What Can We Make Of R S Software (India)'s (NSE:RSSOFTWARE) CEO Compensation?

The CEO of R S Software (India) Limited (NSE:RSSOFTWARE) is Raj Jain, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for R S Software (India).

Check out our latest analysis for R S Software (India)

How Does Total Compensation For Raj Jain Compare With Other Companies In The Industry?

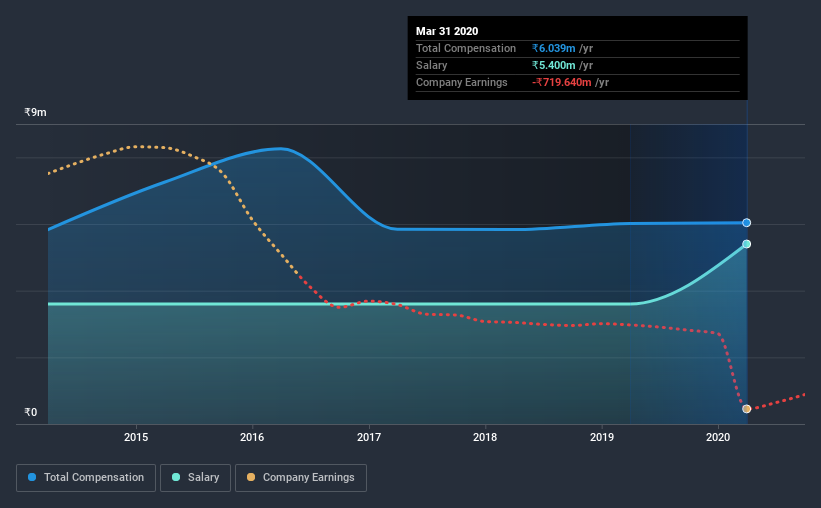

According to our data, R S Software (India) Limited has a market capitalization of ₹602m, and paid its CEO total annual compensation worth ₹6.0m over the year to March 2020. That is, the compensation was roughly the same as last year. In particular, the salary of ₹5.40m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below ₹15b, reported a median total CEO compensation of ₹4.8m. So it looks like R S Software (India) compensates Raj Jain in line with the median for the industry. Moreover, Raj Jain also holds ₹260m worth of R S Software (India) stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹5.4m | ₹3.6m | 89% |

| Other | ₹639k | ₹2.4m | 11% |

| Total Compensation | ₹6.0m | ₹6.0m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. In R S Software (India)'s case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

R S Software (India) Limited's Growth

R S Software (India) Limited has reduced its earnings per share by 41% a year over the last three years. It saw its revenue drop 29% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has R S Software (India) Limited Been A Good Investment?

With a three year total loss of 71% for the shareholders, R S Software (India) Limited would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As previously discussed, Raj is compensated close to the median for companies of its size, and which belong to the same industry. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. We'd stop short of saying compensation is inappropriate, but we would understand if shareholders had questions regarding a future raise.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 4 warning signs for R S Software (India) (3 are potentially serious!) that you should be aware of before investing here.

Switching gears from R S Software (India), if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading R S Software (India) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:RSSOFTWARE

R S Software (India)

Provides software solutions to electronic payment industries in India, the United States, and the United Kingdom.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion