Is Onward Technologies Limited's (NSE:ONWARDTEC) CEO Pay Justified?

Jigar Mehta became the CEO of Onward Technologies Limited (NSE:ONWARDTEC) in 2016. First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for Onward Technologies

How Does Jigar Mehta's Compensation Compare With Similar Sized Companies?

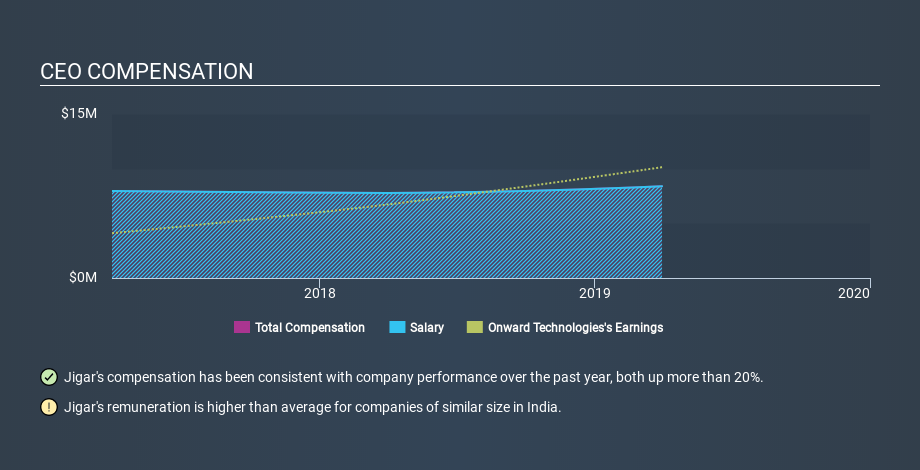

Our data indicates that Onward Technologies Limited is worth ₹674m, and total annual CEO compensation was reported as ₹8.4m for the year to March 2019. Notably, the salary of ₹8.4m is the vast majority of the CEO compensation. We took a group of companies with market capitalizations below ₹15b, and calculated the median CEO total compensation to be ₹3.6m.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of Onward Technologies. At an industry level, our analysis reveals that salaries represent all of CEO compensation for a majority of companies, with non-salary remuneration ignored. At the company level, Onward Technologies pays Jigar Mehta solely through a salary, preferring to go down a conventional route.

As you can see, Jigar Mehta is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Onward Technologies Limited is paying too much. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous. You can see, below, how CEO compensation at Onward Technologies has changed over time.

Is Onward Technologies Limited Growing?

On average over the last three years, Onward Technologies Limited has seen earnings per share (EPS) move in a favourable direction by 34% each year (using a line of best fit). It achieved revenue growth of 4.9% over the last year.

This shows that the company has improved itself over the last few years. Good news for shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Onward Technologies Limited Been A Good Investment?

Given the total loss of 50% over three years, many shareholders in Onward Technologies Limited are probably rather dissatisfied, to say the least. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

We compared the total CEO remuneration paid by Onward Technologies Limited, and compared it to remuneration at a group of similar sized companies. Our data suggests that it pays above the median CEO pay within that group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. Having said that, shareholders may be disappointed with the weak returns over the last three years. Considering positive per-share earnings movement, but keeping in mind the weak returns, we'd need more time to form a view on CEO compensation. Shifting gears from CEO pay for a second, we've spotted 3 warning signs for Onward Technologies you should be aware of, and 1 of them makes us a bit uncomfortable.

Important note: Onward Technologies may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:ONWARDTEC

Onward Technologies

Operates as a software and technology services outsourcing company.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026