- India

- /

- Consumer Services

- /

- NSEI:NIITLTD

We Take A Look At Whether NIIT Limited's (NSE:NIITLTD) CEO May Be Underpaid

Shareholders will be pleased by the impressive results for NIIT Limited (NSE:NIITLTD) recently and CEO Sapnesh Lalla has played a key role. At the upcoming AGM on 05 August 2021, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

Check out our latest analysis for NIIT

Comparing NIIT Limited's CEO Compensation With the industry

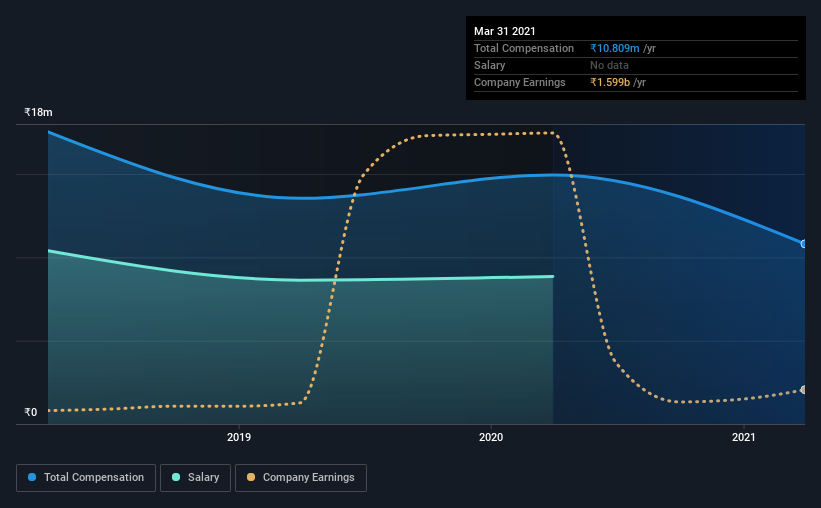

At the time of writing, our data shows that NIIT Limited has a market capitalization of ₹44b, and reported total annual CEO compensation of ₹11m for the year to March 2021. That's a notable decrease of 28% on last year. Notably, the salary which is ₹8.85m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from ₹15b to ₹60b, the reported median CEO total compensation was ₹24m. That is to say, Sapnesh Lalla is paid under the industry median. Furthermore, Sapnesh Lalla directly owns ₹120m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹8.9m | ₹8.6m | 82% |

| Other | ₹2.0m | ₹6.3m | 18% |

| Total Compensation | ₹11m | ₹15m | 100% |

On an industry level, roughly 100% of total compensation represents salary and 0.3647% is other remuneration. NIIT sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

NIIT Limited's Growth

NIIT Limited's earnings per share (EPS) grew 44% per year over the last three years. Its revenue is up 6.8% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has NIIT Limited Been A Good Investment?

Boasting a total shareholder return of 325% over three years, NIIT Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 5 warning signs for NIIT that investors should look into moving forward.

Switching gears from NIIT, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading NIIT or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NIIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:NIITLTD

NIIT

Engages in providing learning and knowledge solutions to individuals, enterprises, and various institutions worldwide.

Excellent balance sheet and good value.

Market Insights

Community Narratives