Should You Worry About Onward Technologies Limited's (NSE:ONWARDTEC) CEO Pay Cheque?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Jigar Mehta has been the CEO of Onward Technologies Limited (NSE:ONWARDTEC) since 2016. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we'll consider growth that the business demonstrates. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Onward Technologies

How Does Jigar Mehta's Compensation Compare With Similar Sized Companies?

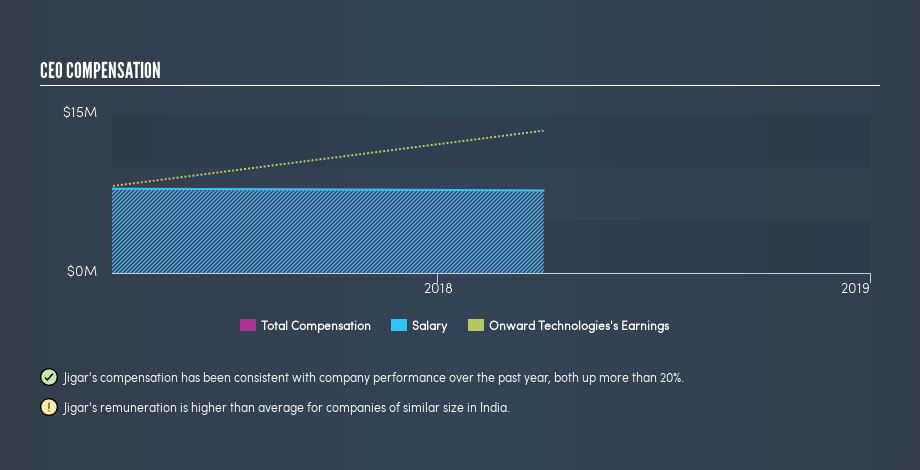

At the time of writing our data says that Onward Technologies Limited has a market cap of ₹1.1b, and is paying total annual CEO compensation of ₹7.8m. (This is based on the year to March 2018). Notably, the salary of ₹7.8m is the vast majority of the CEO compensation. We looked at a group of companies with market capitalizations under ₹14b, and the median CEO total compensation was ₹1.3m.

It would therefore appear that Onward Technologies Limited pays Jigar Mehta more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn't mean the remuneration is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

The graphic below shows how CEO compensation at Onward Technologies has changed from year to year.

Is Onward Technologies Limited Growing?

Over the last three years Onward Technologies Limited has grown its earnings per share (EPS) by an average of 40% per year (using a line of best fit). In the last year, its revenue is up 6.2%.

This shows that the company has improved itself over the last few years. Good news for shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Onward Technologies Limited Been A Good Investment?

Onward Technologies Limited has generated a total shareholder return of 0.5% over three years, so most shareholders wouldn't be too disappointed. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

We compared total CEO remuneration at Onward Technologies Limited with the amount paid at companies with a similar market capitalization. Our data suggests that it pays above the median CEO pay within that group.

However we must not forget that the EPS growth has been very strong over three years. We also think investors are doing ok, over the same time period. So, considering the EPS growth we do not wish to criticize the level of CEO compensation, though we'd recommend further research on management. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Onward Technologies (free visualization of insider trades).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:ONWARDTEC

Onward Technologies

Operates as a software and technology services outsourcing company.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026