpassing the Indian market average. However, recent substantial insider selling and shareholder dilution may concern investors despite no major insider buying in the past quarter. Revenue is expected to grow at 15.1% per year, faster than the market but below high-growth benchmarks. The company recently completed a follow-on equity offering worth ₹4 billion and appointed new auditors.

- Click here and access our complete growth analysis report to understand the dynamics of Mrs. Bectors Food Specialities.

- Our valuation report here indicates Mrs. Bectors Food Specialities may be overvalued.

Five-Star Business Finance (NSEI:FIVESTAR)

Simply Wall St Growth Rating: ★★★★★☆

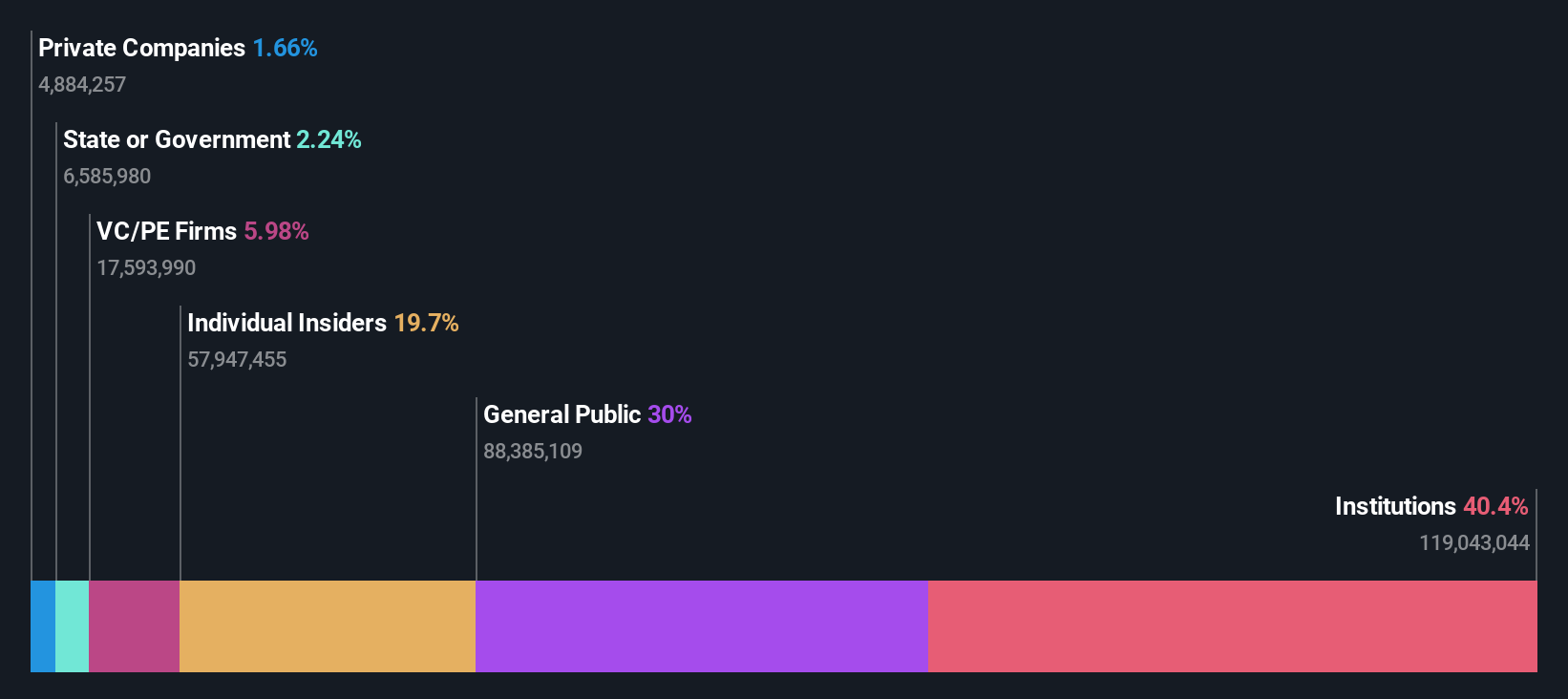

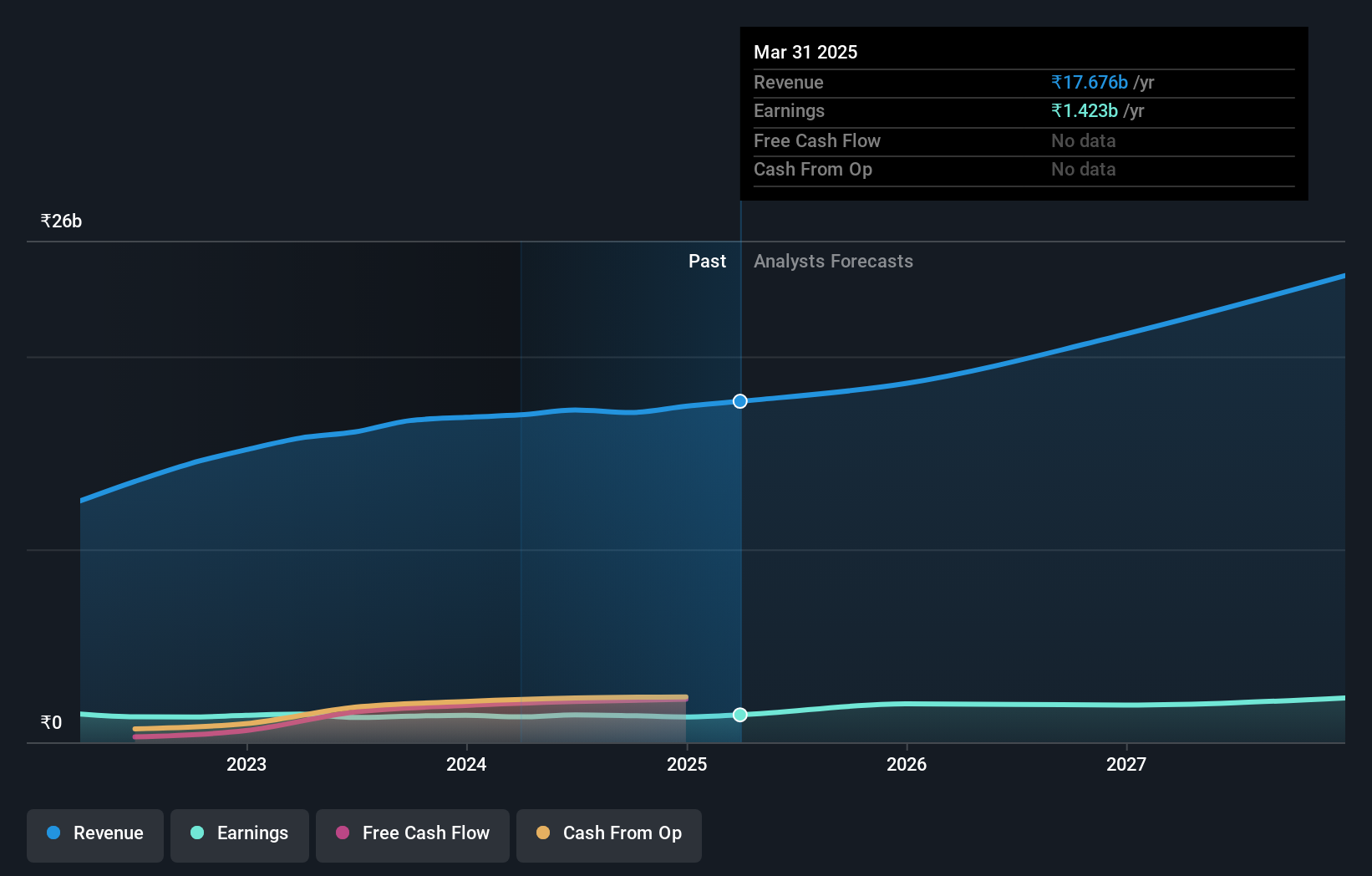

Overview: Five-Star Business Finance Limited is a non-banking financial company in India with a market cap of ₹231.33 billion.

Operations: The company generates revenue primarily from MSME Loans, Housing Loans, and Property Loans amounting to ₹17.79 billion.

Insider Ownership: 18.7%

Revenue Growth Forecast: 22.3% p.a.

Five-Star Business Finance is experiencing robust growth, with earnings rising 39.5% last year and projected to grow significantly at 21% annually over the next three years, outpacing the Indian market. Despite a low forecasted Return on Equity of 19.4%, revenue is expected to increase by 22.3% per year. Recent developments include issuing INR 25 billion in Non-Convertible Debentures and appointing Deloitte Haskins & Sells as auditors, reflecting strategic financial management and governance enhancements.

- Take a closer look at Five-Star Business Finance's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Five-Star Business Finance is priced higher than what may be justified by its financials.

R Systems International (NSEI:RSYSTEMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: R Systems International Limited is a digital product engineering company that designs and builds chip-to-cloud software products and platforms, with a market cap of ₹59.20 billion.

Operations: The company's revenue segments include Information Technology Services generating ₹15.53 billion and Business Process Outsourcing Services contributing ₹1.76 billion.

Insider Ownership: 29.0%

Revenue Growth Forecast: 12% p.a.

R Systems International is experiencing steady growth, with earnings projected to rise 19.1% annually, surpassing the Indian market's average. Recent strategic appointments, including Srikara Rao as CTO for Cloud and Cyber Security Services, aim to enhance its technological capabilities. The launch of OptimaAI Suite underscores its commitment to AI-driven innovation across industries. While revenue growth at 12% annually lags behind high-growth benchmarks, it still outpaces the broader market's 10.1%.

- Click to explore a detailed breakdown of our findings in R Systems International's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of R Systems International shares in the market.

Make It Happen

- Unlock more gems! Our Fast Growing Indian Companies With High Insider Ownership screener has unearthed 88 more companies for you to explore.Click here to unveil our expertly curated list of 91 Fast Growing Indian Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:FIVESTAR

Five-Star Business Finance

Operates as a non-banking financial company in India.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives