Here's What We Think About Onward Technologies Limited's (NSE:ONWARDTEC) CEO Pay

Jigar Mehta has been the CEO of Onward Technologies Limited (NSE:ONWARDTEC) since 2016. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Onward Technologies

How Does Jigar Mehta's Compensation Compare With Similar Sized Companies?

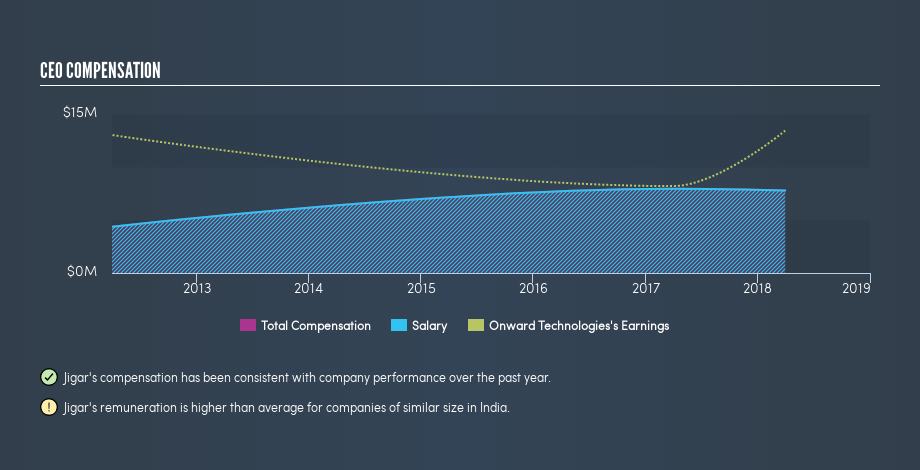

According to our data, Onward Technologies Limited has a market capitalization of ₹936m, and pays its CEO total annual compensation worth ₹7.8m. (This number is for the twelve months until March 2018). It is worth noting that the CEO compensation consists almost entirely of the salary, worth ₹7.8m. We looked at a group of companies with market capitalizations under ₹14b, and the median CEO compensation was ₹1.3m.

As you can see, Jigar Mehta is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Onward Technologies Limited is paying too much. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

The graphic below shows how CEO compensation at Onward Technologies has changed from year to year.

Is Onward Technologies Limited Growing?

Onward Technologies Limited has increased its earnings per share (EPS) by an average of 29% a year, over the last three years (using a line of best fit). It achieved revenue growth of 5.8% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Onward Technologies Limited Been A Good Investment?

Given the total loss of 10% over three years, many shareholders in Onward Technologies Limited are probably rather dissatisfied, to say the least. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

We compared the total CEO remuneration paid by Onward Technologies Limited, and compared it to remuneration at a group of similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

However, the earnings per share growth over three years is certainly impressive. Having said that, shareholders may be disappointed with the weak returns over the last three years. While EPS is positive, we'd say shareholders would want better returns before the CEO is paid much more. Whatever your view on compensation, you might want to check if insiders are buying or selling Onward Technologies shares (free trial).

Important note: Onward Technologies may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:ONWARDTEC

Onward Technologies

Operates as a software and technology services outsourcing company.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives